SoFi Bank

SoFi Bank is a modern, online bank that offers a variety of financial services to help people manage their money. It provides savings and checking accounts, loans for students, home buyers, and personal use, as well as investment options. One of its standout features is that it doesn’t charge traditional bank fees, like overdraft fees. SoFi also offers cash-back rewards on purchases made with their debit card. The bank has a user-friendly mobile app, making it easy to check balances, transfer money, and pay bills from your phone. SoFi aims to make banking simpler and more convenient by offering all these services online, with helpful customer support available when needed. SoFi Bank is a digital bank in the United States that offers a range of financial services online. It was originally known for helping people refinance student loans but has expanded to offer personal loans, mortgages, and investing services. SoFi also provides checking and savings accounts with competitive interest rates and no monthly fees. The bank is known for its user-friendly app, which allows customers to manage their money, pay bills, and transfer funds easily. SoFi members can access financial planning services and get advice from certified financial planners. The bank often offers cash bonuses for new customers and has features like early paycheck access. SoFi also has a rewards program where users can earn points for various activities, which can be redeemed for cash or other perks. In summary, SoFi Bank aims to provide a convenient, all-in-one solution for managing finances, all from a smartphone or computer.

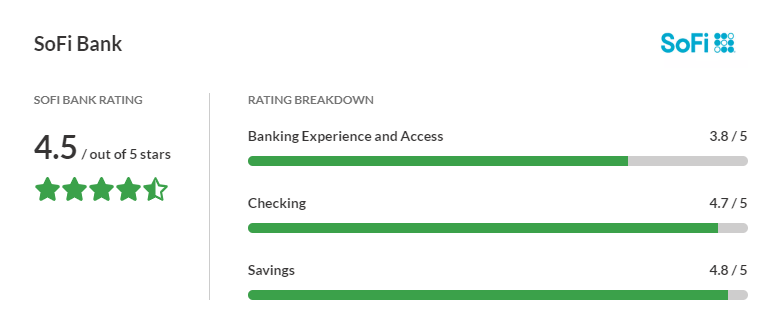

Our SoFi Bank Ratings

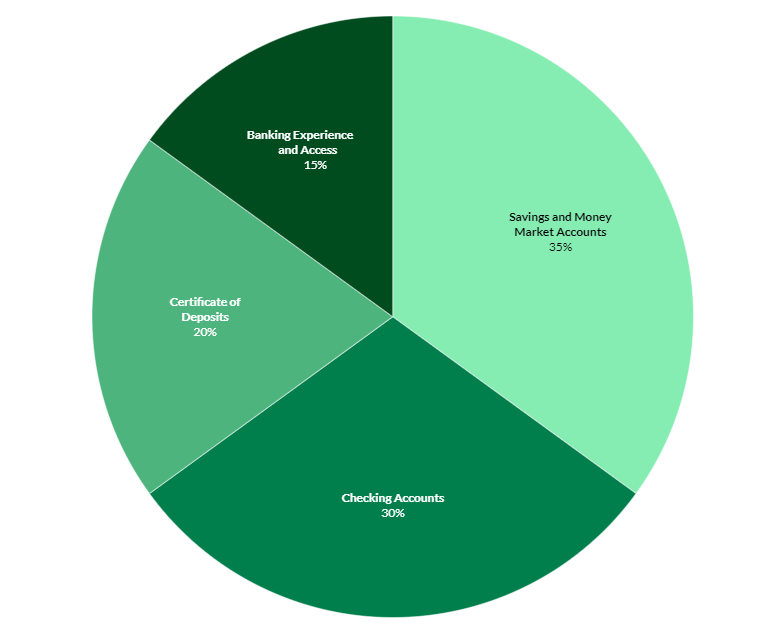

After evaluating SoFi Bank across various categories such as branch availability, account fees, interest rates, and customer support, we give it a rating of 4.5 out of 5 stars. It scores the highest for its savings and checking accounts, but its overall banking experience receives a slightly lower score due to the lack of in-person banking access.

