EverBank

EverBank, now rebranded as TIAA Bank, was established with the mission of providing innovative banking solutions and personalized financial services. Headquartered in Jacksonville, Florida, TIAA Bank offers a comprehensive range of banking products, including checking and savings accounts, CDs, mortgages, and investment services. Known for its competitive interest rates and customer-focused approach, TIAA Bank aims to cater to both personal and business banking needs, offering a variety of online and mobile banking options for convenient account management.

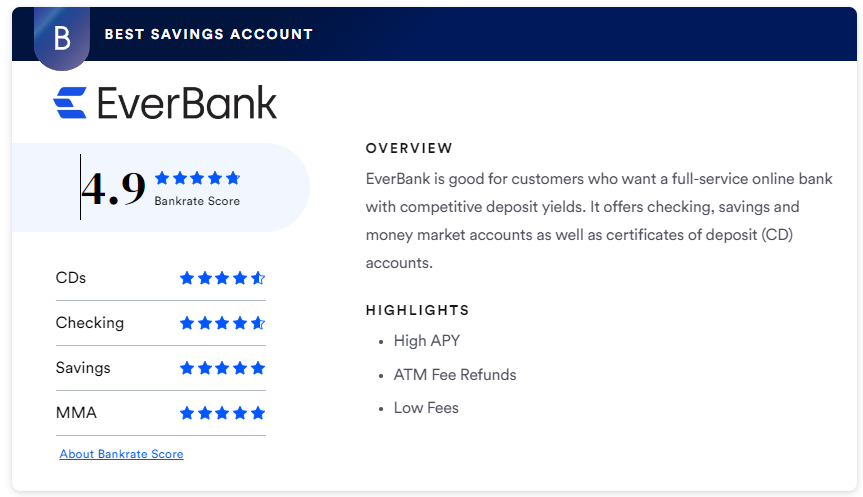

At a glance

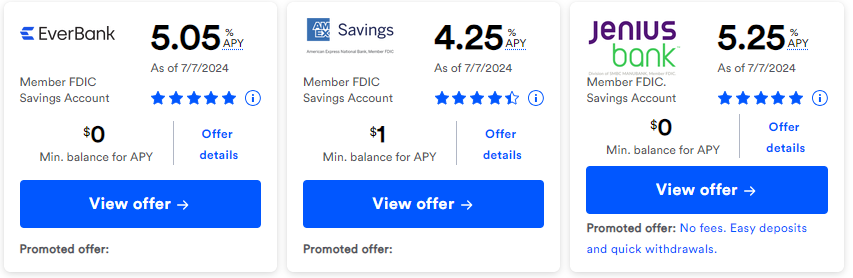

Sponsored offers

Overall

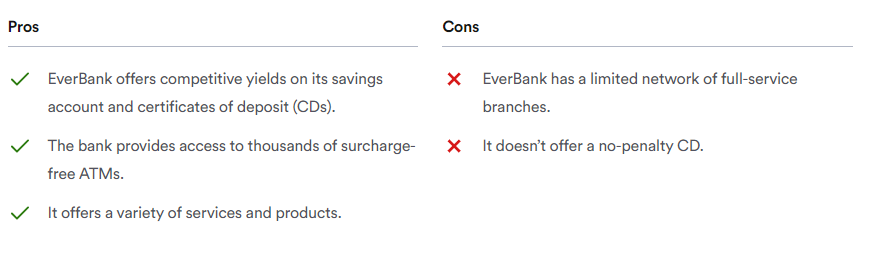

EverBank, now operating primarily online, offers deposit accounts with competitive rates and low minimum balances. Customers enjoy access to nearly 100,000 fee-free ATMs. While the bank has a limited number of branches, primarily located in Florida, it provides extensive online and mobile banking services. EverBank was honored with the Best Savings Account award in the 2024 Bankrate Awards.

EverBank banking products

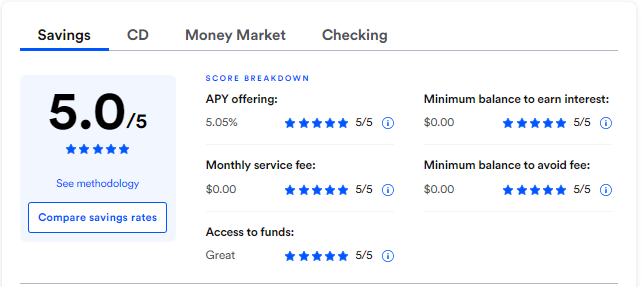

EverBank Savings Overview

The EverBank Performance℠ Savings account offers a highly competitive APY with no minimum opening deposit or monthly maintenance fee.

