Best Credit Cards of July 2024

Certain credit card offers displayed on this website come from companies that are advertising partners of U.S. News. While advertising commissions may influence the placement and order of these offers, they do not affect our editorial choices regarding which card products we feature or how we review them. Not all card issuers or card offers available in the market are included on this site. Terms and conditions apply. Certain credit card offers presented on this website come from companies that advertise with U.S. News. While advertising fees may influence the placement and order of offers on the site, they do not affect our editorial decisions, including the card products we feature and our evaluation methods. Not all credit card companies or available offers are included on this site. Selecting the right credit card can be challenging. At U.S. News, we aim to simplify this process for you. We’ve showcased the best credit cards in each category, along with details on annual percentage rates, fees, rewards programs, and other crucial factors to consider before you apply.

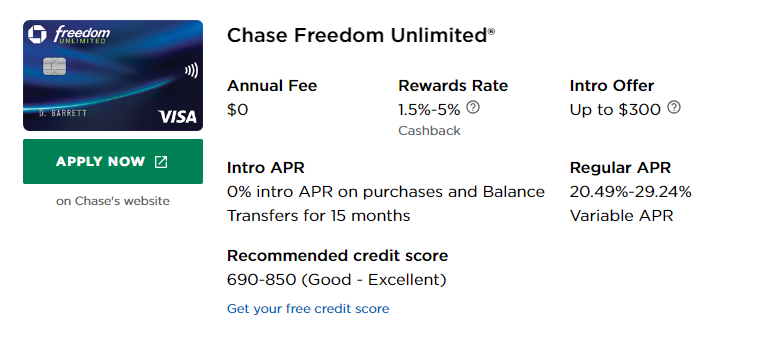

Chase Freedom Unlimited

How Do Credit Cards Work?

Using a credit card allows you to make purchases on credit with the benefit of a grace period, typically between 21 to 25 days. If you pay off your balance in full during this grace period and by the due date, you avoid paying any interest. Ever wondered what happens behind the scenes after you use your card to buy something? It’s actually quite fascinating and straightforward! Here’s a quick overview of how a credit card transaction unfolds when you purchase, say, a pair of shoes at your favorite store:

- You use your credit card to pay for the shoes. Your credit card information is transmitted to the retailer’s bank, known as the acquiring bank.

- The acquiring bank requests authorization for payment from the credit card network associated with your card (Visa, Mastercard, Discover, American Express).

- Your purchase is authorized, and the amount you spent on the shoes is deducted from your credit limit.

- You complete the payment for the shoes. The purchase amount appears on your credit card statement, detailing the due date and minimum payment required. Paying the full balance by the due date means you won’t accrue any interest charges

How Is Credit Card Interest Calculated?

Paying off your entire credit card balance monthly ensures you maintain your available credit limit. Making only the minimum payment, however, can lead to accumulating credit card debt, exacerbated by compound interest that quickly escalates your debt. Most credit card issuers compound interest daily on outstanding balances, meaning you could end up paying interest on top of interest. It’s crucial to avoid this cycle. View your credit card as a tool for a short-term, interest-free loan: by settling your balance within the grace period, you essentially enjoy your purchases for a few weeks before needing to pay. For further insights, explore my U.S. News column:

Types of Credit Cards

Choosing the right credit card can seem daunting given the array of options available. To simplify your decision-making process, here’s a brief overview of different types of credit cards:

Student Credit Cards

For college students seeking their first credit card, student cards can be ideal. Many offer perks like cash back rewards, incentives for good grades, and free credit scores. According to the Credit CARD Act of 2009, applicants must be at least 21 years old or demonstrate sufficient income.

Cash Back Credit Cards

If you’re looking to save on everyday purchases, consider a cash back credit card. These cards allow you to earn rewards across various categories. Some offer a flat rate on all purchases, while others provide higher rewards on specific categories like groceries or gas stations, with rotating categories changing quarterly.

High-Limit Credit Cards

Individuals with good credit may qualify for high-limit credit cards. These cards offer substantial credit limits, enabling rewards accumulation on significant purchases like appliances. To benefit fully, it’s essential to pay off balances in full each month, requiring disciplined money management.

Starter Cards for Building Credit

For those new to credit or rebuilding their credit history, starter cards designed to build credit can be invaluable tools. Responsible use of these cards helps establish a positive credit history and improve credit scores over time.