Here are the bank’s scores in each of these categories:

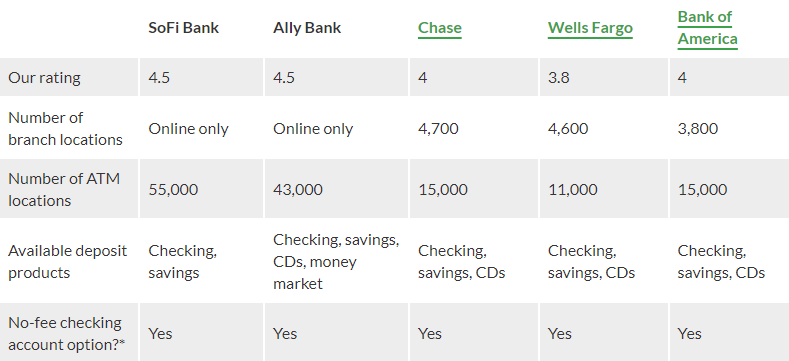

SoFi Bank vs. Other Top Banks

Compared to top banks like Chase, Wells Fargo, and Bank of America, SoFi Bank has both advantages and disadvantages as an online bank. SoFi Bank offers better accounts overall with lower fees and higher interest rates. It also has a larger ATM network through its partnership with Allpoint. However, SoFi Bank does not have any in-person branches.

SoFi Bank is more similar to Ally Bank, another online-only bank. While SoFi has a more extensive ATM network than Ally, it only provides checking and savings accounts. In contrast, Ally Bank offers more deposit account options, including CDs and a money market account.

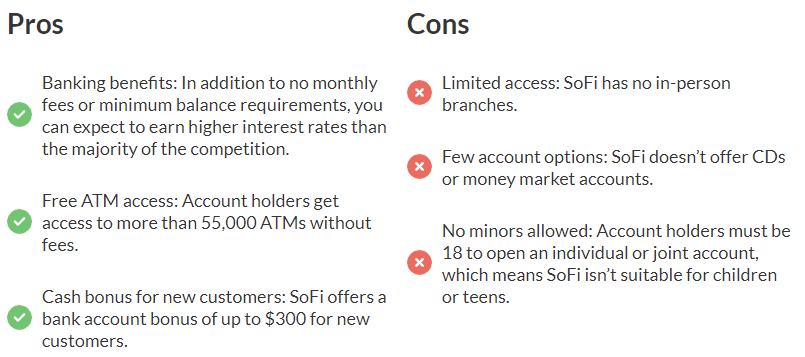

Overview of SoFi Bank: Pros and Cons

SoFi was founded in 2011 as a lending platform, later offering student-loan refinancing, mortgages and personal loans. It began operating as an online bank in February 2022 and soon launched its combined SoFi Checking and Savings account. SoFi Bank quickly grew in popularity, and by the end of 2022, it had over 2.1 million SoFi Money members and $7.3 billion in deposits.

SoFi Bank’s only deposit product is a joint checking and savings account. But, as an online-only bank, SoFi Bank has lower fees, higher interest rates and a more extensive ATM network than traditional banks. In exchange, you won’t get in-person service since there are no physical branches.

Who Is SoFi Bank Best For?

SoFi Bank is best for someone who is looking for a high-yield checking or savings account since the financial institution doesn’t offer other banking services. If you’re comfortable with just those two accounts, and doing your banking online, then SoFi is certainly worthy of consideration.

As an online bank, SoFi offers customers competitive interest rates and low fees, which are desirable to anyone looking to open a deposit account.

