Bank of America is one of the largest banks in the United States, serving millions of customers across the country. Established in 1904, it has grown to become a key player in the financial industry. The bank offers a wide range of services including checking and savings accounts, loans for homes and businesses, credit cards, and investment opportunities.

Headquartered in Charlotte, North Carolina, Bank of America operates thousands of branches and ATMs nationwide, making banking accessible to people in urban and rural areas alike. It is known for its commitment to technology, providing convenient online and mobile banking platforms for its customers.

Bank of America plays a significant role in the global financial markets, offering services to individuals, small businesses, corporations, and institutional investors. With a focus on customer service and financial expertise, Bank of America continues to be a trusted partner for financial solutions for millions of people around the world.

Bank of America Ratings

Bank of America, the second largest bank in the country by assets, serves approximately 69 million customers through its extensive network of branches and ATMs spanning 38 states and Washington, D.C.

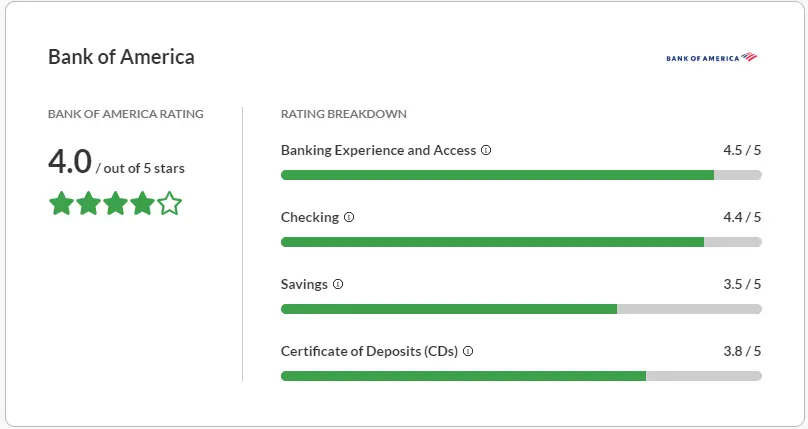

In our evaluation of over 100 traditional and online banks and credit unions, Bank of America received an overall rating of 4 out of 5 stars. It excels due to its widespread branch presence and robust mobile app and online platform. However, it falls short in comparison to competitors in terms of interest rates offered on deposit accounts.

