JPMorganChase Bank

JPMorgan Chase is one of the largest banks in the United States, known for its banking and financial services worldwide. It helps people and businesses with banking accounts, loans for buying homes or cars, and investments like stocks and bonds. The bank also assists companies with financing to grow their businesses and offers services like credit cards and online banking. JPMorgan Chase has branches in many cities and countries, making it convenient for customers to access their money and financial services. It’s a big part of the economy and helps millions of people manage their finances every day.

JPMorgan Chase is a global financial services firm that operates in over 100 markets worldwide. It offers a wide range of services including consumer banking, investment banking, commercial banking, asset management, and treasury and securities services. The firm serves millions of consumers, small businesses, and many of the world’s most prominent corporate, institutional, and government clients. JPMorgan Chase is known for its strong presence in investment banking, providing advisory services for mergers and acquisitions, underwriting of securities, and trading activities across various asset classes. It’s also a leader in technology and digital innovations, continually enhancing its digital banking platforms and services to meet the evolving needs of customers. JPMorgan Chase employs thousands of people globally and is recognized as a major player in the financial industry.

JPMorganChase Bank Reviews

Reviews of JPMorgan Chase Bank vary widely depending on the source and individual experiences. Generally, the bank receives praise for its wide range of financial products and services, including banking accounts, credit cards, loans, and investment opportunities. Many customers appreciate the convenience of its extensive branch network and robust online banking features. However, like many large banks, JPMorgan Chase also faces criticism on various fronts. Some customers report dissatisfaction with customer service, fees, and account policies. There have also been concerns raised about the bank’s involvement in controversial financial practices and regulatory issues. Overall, reviews of JPMorgan Chase Bank reflect a mix of positive and negative feedback, highlighting its scale and influence in the financial services industry alongside challenges in customer satisfaction and public perception.

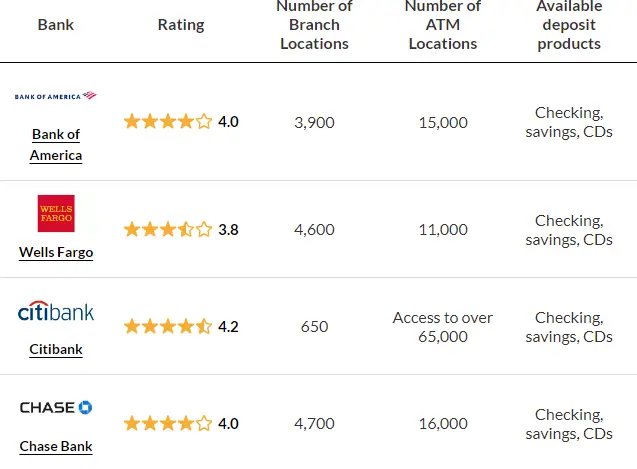

JPMorganChase Bank vs Other Top Banks

Reviews of JPMorgan Chase Bank vary widely depending on the source and individual experiences. Generally, the bank receives praise for its wide range of financial products and services, including banking accounts, credit cards, loans, and investment opportunities. Many customers appreciate the convenience of its extensive branch network and robust online banking features. However, like many large banks, JPMorgan Chase also faces criticism on various fronts. Some customers report dissatisfaction with customer service, fees, and account policies. There have also been concerns raised about the bank’s involvement in controversial financial practices and regulatory issues. Overall, reviews of JPMorgan Chase Bank reflect a mix of positive and negative feedback, highlighting its scale and influence in the financial services industry alongside challenges in customer satisfaction and public perception.

JPMorganChase Bank Overview

JPMorgan Chase Bank, commonly known as JPMorgan Chase, is one of the largest financial institutions in the United States and globally. It offers a comprehensive range of financial services to individuals, businesses, and institutional clients. These services include consumer banking (such as checking and savings accounts, credit cards, mortgages, and personal loans), commercial banking (including lending, treasury services, and cash management), investment banking (which involves advising on mergers and acquisitions, underwriting securities, and managing assets), and asset management (which includes managing investments and providing wealth management services).

Products of JPMorganChase Bank

JPMorgan Chase Bank offers a wide array of financial products and services to meet the diverse needs of individuals, businesses, and institutional clients. Some of the key products and services include:

Consumer Banking:

- Checking Accounts

- Savings Accounts

- Certificates of Deposit (CDs)

- Credit Cards

- Debit Cards

- Personal Loans

- Mortgages and Home Equity Lines of Credit (HELOCs)

Commercial Banking:

- Business Checking and Savings Accounts

- Business Loans and Lines of Credit

- Treasury and Cash Management Services

- Merchant Services

Investment Banking:

- Mergers and Acquisitions Advisory

- Equity and Debt Capital Markets

- Corporate Finance

- Underwriting of Securities

Asset Management:

- Investment Management Services

- Wealth Management and Private Banking

- Retirement Planning Services

- Trust and Estate Services

Other Services:

- Online and Mobile Banking

- Foreign Exchange Services

- Institutional Investment Services

- Insurance Products (through partners)

JPMorganChase Bank Fees

Is Chase fee free?

- no account opening fees. no monthly usage fees. no ATM fees applied by us.

- What is the transaction fee for Chase?

- Yes, keyed-in transactions are 3.5% + 10 cents. These are considered Card not Present transactions (whether customer is in-person or virtual at time of transaction). Tap, insert, swipe transactions are all considered Card Present transactions and charged the same 2.6% + 10 cents rate, including Tap to Pay on iPhone.

How much are fees at Chase Bank?

Personal Checking Accounts:

Business Checking Accounts:

What is the monthly service fee for Chase savings?

