BMO Alto Online Banking

BMO Alto Online Banking is a digital service from BMO Harris Bank that lets you manage your money easily from your computer or mobile device. You can check your account balances, view recent transactions, pay bills, transfer money between accounts, and deposit checks just by taking a photo. It’s designed to be simple and user-friendly, with easy navigation and helpful features like alerts and reminders. You can also set up automatic payments for regular bills, saving you time and hassle. Security is a top priority, so your information is protected with advanced encryption and other safety measures. Plus, if you ever need help, customer support is available to assist you with any questions or issues. BMO Alto Online Banking makes managing your finances convenient, secure, and accessible anytime, anywhere.

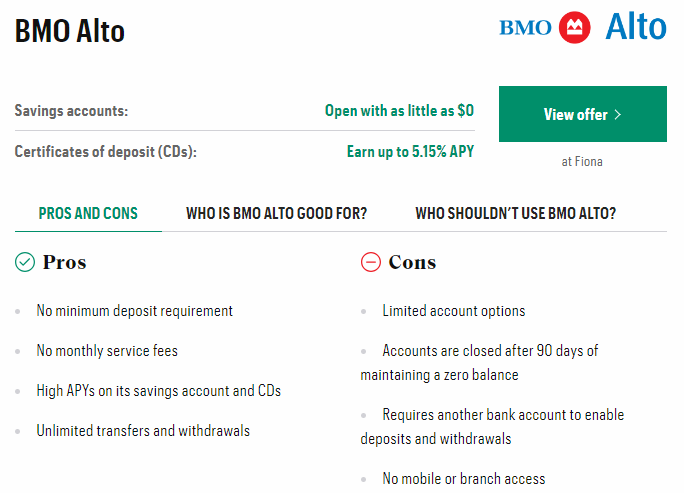

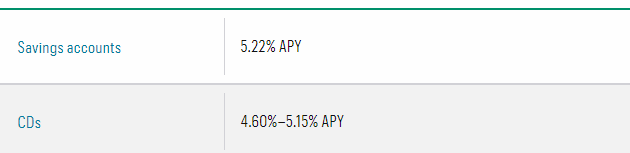

BMO Alto rates and products

BMO Alto offers various banking products with competitive rates to meet your financial needs. For savings accounts, you can earn interest on your deposits, helping your money grow over time. Checking accounts come with low or no fees, depending on the type, making everyday banking affordable. BMO Alto also provides different types of loans, including personal loans, home loans, and auto loans, with interest rates that are often lower than average to make borrowing more affordable. For those looking to invest, BMO Alto offers investment accounts and retirement savings plans, helping you plan for the future. The rates for these products are designed to be attractive and competitive, ensuring you get good value. Additionally, credit cards from BMO Alto come with various perks like cash back, travel rewards, and low interest rates, making it easier to choose one that fits your lifestyle. Overall, BMO Alto’s products are designed to offer good rates and benefits, making banking simple and beneficial for everyone.

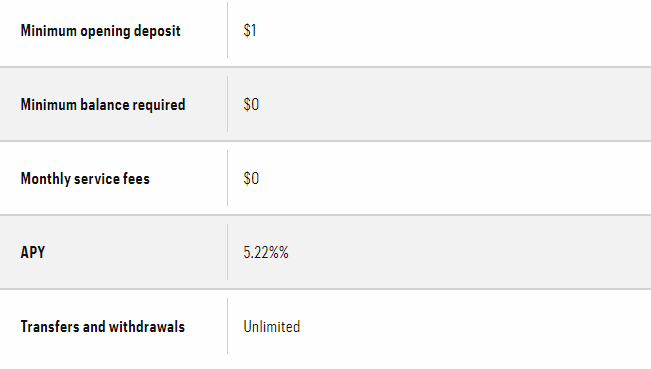

Savings accounts

A savings account is a type of bank account where you can store your money safely while earning interest over time. It’s a good place to keep money that you don’t need to use right away. The interest rate is usually higher than what you get in a checking account, so your money can grow more. You can deposit or withdraw money whenever you want, though there might be some limits on how many withdrawals you can make each month. Savings accounts are great for building an emergency fund or saving for big purchases like a car or vacation. They are also insured by the government, so your money is protected up to a certain amount. Opening a savings account is easy, and you can often do it online or at your local bank branch. Many banks offer tools to help you set savings goals and track your progress. Some savings accounts have no fees, while others might require a minimum balance to avoid charges. Overall, a savings account is a safe and easy way to grow your money and achieve your financial goals.