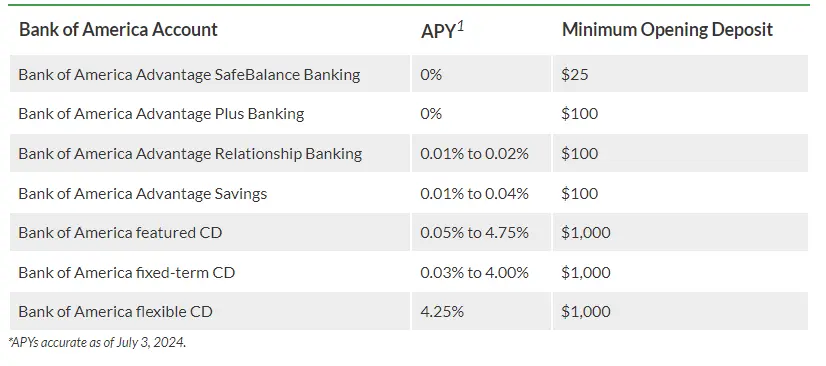

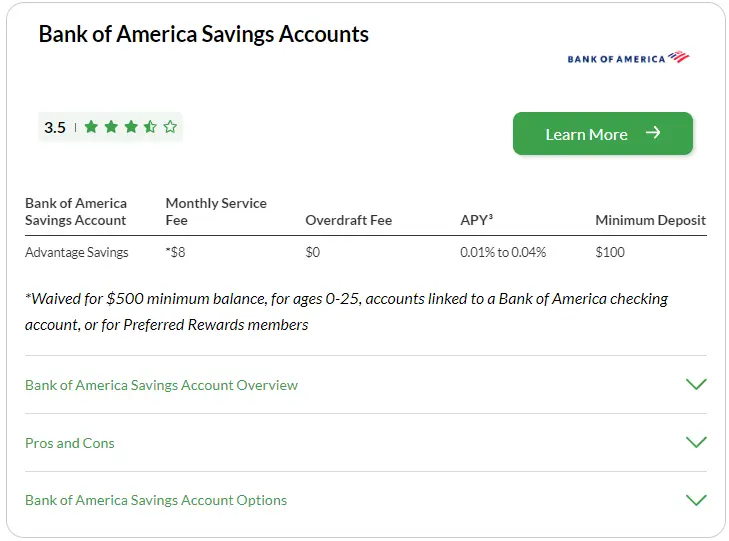

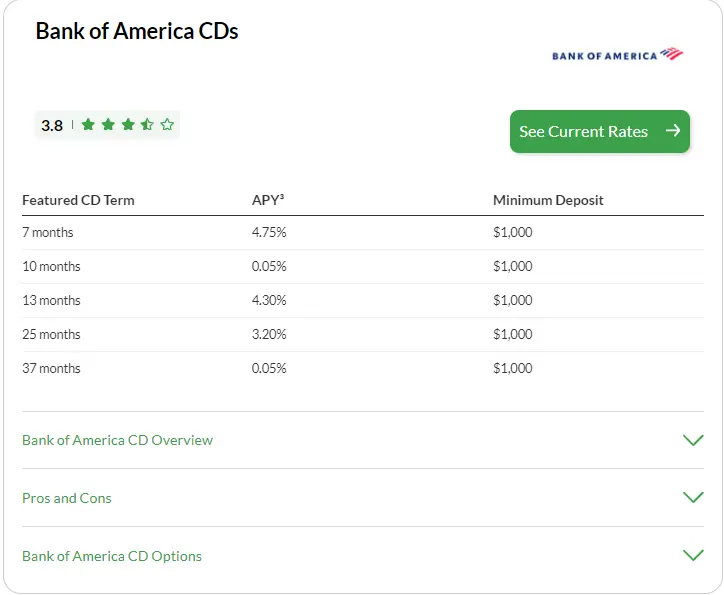

Specifically, Bank of America’s savings accounts and CDs received lower ratings primarily because of their low annual percentage yields (APYs). For instance, its savings account offers rates as low as 0.01% APY, which is one of the least competitive in the industry. Similarly, the APYs on its CDs for longer terms are typically lower compared to institutions like Synchrony Bank, Ally Bank, and USAA Bank.

Overall, while Bank of America provides extensive accessibility and strong digital services, customers looking for higher interest rates on savings and CDs may find better options elsewhere in the market.

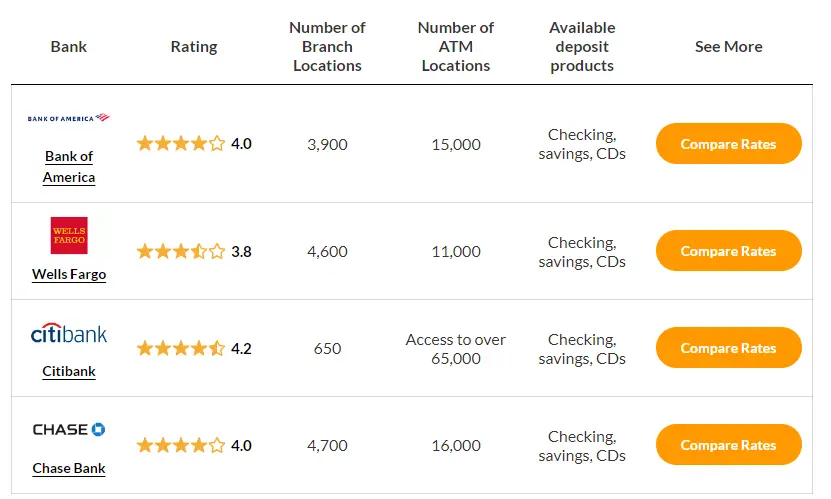

Bank of America vs. Other Top Banks

Bank of America is widely respected and could be a solid choice for your banking needs. However, it’s prudent to compare it with other top banks to fully understand your options. Bank of America offers a comprehensive range of deposit accounts including checking, savings, and CDs, supported by a vast branch network and robust online banking services. They typically require a minimum deposit to open an account, which varies by account type, and charge fees for services like overdrafts and out-of-network ATM withdrawals. Comparing these offerings and fees with other leading banks such as Chase, Wells Fargo, and Citibank will help ensure you find the best fit based on your financial preferences and requirements.

Bank of America Overview

Headquartered in Charlotte, North Carolina, Bank of America boasts a rich history spanning 120 years. With a presence in 38 states plus Washington, D.C., and a network comprising over 3,900 branches and 15,000 ATMs nationwide, it also operates globally in more than 35 countries. For those seeking a traditional brick-and-mortar bank with extensive in-person services, Bank of America is a compelling choice. However, if you prioritize fee-free banking and maximizing deposit account yields, exploring options with online banks or credit unions might be more suitable. According to our latest MarketWatch Guides consumer banking survey, Bank of America customers typically maintain a long-standing relationship with the bank, averaging 13.6 years. They hold median balances of $14,673 in checking accounts and $36,606 in savings accounts, both surpassing the overall median balances in our survey.

