Most people know what a credit card is—a small plastic or metal rectangle used for making payments in person or online. When talking about your credit card company, you might be referring to either your issuer or your network. Your issuer is the bank or credit union that lends you money whenever you use your card. Examples of credit card issuers include Chase and Wells Fargo. Your network is the payment network that processes your transactions; examples include Visa and Mastercard. Some companies, like American Express and Discover, function as both issuers and payment networks.

Let’s break down how the process works behind the scenes when you swipe, tap, or dip your card, and look at some of the major credit card companies with products on the market today.

List of credit card companies

The term “credit card company” can refer to one of two entities. It might mean the credit card network—the companies that process transactions. You’ve likely seen businesses advertising that they accept Visa or American Express, for example.

The four major credit card networks in the United States are Visa, Mastercard, American Express, and Discover. All four are widely accepted within the U.S. However, if you’re traveling abroad, Visa or Mastercard may be your best bet, as American Express and Discover have more limited acceptance in some countries.

The issuer, on the other hand, is the financial institution that actually extends credit to you. It’s worth noting that American Express and Discover function as both payment networks and card issuers, extending credit directly to consumers. In contrast, with Visa and Mastercard, you won’t apply for a card directly through the payment network but rather through a bank or credit union that issues the card.

Common credit card companies

Many of the big names in the credit card industry will likely be familiar to you:

American Express: American Express is unique as it functions as both a credit card network and issuer. It offers a wide range of credit cards for consumers and small business owners, including those that earn points in their Membership Rewards® program.

Discover: Like American Express, Discover acts as both a credit card network and issuer. It provides products for various cardholders, from those looking to build credit to those seeking cash back rewards. Discover cards are known for their lack of annual fees.

Capital One: Capital One issues both Visa and Mastercard credit cards, with products ranging from secured cards for credit rebuilding to premium travel cards for those with excellent credit.

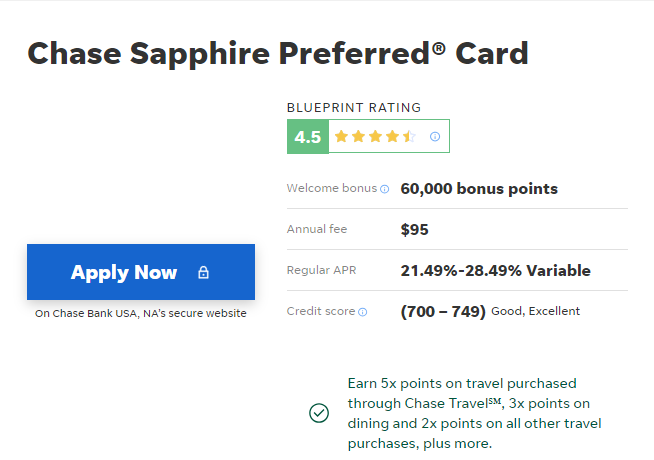

Chase: As one of the largest credit card issuers in the U.S. by purchase volume, Chase’s suite of Ultimate Rewards®-earning credit cards appeals to both business and consumer cardholders.

Bank of America: Though it offers fewer cards than issuers like Chase or Capital One, Bank of America is popular, especially among its banking customers. The Preferred Rewards loyalty program provides elevated credit card rewards based on meeting certain deposit and investment thresholds with Bank of America and Merrill.

Citi: Citi offers various credit card products, including cards under its own name and co-branded cards with companies like American Airlines and Costco. Citi cards come with a range of annual fees and benefits, ensuring options for many types of cardholders.

Barclays: Originally based in the U.K., Barclays also offers credit cards in the U.S. Its current offerings are all co-branded with merchants like Old Navy, JetBlue, Wyndham, and American Airlines.

Wells Fargo: While Wells Fargo has a smaller selection of credit cards compared to other major banks, its products remain competitive. Whether you’re looking for a balance transfer offer or a rewards card, Wells Fargo has great options for various needs.

Synchrony Bank: Synchrony is primarily known for issuing store credit cards. It is a giant in this space, with hundreds of partners and over 120 million open accounts.

U.S. Bank: U.S. Bank offers a range of credit cards that compete with some of the best on the market in various niches, including rewards, balance transfers, and credit building. Most of its consumer cards are on the Visa network, with one on the American Express network.

Credit One Bank: Credit One Bank is known for its credit card offerings aimed at those with lower credit scores. These cards are typically easier to qualify for but may come with high-interest rates and potentially expensive annual fees.

Additional credit card issuers

The major credit card companies listed above offer the majority of the most popular cards on the market, but there are other institutions with credit cards you might encounter as well:

- Goldman Sachs

- Truist

- Huntington Bank

- PNC

- Regions Bank

- Fifth Third Bank

- BMO Harris

- TD Bank

- First National Bank of Omaha

- Citizens Bank

- Merrick Bank

- BBVA

- KeyBank

- HSBC

- Premier Bankcard

- Navy Federal Credit Union

Many of these companies offer only a handful of credit card products, but they might still be a good option for cardholders with specific needs. For example, if you already bank with one of these institutions and want the convenience of managing your credit card and bank account with the same online banking login, opening a card with one of these issuers can streamline your finances.

How credit card companies make money

Credit card companies make money in several ways. First, merchants pay credit card networks a small fee, typically 1% to 3% of each transaction, for processing customer payments.

Issuers profit from consumers by charging various fees, including annual fees, late payment fees, foreign transaction fees, and more. They also earn money from interest charges when cardholders carry a balance from month to month.

Credit card APRs are often very high — with the average rate above 19% as of November 2022, according to the Federal Reserve — so interest can add up significantly on large balances. Fortunately, almost all credit cards offer a grace period to pay your balance in full before interest charges begin accruing.

Frequently Asked Questions (FAQs)

Visa is the most widely accepted credit card company, with acceptance in over 200 countries and territories worldwide.

The top five major credit card companies are:

Visa

Mastercard

American Express

Discover

Chase

Co-branded credit cards are issued through a partnership between a credit card issuer and a specific retailer, airline, hotel chain, or other company. These cards typically offer rewards and benefits related to the partner company, such as discounts, points, or miles for purchases made with the co-branded card.