BMO Alto savings account features

The BMO Alto savings account is a basic savings account that offers easy ways to save money. It has no monthly fees, so you don’t have to worry about extra costs. You can start with just a small amount of money, making it easy to open. The account gives you interest on your savings, so your money grows over time. You can access your account online or through the BMO mobile app, making it convenient to manage your money anytime, anywhere. The account also offers free e-transfers, which means you can send money to friends or family without any charges. There are no minimum balance requirements, so you don’t need to keep a certain amount in the account. Plus, you get easy access to your funds with unlimited transactions, and there’s 24/7 customer support if you need help. This account is great for anyone who wants a simple and straightforward way to save money.

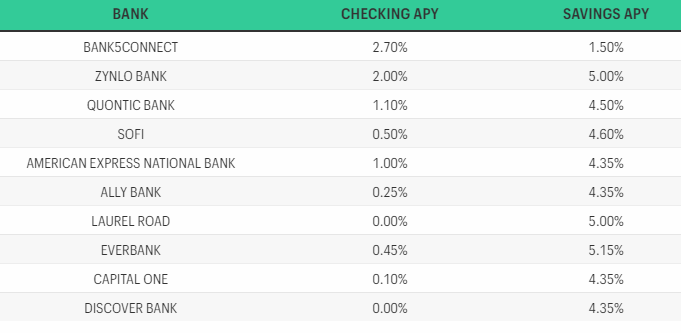

BMO Alto savings rates compared to current top rates*

The BMO Alto savings account offers competitive interest rates on your savings. While it provides a solid rate to help your money grow, it might not be the highest available. Currently, some other banks offer top rates that can be slightly higher. For example, some high-interest savings accounts from other banks might offer rates that are a bit better. However, BMO Alto balances this with no monthly fees, easy online access, and free e-transfers, which are great perks. When choosing a savings account, it’s important to consider both the interest rate and the extra features. While the top rates might give you a bit more interest, BMO Alto’s overall package can still be a very good deal, especially for people who value convenience and no extra fees. So, even if it’s not the absolute top rate, the BMO Alto savings account still offers good value and benefits that might be perfect for your needs.

Compare savings & checking interest rates

Sure! Savings and checking accounts are two common types of bank accounts that offer different benefits. Savings accounts typically pay you interest on the money you deposit, meaning the bank gives you a little extra money over time just for keeping your savings with them. The interest rates for savings accounts can vary, but generally, they are higher than those for checking accounts. Checking accounts, on the other hand, are designed for everyday transactions like paying bills and making purchases. While some checking accounts may offer interest, it’s usually much lower than what savings accounts provide. The main difference is that savings accounts help you grow your money over time, while checking accounts are more for managing your day-to-day spending. When comparing the two, it’s important to consider how often you’ll use the money and whether you want to earn interest on it. Always check with your bank for their specific rates and terms, as they can vary widely between institutions.

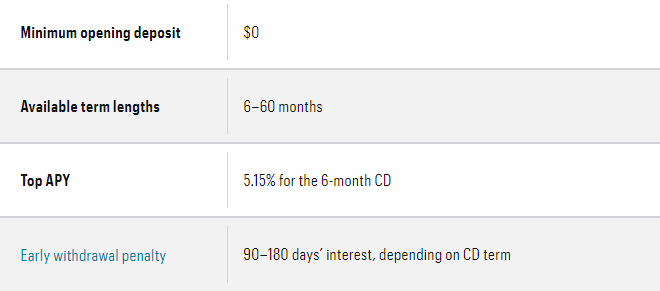

Certificates of deposit

Certificates of Deposit (CDs) are a type of savings account where you deposit a fixed amount of money for a fixed period of time, ranging from a few months to several years. In return, the bank pays you interest, typically at a higher rate than regular savings accounts. CDs are considered low-risk investments because they are insured by the Federal Deposit Insurance Corporation (FDIC) up to certain limits, ensuring your money is safe. The longer you agree to keep your money in a CD (known as the term), the higher the interest rate usually is. However, withdrawing your money before the CD matures often results in a penalty, so it’s important to be sure you won’t need the money during the term. CDs are popular for people who want a predictable return on their savings without risking their principal amount. They’re straightforward to open at most banks and can be a useful part of a diversified savings strategy, especially for saving towards specific financial goals like buying a car or funding a vacation.