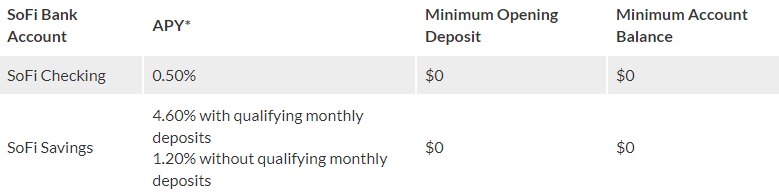

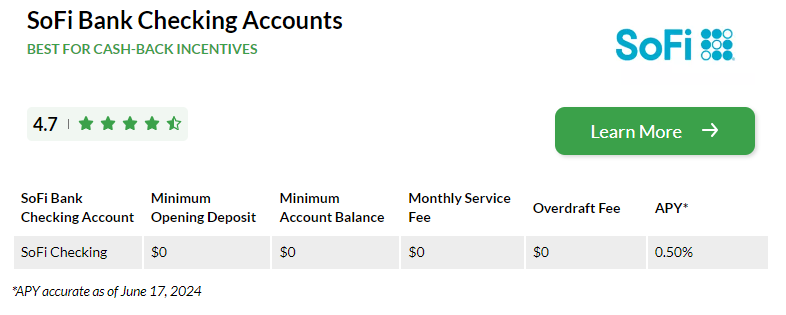

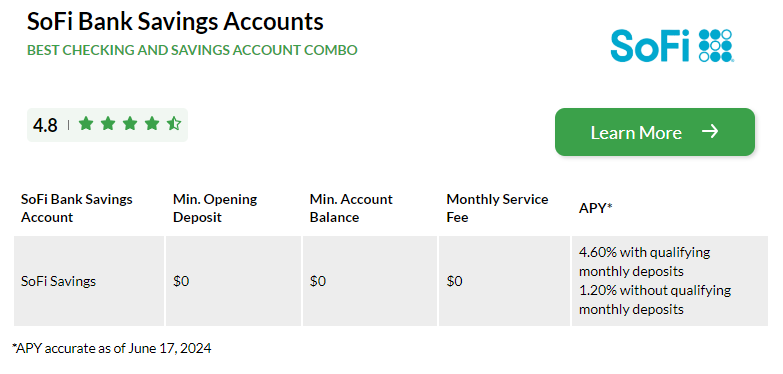

SoFi Bank Accounts

SoFi Bank only offers a checking account and a savings account, and you’ll receive both accounts in the form of a combined account called SoFi Checking and Savings. SoFi bank accounts can be managed online or through SoFi’s mobile app.

Both deposit accounts are insured by the Federal Deposit Insurance Corp. (FDIC) up to the legal limit of $250,000 per depositor and account ownership category. SoFi also offers up to $2 million in FDIC insurance for customers enrolled in its SoFi Insured Deposit Program.

SoFi Bank Reputation and Customer Satisfaction

SoFi Bank has an excellent reputation, boasting an A+ rating from the Better Business Bureau (BBB), though it is not BBB accredited. It also holds a perfect 5 out of 5 stars from Bauer Financial and an average rating of 4.6 out of 5 stars from customers on Trustpilot.

SoFi Bank’s mobile app receives solid reviews, with a slight difference between Apple and Google Play users. On the App Store, it has 4.8 out of 5 stars, with most reviewers praising its ease of use, design, and features. On Google Play, it has 4 out of 5 stars. While most reviews are positive, some users have reported frustration with glitches, bugs, and slow performance.

The Bottom Line: Is SoFi Bank Right for You?

If you’re looking for a high-yield checking or savings account and are comfortable managing your account online, SoFi Bank is worth considering. Its checking and savings accounts come with no fees or balance requirements and offer competitive interest rates.

SoFi Bank can provide these advantages because it saves money by not having physical branch locations. However, if you prefer face-to-face customer service or need in-person banking access, a traditional brick-and-mortar bank would be a better choice.

Methodology

Our team researched over 100 of the largest and most well-known financial institutions in the country, gathering information on each provider’s account options, fees, rates, terms, and customer experience. We then scored each firm based on the data points and metrics that are most important to potential customers. Read our full methodology for more details.

- Savings and money market accounts (35% of total score): The best scores go to banks, loans and fintech companies with high interest rates and low or no fees or minimum opening deposits.

- Checking accounts (30% of total score): High marks are given to those with multiple accounts and minimal fees, plus benefits such as reward programs and mobile check deposit.

- Certificates of deposit (20% of total score): Top-rated financial institutions have low or no minimum opening deposits, as well as a variety of term options and specialty CDs for flexibility.

- Banking experience and access (15% of total score): Providers that excel in this category have large branch and ATM networks and multiple checking and savings accounts, and they earn more points for offering CDs and money market accounts.

Bank and Credit Union Rating Methodology

SoFi Bank is a digital financial services company that offers a range of products including personal loans, student loan refinancing, mortgages, investing, and banking services.

Yes, SoFi Bank is FDIC insured, which means deposits are protected up to $250,000 per depositor, per ownership category.

You can open an account by visiting the SoFi website or downloading the SoFi app, then following the prompts to sign up.

Yes, you can have multiple accounts, including checking, savings, and investment accounts.

You can deposit money via direct deposit, mobile check deposit, electronic funds transfer, or wire transfer.

Pingback: BMO Alto Online Banking Review July 2024 BMO Alto Online Banking