There isn’t a one-size-fits-all credit card that suits every family, purchase, or budget. Forbes Advisor has identified the best credit cards of 2024 to cater to a diverse range of needs. Instead of naming a single top card and listing the next fifteen, we’ve highlighted the best credit cards for various situations.

Best Travel Rewards Credit Cards of 2024

The best travel rewards credit cards of 2024 offer exceptional benefits for frequent travelers, including generous points or miles on travel purchases, access to exclusive airport lounges, and comprehensive travel insurance. These cards often feature lucrative sign-up bonuses, flexible redemption options, and valuable partnerships with airlines and hotels, ensuring that you get the most out of your travel expenses. Whether you’re a globetrotter or a frequent flyer, these top travel rewards cards can help you maximize your travel experiences while saving money and earning rewards.

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is a premium travel rewards card offering a generous earning rate of 2 miles per dollar on all purchases and 10 miles per dollar on hotels and rental cars booked through Capital One Travel. With a lucrative sign-up bonus, access to airport lounges, a $300 annual travel credit, and no foreign transaction fees, it’s designed to provide exceptional value for frequent travelers. This card combines extensive travel perks with straightforward earning potential, making it an excellent choice for those looking to enhance their travel experiences.

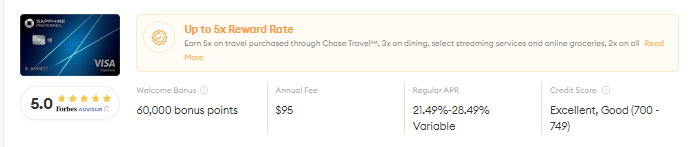

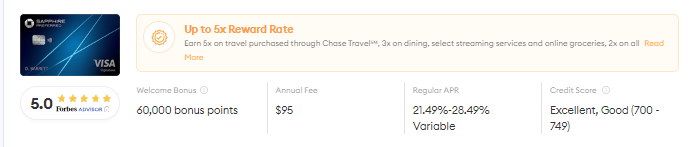

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is a top-tier travel rewards card known for its exceptional benefits and rewards structure. Cardholders earn 3 points per dollar on travel and dining worldwide, and 1 point per dollar on all other purchases. The card offers a substantial sign-up bonus, a $300 annual travel credit, and access to over 1,000 airport lounges globally through Priority Pass Select. Additionally, points are worth 50% more when redeemed for travel through Chase Ultimate Rewards®. With robust travel protections, no foreign transaction fees, and comprehensive purchase protection, the Chase Sapphire Reserve® is an outstanding choice for avid travelers seeking luxury and value.

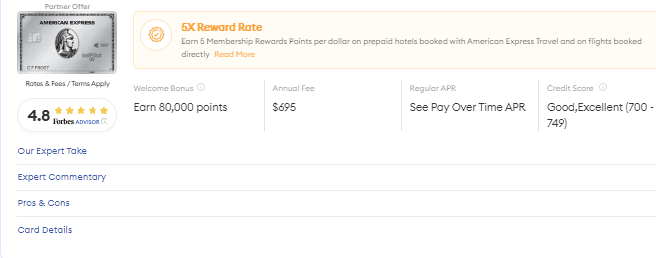

The Platinum Card® from American Express

The Platinum Card® from American Express is renowned for its premium travel benefits and extensive rewards. Cardholders earn 5 points per dollar on flights booked directly with airlines or through American Express Travel, and on prepaid hotels booked through Amex Travel, with 1 point per dollar on other purchases. The card includes access to the Global Lounge Collection, featuring over 1,300 airport lounges worldwide, and up to $200 in annual airline fee credits. Additional perks include Uber Cash, Saks Fifth Avenue credits, and comprehensive travel and purchase protections. With no foreign transaction fees, The Platinum Card® from American Express is a top choice for frequent travelers seeking luxury and extensive rewards.

