Truist Bank

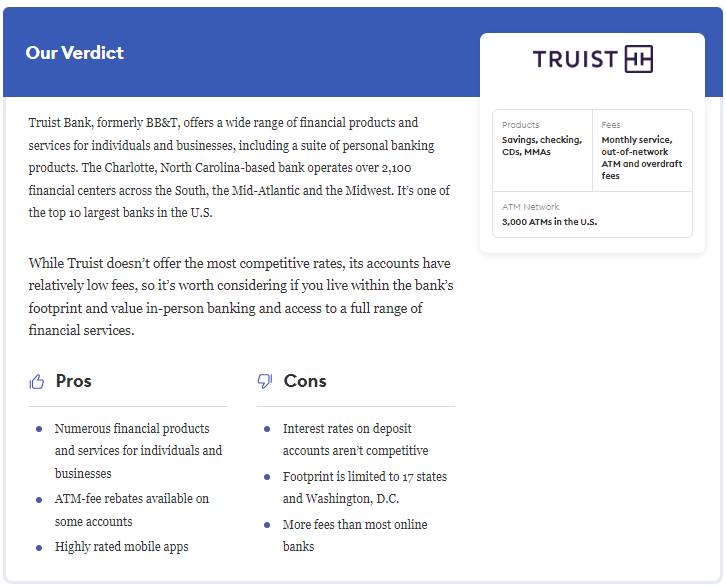

Truist Bank, formed through the merger of BB&T and SunTrust in 2019, is one of the largest financial institutions in the United States. Headquartered in Charlotte, North Carolina, Truist Bank offers a wide array of banking, lending, investment, and wealth management services to individuals, businesses, and institutions across various markets. With a strong presence in the Southeastern and Mid-Atlantic regions, Truist emphasizes customer-centric solutions and innovative banking technologies to meet the diverse financial needs of its clients. The bank is committed to community engagement, digital transformation, and delivering personalized financial strategies to help customers achieve their financial goals.

Truist Account Basics

Truist Financial’s product details, rates, and fee information may vary depending on location. For the purposes of this review, North Carolina is used as it is where the bank is headquartered. This review specifically covers Truist’s personal banking services. Account specifics and annual percentage yields (APYs) are current as of June 6, 2023.

Checking

Truist offers two checking accounts tailored to meet diverse customer needs: Truist One Checking and Truist Confidence Account, both serving as primary options for everyday transactions.

Truist One Checking

Following the merger, Truist introduced its flagship checking account, Truist One Checking. You can waive the $12 monthly fee by meeting any of these requirements:

- Receive at least $500 in direct deposits per statement cycle

- Maintain a combined balance of at least $500 across all Truist deposit and investment accounts

- Open and link a Truist small business checking account

- Have a personal Truist credit card, mortgage, or qualifying loan

- Be a student under the age of 25

Truist One Checking does not charge overdraft fees and offers a $100 Negative Balance Buffer. As your balance grows, you can also benefit from additional perks such as a loyalty bonus on credit card rewards and ATM fee waivers.

Truist Confidence Account

Truist offers a second-chance bank account designed for individuals who may face challenges qualifying for a standard checking account. This account has limited features, including no paper checks, and requires a minimum opening deposit of $25. It charges a $5 monthly fee, which can be waived by meeting one of the following criteria: receiving at least $500 in direct deposits per statement cycle, making 10 or more qualifying transactions per statement cycle, or being a student under the age of 25.

Savings

Truist offers a range of savings options tailored to different customer needs:

Truist One Savings: Truist’s primary savings account earns a minimal interest rate of 0.01% APY and requires a minimum opening deposit of $50. Account holders aged 18 or older incur a $5 monthly fee, but this fee can be waived by maintaining an eligible Truist checking account, keeping a minimum daily balance of $300, or scheduling a preauthorized internal transfer of at least $25 per statement cycle.

Truist Confidence Savings: Designed to complement the Truist Confidence Account, this basic savings account earns interest and imposes no monthly fees or overdraft fees. It requires a minimum opening deposit of $25.

Truist One Money Market Account: Truist also offers a money market account that blends competitive rates with checking-like features such as a debit card and check-writing privileges. Currently, the account earns 0.01% APY on all balances. To open this account, a $50 minimum deposit is required, and there’s a $12 monthly maintenance fee that can be waived by maintaining a $1,000 minimum balance. The account allows up to six fee-free withdrawals per month, with a $15 fee for each additional withdrawal.

CDs

Truist offers a variety of certificates of deposit (CDs) to suit different financial needs:

Personal CDs: Truist provides CDs with terms ranging from seven days to five years, requiring a minimum deposit of $1,000. Shorter terms (seven to 31 days) may have higher minimum deposits, while longer terms require lower amounts.

Can’t Lose CDs: These CDs allow you to deposit additional funds, up to $10,000, after the first 12 months of your term. They also permit one penalty-free withdrawal after the initial 12-month period.

Stepped Rate CDs: With Stepped Rate CDs, you enjoy a guaranteed interest rate increase once a year throughout the term. You can add one additional deposit, up to $10,000, per year. Additionally, one penalty-free withdrawal is allowed 24 months after the initial deposit.

Please note that Truist’s CD rates are not published online, and CD accounts can only be opened by visiting one of the bank’s branches.

