PNC Bank USA

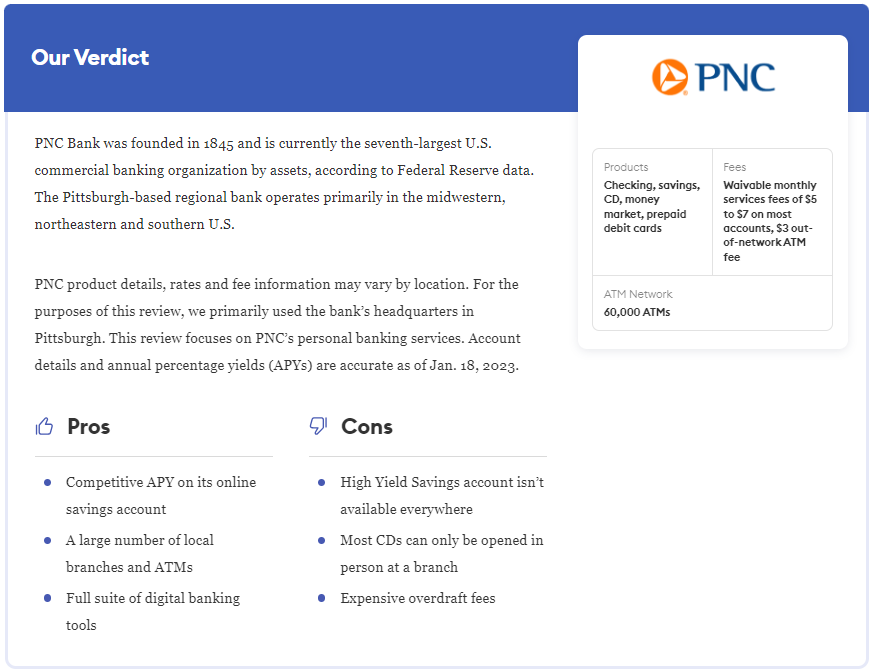

PNC Bank is a prominent American financial services corporation headquartered in Pittsburgh, Pennsylvania. With a history dating back to 1845, PNC Bank offers a comprehensive range of banking and financial services to individuals, businesses, and institutions. These services include personal and business banking, wealth management, asset management, and mortgage banking. Known for its extensive branch network and robust digital banking capabilities, PNC Bank serves millions of customers across the United States. The bank is committed to innovation, customer service, and community engagement, providing a wide array of financial products designed to meet diverse needs and enhance the customer banking experience.

Account Basics

Banking with PNC, as detailed on its corporate website, can be somewhat confusing, especially for those seeking stand-alone accounts. PNC combines three accounts into what it calls its Virtual Wallet. Additionally, customers are required to enter their ZIP code on various pages to ensure they are viewing the correct interest rates and offers.

PNC offers different versions of the Virtual Wallet tailored to customer needs. Here’s an overview of the various accounts available through PNC.

Checking

Two out of the three accounts within PNC’s Virtual Wallet are checking accounts. The primary checking account, PNC Virtual Wallet with Performance Spend (“Spend”), is a standard non-interest-bearing account with no minimum deposit required to open online. It includes a free debit card and access to PNC’s fee-free ATM network. PNC charges a fee for out-of-network ATM use but waives the first two fees per statement cycle and provides a $5 reimbursement per statement cycle for ATM fees charged by other institutions.

A notable feature of the Virtual Wallet is double overdraft protection, where PNC automatically transfers funds from your Reserve or Growth account to cover potential overdrafts on your Spend account.

PNC Virtual Wallet with Reserve (“Reserve”) is an interest-bearing checking account designed to help customers save for upcoming or unforeseen expenses. It earns 0.01% APY on balances over $1.

PNC also offers versions of the Virtual Wallet tailored for students and military personnel. The Student Virtual Wallet includes benefits such as no monthly service fees for up to six years. The military version features reduced requirements for waiving monthly fees.

In certain markets, the package is known as Virtual Wallet Checking Pro, which can be configured with just the Spend account or with the Spend, Reserve, and Growth accounts.

Savings

The third account that makes up PNC’s Virtual Wallet is the PNC Virtual Wallet with Growth (“Growth”). This savings account earns between 0.01% and 0.03% APY, depending on your balance and whether you meet the monthly requirements for relationship rates.

Eligible markets can also access the PNC High Yield Savings℠, an online-only savings account offering a competitive rate currently at 4.65% APY. This account requires no minimum opening deposit or ongoing balance and has no monthly service charges.