Pros:

- Highly competitive APY

- No monthly maintenance fee

- Mobile check deposit capability

- No minimum opening balance requirement

Cons:

- Some savings accounts offer slightly higher yields.

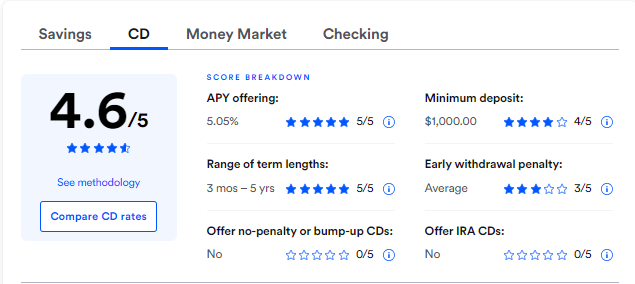

EverBank CD overview

EverBank offers standard CDs with terms ranging from three months to five years, each requiring a manageable minimum deposit and yielding rates well above national averages. Additional options include a bump-up CD and CDs with expanded Federal Deposit Insurance Corporation (FDIC) coverage. Early withdrawal penalties vary by CD type and term. For example:

- A one-year standard CD has an early withdrawal penalty of 91 days of simple interest.

- A five-year standard CD has an early withdrawal penalty of 456 days of simple interest.

Pros:

- CDs offer competitive APYs.

- A variety of CD terms are available.

- The minimum opening deposit for standard CDs is manageable.

Cons:

- EverBank doesn’t offer IRA CDs.

- No-penalty CDs are not available.

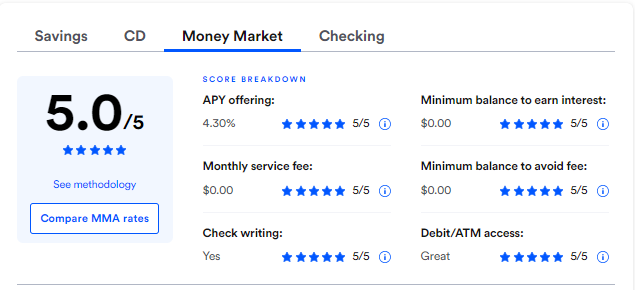

EverBank money market overview

At the time of Bankrate’s review, EverBank’s Yield Pledge Money Market account offered the same competitive introductory APY to all balances of $250,000 or less. After the introductory period, balances are subject to a tiered APY structure, with smaller balances earning a somewhat lower yield.

The money market account requires no minimum opening deposit and doesn’t charge a monthly service fee. The account includes check-writing privileges and a debit card.

Pros:

- During the first year, all balances earn the highest competitive rate, despite the account’s tiered APY structure.

- No monthly service fee.

- Comes with check-writing privileges and a debit card.

Cons:

- To earn the highest yield after the introductory period, a balance of at least $100,000 is required.

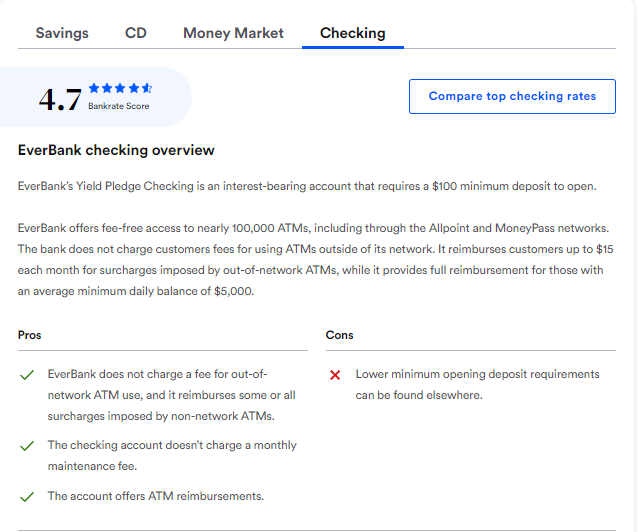

EverBank checking overview

EverBank’s Yield Pledge Checking is an interest-bearing account that requires a $100 minimum deposit to open.

