M&T Business Banking Review

M&T Bank’s Business Banking division provides comprehensive financial solutions tailored to the needs of businesses across various industries. Specializing in serving small to mid-sized businesses, M&T Bank offers a range of products and services designed to facilitate growth, manage finances efficiently, and support day-to-day operations. With a focus on personalized service and local market expertise, M&T Bank aims to be a trusted partner for businesses seeking banking solutions that align with their goals and ambitions.

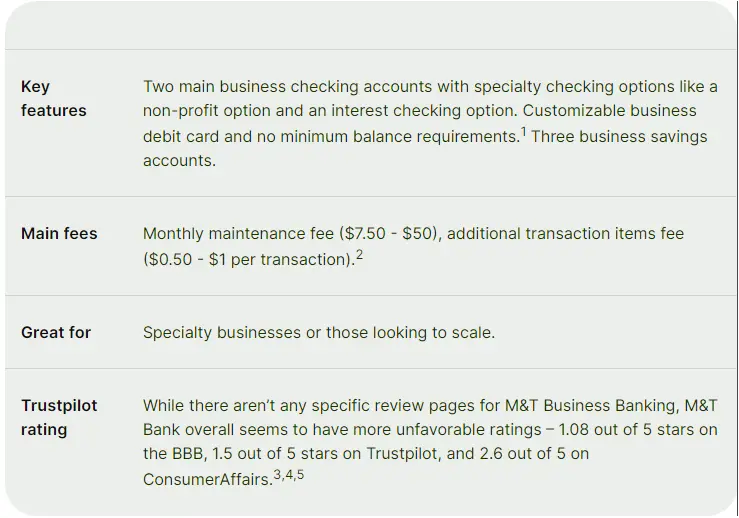

M&T Business Banking Review: Quick Overview

M&T Business Banking Review: What is it? Key Features

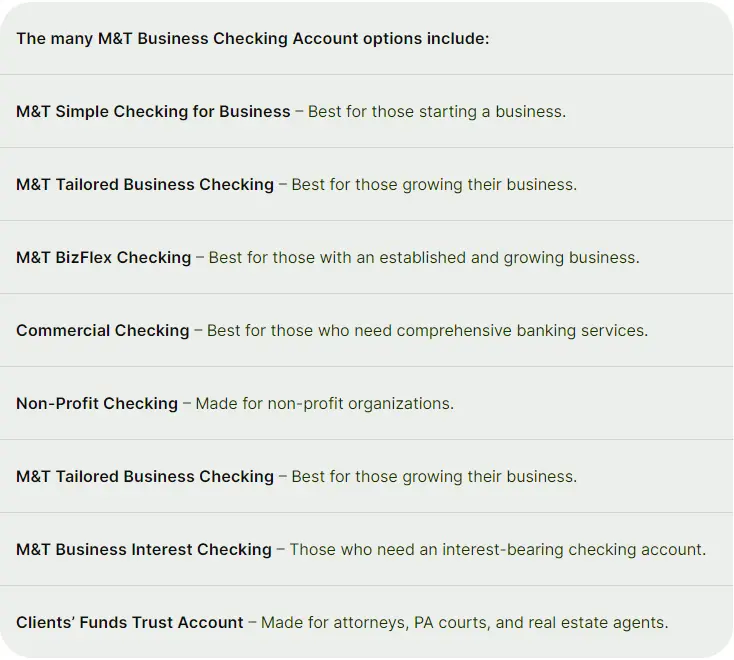

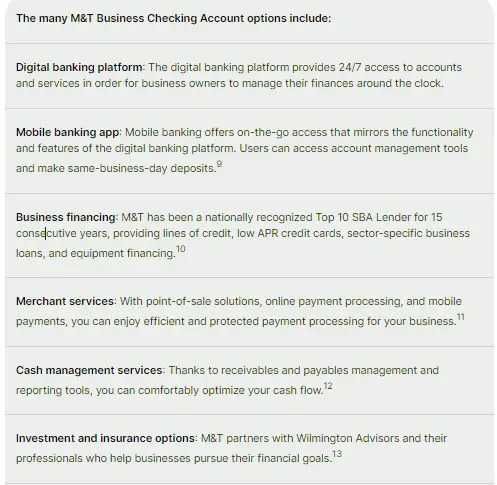

M&T Bank’s Business Banking division is designed to cater to the needs of small to mid-sized businesses, offering a variety of financial products and services. Key features include tailored banking solutions such as business checking and savings accounts, business loans and lines of credit, cash management services, merchant services, and business credit cards. M&T Bank emphasizes personalized customer service and local market knowledge, aiming to provide businesses with the tools and support they need to manage their finances effectively and achieve their growth objectives.