PNC also provides a Standard Savings Account, which features relatively low interest rates. A $25 minimum deposit is required to open this account.

For children, PNC offers the ‘S’ is for Savings® account. A $25 minimum deposit is needed to open the account, which earns 0.01% APY on all balances. This account includes access to an interactive banking learning center with tips from Sesame Street characters, making it ideal for younger kids.

Money Market

The PNC Premiere Money Market Account, available in select markets, offers rates ranging from 2.80% to 3.50% APY, depending on your balance and qualification for relationship rates. This money market account features unlimited deposits and includes a PNC debit card.

CDs

PNC offers two types of certificates of deposit (CDs). The PNC Fixed Rate Certificates of Deposit come in terms ranging from seven days to 10 years, with a $1,000 minimum deposit required to open. CDs with terms between three months and 36 months can be opened online, while other term lengths require a visit to a local PNC branch.

PNC’s rates vary depending on your ZIP code. The rates provided are for Fixed Rate CDs with opening deposits between $1,000 and $24,999.99 in New York’s 10001 ZIP code.

PNC Ready Access Certificates of Deposit offer a fixed rate with greater flexibility. Funds can be withdrawn from a Ready Access CD anytime after the first seven days from account opening. Available terms are three months and 12 months. A $1,000 minimum deposit and a visit to a local PNC branch are required, as these CDs are not available online.

Other Accounts and Services

In addition to its personal deposit accounts, PNC Bank provides a diverse range of financial products and services, including:

- Credit cards

- Mortgage loans

- Mortgage refinancing

- Home Equity Lines of Credit (HELOCs)

- Auto loans

- Personal loans and lines of credit

- Student loans

- Student loan refinancing

- Retirement and investment accounts and services

- Private banking

- Business banking, credit cards, and lending

- Commercial, corporate, and institutional banking and financial services

Distinguishing Features

As part of PNC’s Virtual Wallet, there’s a feature called Low Cash Mode. This service ensures there are no non-sufficient funds fees, and limits overdraft fees to a maximum of one $36 charge per day. Virtual Wallet customers receive customized alerts whenever their account balance is low.

Additionally, users get a minimum of 24 extra hours to bring their account balance back to at least $0 before any overdraft fee is applied. PNC’s mobile app includes a countdown clock that displays the remaining time until the fee would be charged.

Access on the Go

PNC offers a robust mobile app available on iOS and Android for convenient on-the-go banking. Through the app, PNC customers can:

- Manage accounts

- Deposit checks

- Pay bills

- Send and receive money via Zelle

- Lock a PNC debit or credit card if lost or stolen

- Set travel notifications

- Contact PNC customer support

The app also features a functionality to access select PNC ATMs without a card using a one-time access code. Similar banking functions are accessible online via PNC’s website.

For those preferring in-person banking, PNC operates approximately 2,300 local branches and around 18,000 ATMs across the United States. Customer support is available at local branches, through online chat, or by phone at 1-888-762-2265, Monday through Friday from 7 a.m. to 10 p.m. ET, and Saturday and Sunday from 8 a.m. to 5 p.m. ET. Customers can also tweet @PNCBank_Help for assistance.

How PNC Bank Stacks Up

Understanding PNC’s banking products online can be challenging, particularly due to the various versions of its Virtual Wallet and availability restrictions. Stand-alone bank accounts are also available but may require significant effort to find information on opening one.

For residents within PNC’s service areas seeking comprehensive banking services, PNC offers a reliable option. While competitive rates are more limited, except for its online-only savings account, PNC appeals to customers who prefer in-person banking or prefer consolidating all their accounts with one institution.

Frequently Asked Questions (FAQs)

PNC Bank offers a variety of accounts including checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), and specialized accounts like the Virtual Wallet.

PNC Bank provides fee-free access to their extensive ATM network. Fees may apply for using ATMs outside of the network, but certain accounts offer reimbursements for a limited number of these fees.

Yes, PNC Bank provides online and mobile banking services where you can manage your accounts, deposit checks, pay bills, transfer money, and more.

The Virtual Wallet combines checking and savings accounts with additional features like budgeting tools, automatic savings options, and customized alerts to help manage finances effectively.

Pingback: Review of SoFi Bank 2024 Review of SoFi Bank 2024

Pingback: Quontic Bank Review 2024: Online Banking

Virtual Wallet and availability

PNC Bank offers are Good

PNC Virtual Wallet is good they provide different Accounts.

pnc atm card is vitual or physical ?