Navigating the world of credit cards involves understanding your financial needs and choosing a card that aligns with your spending habits and goals. For more detailed insights, explore my U.S. News column on credit card selection.

How Credit Card Rewards Work

Credit card rewards are incentives that credit card companies give you for using their cards. When you make purchases, you earn points, miles, or cash back. Points can be exchanged for things like gift cards or merchandise. Miles are usually used for travel expenses like flights and hotels. Cash back gives you a percentage of what you spent back as cash. For example, if you have a card that offers 1% cash back and you spend $100, you’ll get $1 back. Some cards offer higher rewards for certain categories, like 3% back on groceries or 2% on gas. It’s important to pay your bill on time because interest charges can outweigh the rewards. By using the right card for your spending habits, you can save money or earn bonuses. However, always read the fine print to understand how to maximize your rewards and avoid fees.

What Credit Card Should I Get?

Choosing a credit card depends on your needs and spending habits. First, check your credit score, as it determines which cards you qualify for. If you’re new to credit, consider a secured card where you deposit money upfront. For rewards, pick a card that matches your spending, like a travel card if you fly often or a cash back card for everyday purchases. Look at interest rates if you might carry a balance. Some cards have no annual fee, while others offer big perks but charge a yearly fee. Consider the sign-up bonus, which is extra points or cash back for spending a certain amount early on. Read about the card’s benefits, like fraud protection or rental car insurance. Also, check for fees, like those for late payments or foreign transactions. By matching a card to your financial habits and goals, you can get the most value from it.

How to Apply for a Credit Card

Applying for a credit card is simple if you follow a few steps. First, check your credit score to know which cards you might qualify for. Research and choose a card that fits your needs, whether it’s for rewards, low interest, or building credit. Gather your personal information, like your Social Security number, income, and employment details. You can apply online, by mail, or in person. Fill out the application form with accurate information. Submit the application and wait for a response, which can be instant or take a few days. If approved, read the terms and conditions carefully before using the card. If denied, review your credit report to understand why and consider applying for a different card or improving your credit before trying again. Once you get your card, use it responsibly by paying your bill on time and keeping your balance low to build a good credit history.

How Many Credit Cards Should I Have?

The number of credit cards you should have depends on your financial habits and how well you can manage them. Some people find one card is enough for their needs, making it easy to track spending and payments. Others might benefit from having multiple cards to maximize rewards, like one for travel and another for groceries. Having several cards can also improve your credit score by increasing your total available credit, as long as you keep balances low. However, too many cards can be difficult to manage and might lead to missed payments or overspending. It’s crucial to only have as many cards as you can handle responsibly. Start with one or two cards and see how you manage them. If you can pay off balances in full and on time, you might add another card. Always consider the fees, interest rates, and benefits before getting a new card. Quality and responsible use are more important than the number of cards you have.

What Is the Best Credit Card Issuer?

The best credit card issuer depends on what you value most in a card. Major issuers like Chase, American Express, Citi, and Discover each offer different benefits. Chase is known for its versatile rewards and travel benefits, especially with cards like the Chase Sapphire Preferred. American Express is famous for excellent customer service and premium cards like the Platinum Card, which offers high-end travel perks. Citi cards often provide good balance transfer offers and rewards, such as the Citi Double Cash card, which gives 2% cash back. Discover is popular for its cash back program and no annual fees, plus their customer service is highly rated. Ultimately, the best issuer for you depends on your spending habits and what benefits you seek, such as travel rewards, cash back, or low-interest rates. Comparing the features and fees of cards from these issuers will help you find the best fit for your needs.

Best Credit Cards Methodology

To determine the best credit cards, a methodology is used that looks at several key factors. First, rewards programs are evaluated, including cash back, points, and miles, to see which cards offer the best returns. Interest rates are considered, especially the annual percentage rate (APR), to find cards with the lowest costs for carrying a balance. Annual fees are checked to ensure the card’s benefits outweigh its cost. Sign-up bonuses are reviewed for the value they provide to new cardholders. Customer service quality and cardholder reviews are assessed to gauge user satisfaction. Additional perks like travel insurance, purchase protection, and extended warranties are also important. Credit card issuers’ reputations and their policies, such as fraud protection and ease of use, are taken into account. By comparing these factors across different cards, we can identify the best options for various needs, such as travel, cash back, or building credit. This comprehensive approach ensures that the recommended cards offer great value and meet diverse consumer needs.