- You can avoid the $5 monthly service fee on this account in one of two ways each month:

- Maintain a balance of $300 or more in the account every day during the month

- Have at least one of the following occur during the month:

- A direct deposit of $300 or more

- A linked Chase personal checking account with a $300 or more balance

- A linked Chase Liquid Card with a $300 or more balance

What is the annual fee for Chase?

The Chase Sapphire Preferred Card has a $95 annual fee, while the more premium Chase Sapphire Reserve card has a higher $550 annual fee. On the other hand, the Ink Business Unlimited Credit Card and Ink Business Cash Credit Card both have no annual fee. The choice between these Chase credit cards will depend on your spending habits, travel needs, and willingness to pay an annual fee in exchange for more robust rewards and benefits.

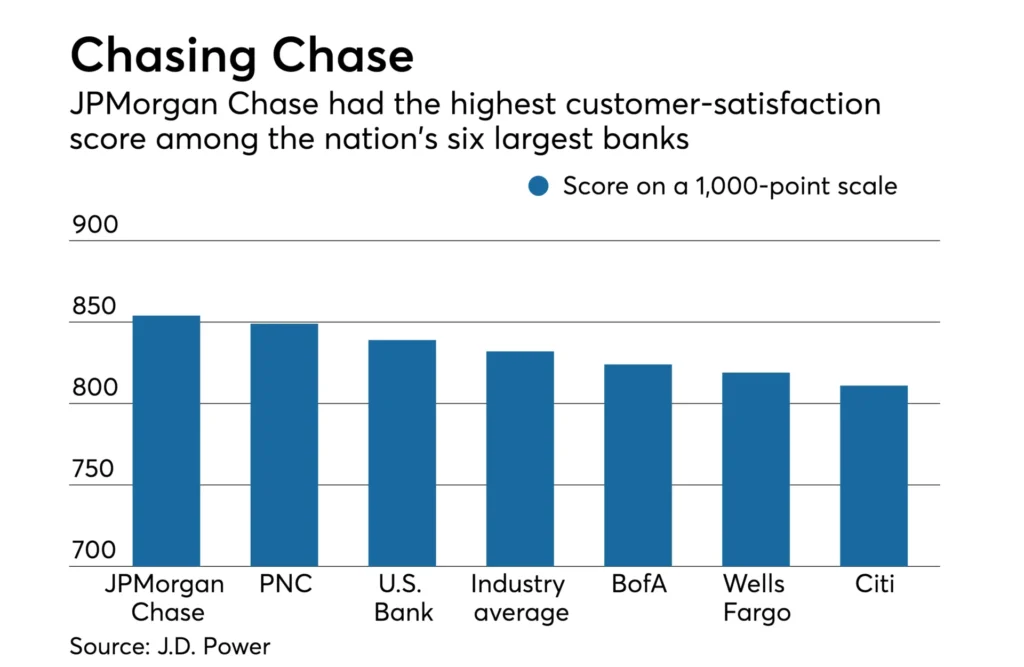

JPMorgan Chase Reputation and Customer Satisfaction

Bank of America, one of the largest banks in the United States, generally enjoys a mixed reputation and varying levels of customer satisfaction. The bank is known for its extensive branch network and diverse range of financial products and services, including banking accounts, credit cards, loans, and investment opportunities. Customers appreciate its technological advancements in digital banking, providing convenient online and mobile banking platforms. However, Bank of America has faced criticism for its customer service, fees, and account policies, which have occasionally led to dissatisfaction among some customers. Despite these challenges, the bank continues to be a significant player in the financial industry, serving millions of individuals, businesses, and institutional clients across the country.

Our methodology

Methodology in the context of JPMorgan Chase Bank typically refers to the approach or system the bank employs to conduct its business operations, manage risks, and deliver financial services. Here are some key aspects of JPMorgan Chase’s methodology:

Risk Management: JPMorgan Chase employs sophisticated risk management techniques to assess and mitigate various types of risks, including credit risk, market risk, operational risk, and compliance risk. This involves using advanced analytics, models, and systems to monitor and control risk exposure across its diverse business lines.

Financial Services Delivery: The bank utilizes a multi-channel approach to deliver financial services to its customers. This includes traditional brick-and-mortar branches, ATMs, online banking platforms, and mobile banking applications. These channels enable customers to access banking services conveniently and efficiently.

Investment Banking Expertise: As a major player in investment banking, JPMorgan Chase leverages its expertise in advising corporations and institutions on mergers and acquisitions, underwriting securities, and managing capital markets transactions. The bank’s investment banking methodology involves providing tailored financial solutions and advisory services to meet client needs.

Technological Innovation: JPMorgan Chase is committed to technological innovation in banking. It continuously invests in upgrading its digital infrastructure, enhancing cybersecurity measures, and developing new digital products and services to improve customer experience and operational efficiency.

Compliance and Regulation: Given its size and global presence, JPMorgan Chase adheres to strict regulatory requirements and compliance standards in each market it operates. The bank’s methodology includes maintaining robust compliance programs and internal controls to ensure adherence to legal and regulatory frameworks.

JPMorgan Chase offers a variety of banking services including checking and savings accounts, credit cards, mortgages, personal loans, investment products, and business banking solutions.

You can open an account online through their website, by visiting a branch location, or by calling their customer service. You’ll typically need to provide identification and personal information.

Fees vary depending on the type of account and services used. Common fees include monthly maintenance fees for checking accounts, overdraft fees, and fees for certain transactions. Many accounts offer ways to waive monthly fees, such as maintaining a minimum balance or having direct deposits.

JPMorgan Chase provides online banking services through their website and mobile app. Customers can check balances, transfer money, pay bills, and manage account settings online.

Yes, JPMorgan Chase offers investment products and services through its wealth management and investment banking divisions. These include investment advisory services, retirement planning, and access to mutual funds, stocks, and bonds.