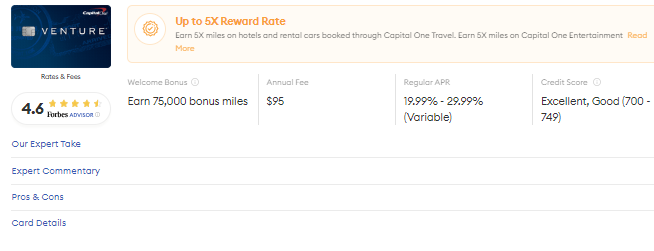

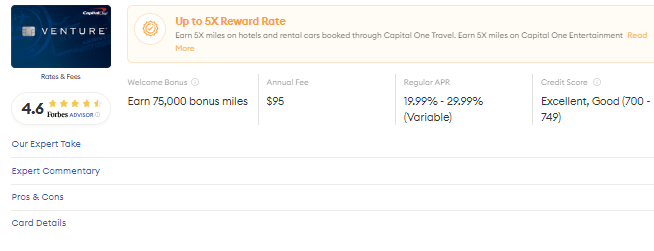

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a versatile travel card offering a straightforward and rewarding points system. Cardholders earn 2 miles per dollar on every purchase, with no limit on how many miles they can earn. The card also offers a generous sign-up bonus and a range of travel benefits, including up to a $100 credit for Global Entry or TSA PreCheck. Miles can be redeemed for travel expenses or transferred to numerous travel loyalty programs. With no foreign transaction fees, the Capital One Venture Rewards Credit Card is an excellent choice for travelers seeking flexibility and value.

Best Cash-Back Credit Cards of 2024

Chase Freedom Flex®

The Chase Freedom Flex® is a top-tier cash back credit card that offers a mix of valuable rewards and flexible redemption options. Cardholders can earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter they activate, 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstore purchases, and 1% on all other purchases. With no annual fee, the Chase Freedom Flex® also includes benefits like purchase protection and extended warranty coverage, making it an excellent choice for those looking to maximize their everyday spending.

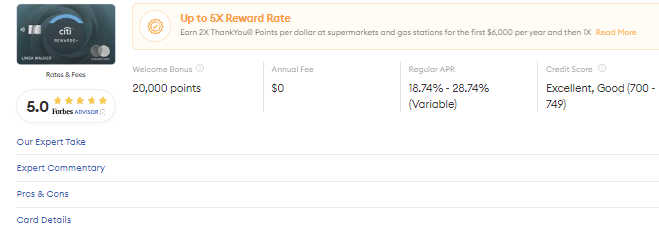

Citi Rewards+® Card

The Citi Rewards+® Card is a unique option for those seeking to maximize their rewards on everyday purchases. This card rounds up to the nearest 10 points on every purchase, a feature that can significantly boost your rewards. Additionally, cardholders earn 2X points at supermarkets and gas stations for the first $6,000 per year and 1X points on all other purchases. With no annual fee and a 10% points rebate on the first 100,000 points redeemed each year, the Citi Rewards+® Card offers a compelling blend of value and flexibility for everyday spending.

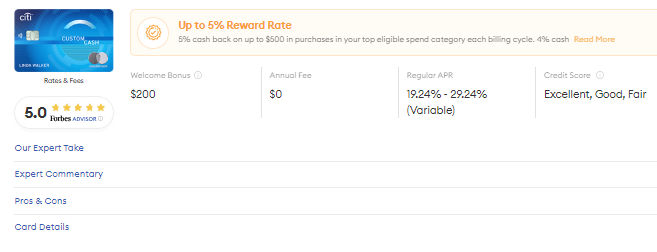

Citi Custom Cash® Card

The Citi Custom Cash® Card is designed to adapt to your spending habits, offering 5% cash back on your highest eligible spend category each billing cycle, up to the first $500 spent, and 1% cash back on all other purchases. This flexible rewards structure ensures that you can maximize your earnings in the categories where you spend the most. With no annual fee and a straightforward cashback program, the Citi Custom Cash® Card provides a valuable and user-friendly option for everyday purchases.