Other Accounts and Services

In addition to its personal deposit accounts, Truist provides a comprehensive range of financial products and services, including:

- Health Savings Account (HSA)

- Prepaid cards

- Credit cards

- Mortgage loans

- Home equity loans

- Home Equity Lines of Credit (HELOCs)

- Auto loans

- Personal loans

- Investment products and services

- Retirement accounts

- Personal insurance

- Small business banking and lending

- Commercial banking and lending

- Wealth management services

Access on the Go

Truist accounts are easily accessible through its online platform or via the Truist Mobile app, available on both the App Store and Google Play. The highly rated app provides a comprehensive range of banking features, including:

- Account management

- Mobile check deposit

- Bank transfers

- Bill pay

- Email and text payments

- Card lock

- Budgeting tools

- Branch and ATM locator

Online account management offers additional tools such as free credit score monitoring, transaction categorization, budgeting features, and goal setting and tracking. For customer support, Truist offers general assistance via phone at 844-4TRUIST (844-487-8478) during business hours, and customers can also securely message through their online accounts.

Truist Banking Fees

Following the merger of BB&T with SunTrust, Truist has simplified and reduced fees across its personal checking and savings accounts. Here’s an overview of the fees for Truist’s personal banking products:

Truist Confidence Account Fees:

- Monthly Maintenance Fee: $5, waived if you:

- Receive $500 in monthly direct deposits

- Complete 10 or more transactions per statement cycle

- Are under age 25

- Monthly Paper Statement Fee: $2, waived with e-statements sign-up

Truist One Checking Fees:

- Monthly Maintenance Fee: $12, waived if you:

- Receive $500 in monthly direct deposits

- Maintain a minimum combined balance of $500 across all personal accounts

- Have a Truist personal credit card, mortgage, or consumer loan

- Open and link a Truist small business checking account

- Are under age 25

- Monthly Paper Statement Fee: $3, waived with e-statements sign-up

Truist One Savings Fees:

- Monthly Maintenance Fee: $5, waived if you:

- Maintain a $300 minimum daily balance

- Set up $25 in monthly automatic transfers into savings

- Hold a Truist checking account

- Are under age 18

- Paper Statement Fee: $3, waived with e-statements sign-up

- Excess Withdrawal Fee: $5 per withdrawal over six per month, with a maximum of six withdrawal fees per statement cycle

Truist Confidence Savings Fees:

- Monthly Maintenance Fee: $0

- Paper Statement Fee: $2, waived with e-statements sign-up

- Excess Withdrawal Fee: $5 per withdrawal over six per month, with a maximum of six withdrawal fees per statement cycle

Truist One Money Market Account Fees:

- Monthly Maintenance Fee: $12, waived with a daily balance of $1,000 or more

- Paper Statement Fee: $3, waived with e-statements sign-up

- Excess Withdrawal Fee: $15 per withdrawal over six per month, with a maximum of six withdrawal fees per statement cycle

These fee structures help customers manage their banking costs effectively, with opportunities to waive fees through various account activities and preferences for electronic statements.

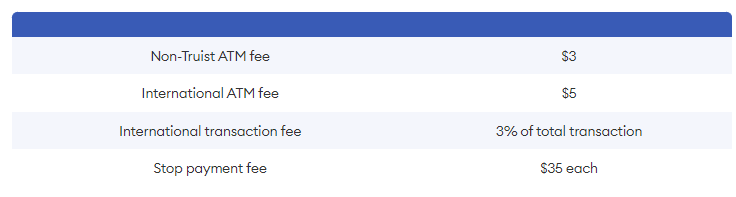

Miscellaneous fees apply to all accounts

How Truist Stacks Up

Truist, previously known as BB&T, is a solid option for individuals seeking both in-person and online banking services in regions where Truist operates. While its deposit accounts do not offer competitive interest rates, the bank offers a comprehensive range of account options tailored to diverse customer needs. Many of Truist’s accounts feature manageable monthly fees that can be waived through straightforward criteria. However, customers aiming to grow their savings with higher interest rates might find more attractive options elsewhere.

Truist vs. Wells Fargo

Wells Fargo stands as one of the oldest banks in the United States, offering a diverse array of banking products and financial services tailored to both consumers and businesses. Similar to Truist, many of its bank accounts come with monthly fees that can be avoided by meeting specific criteria. However, Wells Fargo’s savings products do not typically offer competitive rates compared to those available at online banks.

Both Truist and Wells Fargo provide account options designed for children and students, featuring waived monthly fees up to a certain age. Wells Fargo’s extensive network includes 4,900 retail branches and over 12,000 ATMs, offering broad accessibility for in-person banking needs.

Truist vs. Chase

Chase provides a comprehensive range of banking and financial services. Like Truist, Chase typically offers low interest rates on its deposit products. Monthly fees apply to most Chase accounts, although the bank provides various options to waive these fees.

Both banks offer robust full-service banking solutions supported by online and in-person assistance. Chase boasts a significantly larger footprint with 4,700 branch locations and over 15,000 ATMs nationwide. Depending on your location, Chase may offer greater accessibility for in-person banking services.

Frequently Asked Questions (FAQs)

Opening a Truist checking, savings, or money market account does not incur any fees. However, each account requires a minimum opening deposit ranging from $25 to $50 for checking and savings accounts, and $1,000 for CDs. Additionally, these accounts may include a monthly maintenance fee, which can be waived under certain conditions.

Truist checking and savings accounts do not have a mandatory minimum balance requirement, although maintaining a specified balance can waive monthly maintenance fees. Certificates of deposit (CDs) necessitate a minimum deposit of $1,000 to initiate.

Truist, formerly BB&T, operates over 2,000 branches spanning the South, Mid-Atlantic, and Midwest regions. Branches are conveniently located in Alabama, Florida, Georgia, Indiana, Kentucky, Maryland, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia, and Washington, D.C.

Pingback: EverBank Review 2024