M&T Bank offers various incentives for its checking accounts, including a waiver of the monthly maintenance charge for the first three months and options to continue waiving the fee thereafter for most accounts. Additionally, some accounts include a set number of free transactions per month and provisions for currency deposits. As for savings options, M&T Bank provides three distinct choices: the Commercial Money Market Savings Account, offering tiered interest rates suitable for larger cash balances; the Commercial Savings Account, which earns interest; and the M&T Market Advantage for Business Savings, designed for businesses maintaining higher average daily balances. This variety allows businesses to select the account that best aligns with their financial needs and goals, ensuring they can optimize their savings with competitive interest rates.

M&T Business Banking Fees

M&T Bank follows a conventional fee structure that includes a monthly maintenance charge ranging from $5 to $50, with options available to waive this fee under certain conditions. Additional transaction fees may apply depending on account activity. While M&T Bank does not publicly disclose its exchange rates, customers can contact them via phone or visit a branch for more information.

One of the main drawbacks of M&T Bank is its international wire transfer fees, which can be significant for businesses involved in international transactions. Outgoing international wire transfers incur a fee of $75, while incoming transfers are subject to a $16 fee. These fees do not cover exchange rate conversions or markup fees, which can further impact costs for businesses.

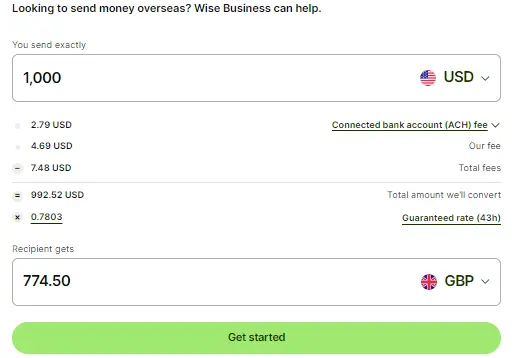

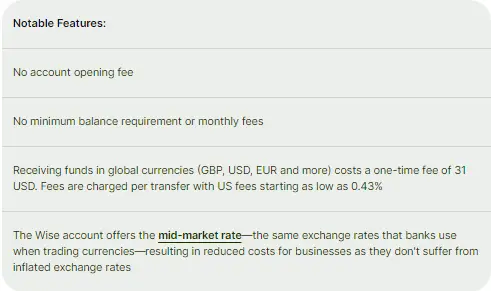

For businesses frequently engaged in international transactions, Wise (formerly known as TransferWise) presents a beneficial alternative. Wise allows businesses to manage multiple currencies efficiently, offering transparent, pay-as-you-go fee structures and access to real mid-market exchange rates, potentially reducing costs compared to traditional bank services.

M&T Business Banking: Benefits and Disadvantages

M&T Business Banking offers several benefits, including tailored banking solutions for small to mid-sized businesses, personalized customer service with local market expertise, and a variety of savings options with competitive interest rates. Additionally, many checking accounts have their monthly maintenance charges waived for the first three months, with options for ongoing fee waivers. However, the traditional fee structure includes monthly maintenance and transaction fees that can add up, and the high international wire transfer fees ($75 for outgoing and $16 for incoming) can be a significant drawback for businesses dealing with international clients. Furthermore, the lack of public disclosure on exchange rates can create transparency issues for international transactions.

M&T Business Banking Alternatives

Wise Business (Money Service Provider)

Wise provides a banking alternative ideal for businesses seeking to expand globally. Their international business account offers transparent, low-fee banking solutions. Small businesses benefit from an intuitive digital platform equipped with features like accounting software integrations and batch payments, streamlining daily operations for their teams.

Wells Fargo

Wells Fargo, a prominent banking institution, provides an extensive range of business banking services. Their platform includes advanced digital and mobile banking tools, offering a user-friendly experience similar to M&T Bank. However, Wells Fargo stands out with a vast network of branches and ATMs across the nation, enhancing accessibility for their customers.

PNC

Similar to M&T Bank, PNC offers a range of solutions tailored to diverse business needs, sizes, and stages. PNC’s tiered banking packages allow businesses to scale their banking solutions as they grow, optimizing their operations and expanding efficiently. One standout feature of PNC is its Cash Flow Insight tool, which provides businesses with detailed insights into their cash flow. This tool enables businesses to better manage, predict, and enhance their funds, contributing to more effective financial management.

M&T Business Banking: FAQ

Business checking, savings, loans, lines of credit, cash management, merchant services, and business credit cards.

First three months waived; options to continue with account activity or minimum balance.

Outgoing: $75; Incoming: $16; excludes exchange rate costs.

Yes, three types: Commercial Money Market Savings, Commercial Savings, M&T Market Advantage for Business Savings.