Best Credit Cards With Category Bonuses of 2024

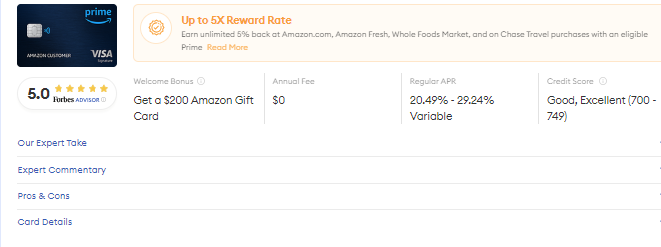

Prime Visa

The Prime Visa, designed for Amazon Prime members, offers impressive category bonuses tailored to frequent Amazon shoppers. Cardholders earn 5% back on purchases made at Amazon.com and Whole Foods Market, 2% back at restaurants, gas stations, and drugstores, and 1% back on all other purchases. With no annual fee for Prime members, this card enhances the value of an Amazon Prime membership by providing significant cashback rewards on everyday and specialized spending. The Prime Visa is a compelling choice for those who want to maximize their rewards on Amazon and Whole Foods Market purchases while enjoying additional perks in other spending categories.

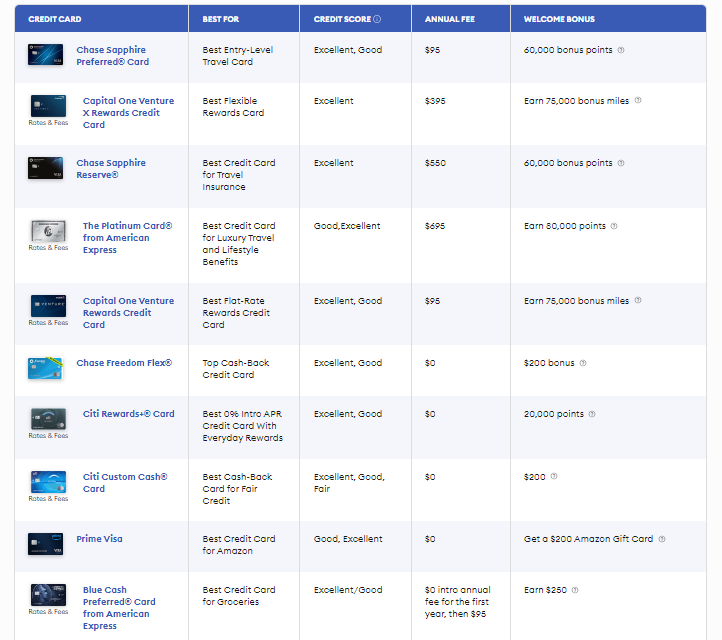

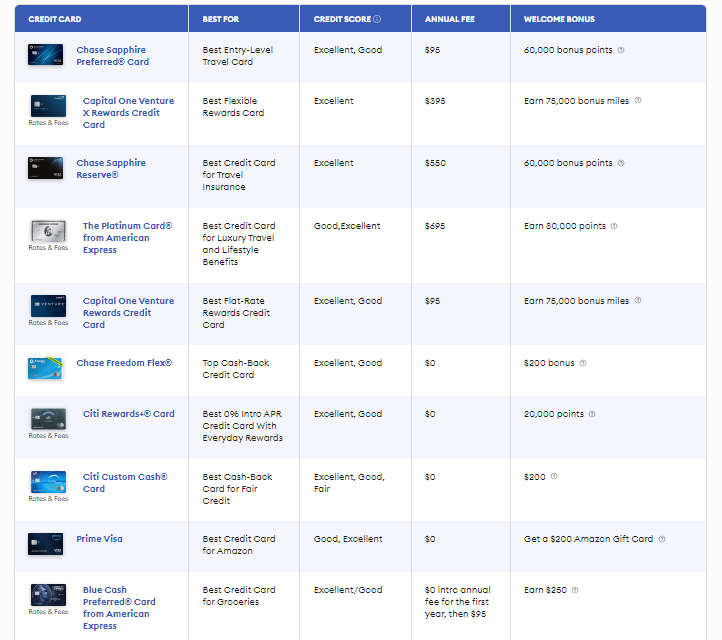

Here’s a Summary of the Best Credit Cards of 2024

Methodology

Forbes Advisor meticulously assesses over 300 credit cards in 2024 across various categories such as cash-back, travel, flexible rewards, business, student, and cards banking accounts offering 0% APR. Each card undergoes thorough evaluation based on key factors including annual fees, rewards rates and values, welcome bonuses, interest rates or promotional offers, card benefits and perks, and consumer protections. Cards are carefully compared within their respective categories to determine which features are most crucial. This rigorous scoring process enables Forbes Advisor to rank and highlight the top credit cards of 2024, ensuring informed decisions for potential cardholders seeking the best options available.

Best Credit Card Deals Right Now

If you’re currently exploring new credit card options, it’s essential to consider those with the most valuable welcome bonuses available this week. Various cards stand out with enticing offers across different categories. Remember to factor in annual fees and additional benefits, which can vary widely, when assessing each card beyond just the initial bonus before making your decision.

What Credit Card Should I Get?

Different types of credit card users will find the most benefit from different types of credit cards. Here are some tips to help you decide which credit card is best suited for your needs:

- Value Shoppers: If you prioritize cash back on everyday purchases and aim to minimize annual fees, consider cash-back cards that offer rewards on groceries and shopping. These cards focus on practical rewards rather than travel perks or luxury benefits.