BMO Alto CD features

The BMO Alto CD is a type of certificate of deposit (CD) offered by BMO Harris Bank. It is designed for customers who want to earn a competitive interest rate on their savings over a fixed period of time. The BMO Alto CD typically offers higher interest rates compared to regular savings accounts, making it a potentially attractive option for people looking to grow their money with low risk. One of its key features is flexibility in terms of the CD’s length, ranging from 6 months to 5 years, allowing customers to choose a term that suits their financial goals. Additionally, the BMO Alto CD is FDIC-insured up to certain limits, ensuring that your money is protected. While CDs generally require you to keep your money invested for the duration of the term to earn the full interest, withdrawing funds early may incur penalties. Overall, the BMO Alto CD offers a straightforward way to save and earn interest, providing security and a predictable return on your savings.

BMO Alto CD Rates

The BMO Alto CD offers different interest rates depending on the length of time you choose to keep your money invested. Generally, longer terms tend to have higher interest rates compared to shorter terms. For example, if you opt for a 6-month CD, the interest rate might be lower than if you choose a 5-year CD. This means you can select a term that fits your savings goals and how long you’re willing to keep your money untouched. BMO Harris Bank periodically adjusts these rates based on economic factors and market conditions, so it’s a good idea to check their current rates before opening a CD. The interest rates offered by BMO Alto CDs are competitive within the banking industry, aiming to provide customers with a way to earn a predictable return on their savings while keeping their funds secure under FDIC insurance protections. It’s important to note that the interest rates advertised may also depend on the amount of money you’re depositing and whether you’re a new or existing customer.

The BMO Alto platform and customer support

The BMO Alto platform is a digital banking service offered by BMO Harris Bank, designed to provide convenient access to financial services online and through mobile devices. It allows customers to manage their accounts, transfer money, pay bills, and monitor transactions from anywhere at any time. The platform is user-friendly with intuitive navigation, making it easy for customers to navigate their banking needs without visiting a physical branch. BMO Alto also emphasizes security, employing advanced encryption and authentication measures to protect users’ sensitive information and transactions. Customer support for BMO Alto is available through various channels, including phone, email, and online chat, ensuring that customers can get assistance promptly with any questions or issues they encounter. The support team is trained to provide helpful and personalized service, aiming to resolve concerns and provide guidance on using the platform effectively. Overall, BMO Alto combines the convenience of digital banking with reliable customer support to enhance the banking experience for its users.

Is BMO Alto secure?

Yes, BMO Alto is designed with strong security measures to protect users’ information and transactions. The platform uses advanced encryption technology to safeguard sensitive data transmitted between users’ devices and BMO Harris Bank’s servers. This encryption ensures that unauthorized parties cannot access or intercept the information. BMO Alto also employs secure authentication methods, such as passwords, security questions, and sometimes multi-factor authentication, to verify users’ identities when they log in or perform sensitive transactions. Additionally, the platform monitors for suspicious activities and may prompt users to verify their identity further if unusual behavior is detected. BMO Harris Bank, like all banks in the United States, is regulated by federal agencies and adheres to strict security standards to protect customer funds and data. It’s important for users to also take precautions, such as using strong passwords and keeping their login credentials confidential, to further enhance the security of their accounts. Overall, BMO Alto is committed to providing a secure environment for digital banking transactions and protecting customers’ financial information.

BMO Alto user reviews

BMO Alto has received mixed reviews from users. Many customers appreciate the convenience of managing their finances online and through the mobile app, noting the platform’s user-friendly interface and ease of navigation for tasks like checking balances, transferring money, and paying bills. Users also value the security measures in place, such as encryption and authentication, which provide peace of mind when conducting transactions. However, some users have reported occasional issues with functionality, such as glitches during transactions or delays in updates to account information. Customer support reviews vary, with some users praising responsive and helpful service, while others have expressed frustration with long wait times or difficulty reaching support agents. Overall, while BMO Alto generally offers convenient digital banking options with robust security features, user experiences can vary based on individual interactions and technical performance. Potential users may find it helpful to consider both positive and negative feedback to assess if the platform meets their specific banking needs.

Is BMO Alto right for you?

Whether BMO Alto is right for you depends on your banking preferences and needs. If you value the convenience of managing your finances online or through a mobile app, BMO Alto offers easy access to services like checking balances, transferring money, and paying bills from anywhere at any time. The platform’s strong security measures, including encryption and secure authentication, ensure that your transactions and personal information are protected. However, consider your comfort level with digital banking and your reliance on in-person banking services. If you prefer face-to-face interactions or need access to physical branches for certain transactions, you may find BMO Alto’s digital-only approach limiting. Additionally, reading user reviews can give you insights into others’ experiences with the platform’s functionality and customer service. Ultimately, whether BMO Alto is right for you depends on how well it aligns with your banking habits and preferences for digital versus traditional banking services.

Pingback: Quorum Federal Credit Union Review 2024

Pingback: Achieva Credit Union Online Banking

Very interested. Love to Use.