EverBank offers fee-free access to nearly 100,000 ATMs, including those in the Allpoint and MoneyPass networks. The bank does not charge customers fees for using ATMs outside of its network and reimburses customers up to $15 each month for surcharges imposed by out-of-network ATMs. For customers with an average minimum daily balance of $5,000, EverBank provides full reimbursement for those surcharges.

Pros:

- No fees for out-of-network ATM use, with reimbursement for some or all surcharges imposed by non-network ATMs.

- No monthly maintenance fee.

- Access to nearly 100,000 fee-free ATMs and ATM reimbursements.

Cons:

- Some banks offer lower minimum opening deposit requirements.

Bank fees

Customer experience

Customer support

Physical Presence EverBank serves customers nationwide, although the majority of its branches are located in Florida. The bank provides access to nearly 100,000 surcharge-free ATMs.

Customer Service Customer service is available by phone on weekdays from 8 a.m. to 8 p.m. Eastern Time and on Saturdays from 9 a.m. to 7 p.m.

Digital experience

Mobile App

Mobile App

In August 2023, TIAA Bank transitioned to EverBank. While the highly-rated TIAA mobile app remains available for download, EverBank plans to launch a new mobile app in 2024, according to its website.

About EverBank

TIAA Bank now operates as EverBank, primarily serving customers online across all 50 states. It maintains nearly two dozen branches, most of which are located in Florida.

EverBank offers several conveniences, including access to nearly 100,000 fee-free ATMs nationwide, low minimum balance requirements, and peer-to-peer payment capabilities through Zelle.

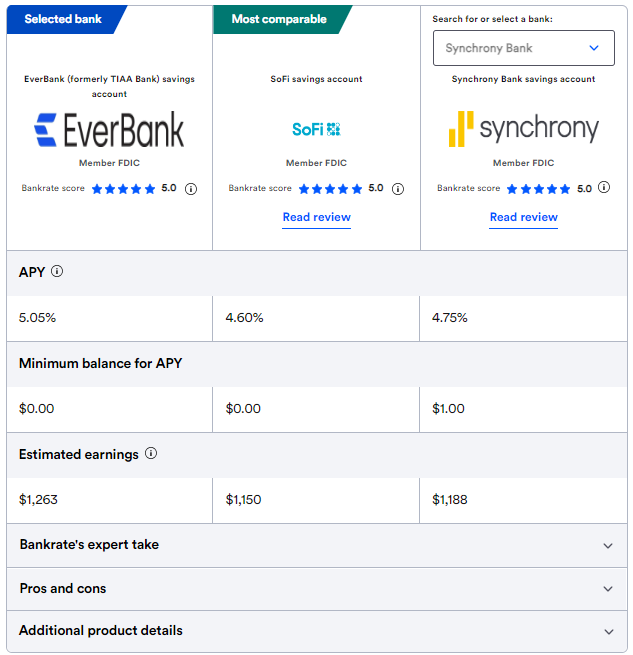

How EverBank compares to other banks

EverBank vs. Ally Bank

You’ll find a comparable banking experience at both EverBank and Ally Bank.

EverBank and Ally Bank provide a comprehensive range of consumer deposit products with competitive yields. EverBank operates primarily online, while Ally Bank is entirely online. Both banks offer extensive ATM networks and typically waive fees for out-of-network ATM usage.

However, EverBank offers a broader selection of standard CDs compared to Ally and generally offers higher CD yields. Similarly, EverBank provides higher yields on its savings and money market accounts.

Review methodology

With a plethora of financial institutions available, navigating the landscape can be daunting. Bankrate continually expands its repository of bank and credit union reviews, keeping them updated regularly. Our editorial team meticulously evaluates each institution across various deposit products including savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts (MMAs). We meticulously rate banks based on crucial factors such as interest rates offered, fees, minimum balance requirements, accessibility to funds, and more.

Each type of account and its features are carefully scored and weighed based on their significance to account holders, resulting in a comprehensive overall assessment.

Pingback: BMO Alto Online Banking Review July 2024 BMO Alto Online Banking