- Travelers: The best credit card for travel in 2024 depends on your travel preferences. Road trip enthusiasts may prefer cards tailored for driving adventures, while frequent flyers might benefit from airline-specific credit cards offering travel rewards and top-notch perks. Each type typically features attractive credit card offers tailored to their specific travel needs.

Credit Builders: Starting out or rebuilding credit can be challenging, but there are credit cards designed to help. Explore options like first credit cards or cards for rebuilding credit, which offer opportunities to establish or improve your credit history.

Students: College students have access to a variety of credit cards designed with their needs in mind. These cards often provide rewards and benefits suitable for students who may not have an extensive credit history yet.

Business Owners: Small business owners, whether just starting or established, benefit from business credit cards. These cards not only help manage business expenses but also offer perks tailored to business needs. Look into options like cards for new businesses or explore comprehensive business credit card lists.

Brand Loyalists: If you have a preference for specific brands like hotels or retailers, consider co-branded credit cards. These cards earn points and offer perks within a particular brand’s ecosystem, enhancing your loyalty rewards and benefits.

Frequently Asked Questions (FAQs)

In 2024, the best credit cards vary based on your needs and preferences. Whether you’re looking for cash back, travel rewards, or building credit, top options include cards like the Chase Sapphire Preferred® Card for travel, the Citi® Double Cash Card for cash back, and the Discover it® Secured Credit Card for building or rebuilding credit.

The easiest credit cards to get generally include secured credit cards or student credit cards. Secured cards require a security deposit, which reduces the risk for lenders, making approval more accessible for those with limited or poor credit history. Student cards are tailored for college students and typically have more lenient approval requirements.

The best credit card company depends on what you prioritize—customer service, rewards programs, fees, and benefits. Companies like Chase, American Express, and Capital One are frequently praised for their customer service and robust rewards offerings across various card types.

To select the best credit card, consider your spending habits, financial goals, and credit history. Look for cards that offer rewards or benefits aligned with your lifestyle, have manageable fees, and fit your credit profile. Compare annual fees, interest rates, rewards structure, and additional perks before making a decision.