Bank of America Products

Bank of America offers a comprehensive array of financial products and services designed to meet the diverse needs of its customers. These include:

· Checking Accounts

· Savings Accounts

· Certificates of Deposit (CDs)

· Credit Cards

· Home Loans and Mortgages

· Personal Loans

· Investment and Wealth Management

· Auto Loans

· Insurance Products

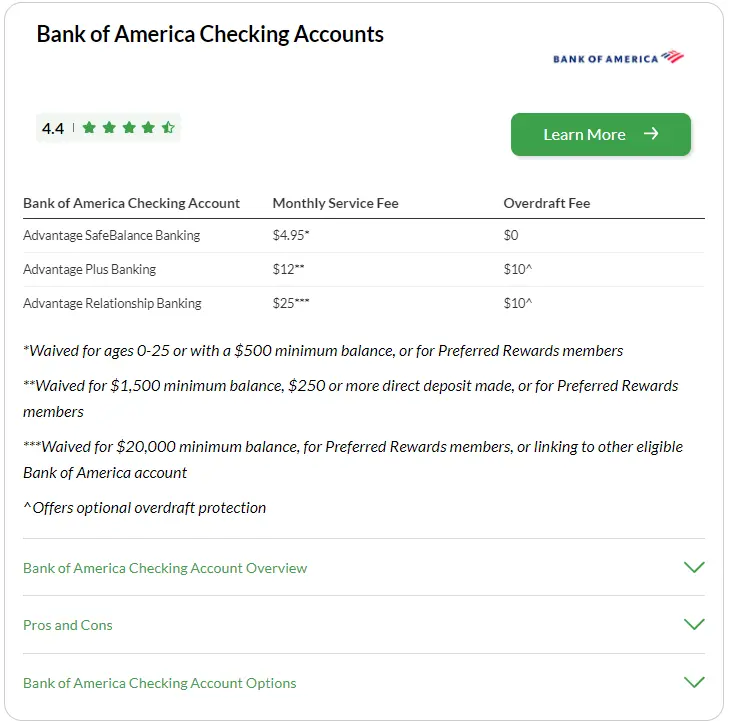

Bank of America Fees

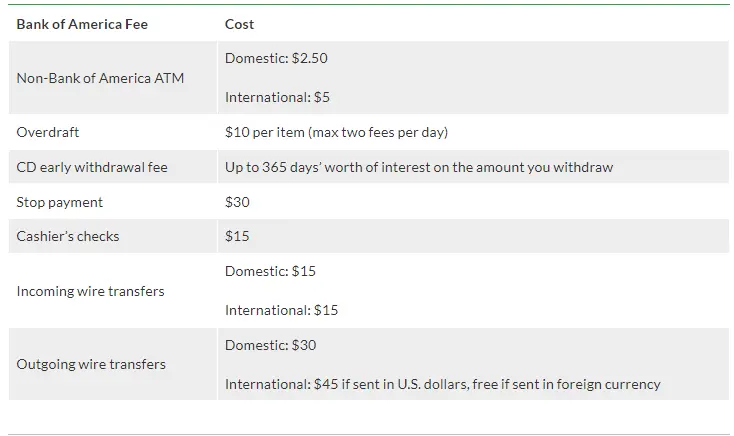

Bank of America applies monthly service fees to checking and savings accounts, alongside charges for specific services. Preferred Rewards members in designated tiers and Advantage Relationship Banking account holders may have certain fees waived. Additionally, using non-Bank of America ATMs or conducting wire transfers may incur additional charges at Bank of America and other banks.

Bank of America Mobile App

Bank of America’s banking app receives strong ratings, scoring 4.6 out of 5 stars on Google Play from over 1 million reviews and 4.8 out of 5 stars on the Apple App Store from more than 4.4 million ratings. Users generally praise its efficiency, though some note occasional slowness. According to survey responses, one user described it as “smooth and error-free,” while another labeled it as “excellent.” However, critiques mention the need for faster performance and improvements. Bank of America actively addresses user feedback, indicating a responsive approach to enhancing their app experience.

Bank of America vs. Wells Fargo

Citibank operates with just 650 physical branches, yet it boasts over four times the number of ATMs compared to Bank of America. Citibank’s checking accounts do not require a minimum balance, unlike Bank of America’s, though their fee structures are comparable. When it comes to savings account rates, Citibank edges out Bank of America slightly. Both banks offer similar CD APYs, but Bank of America requires a higher initial deposit of $1,000 compared to Citibank’s $500 minimum. Citibank receives slightly better reviews for its mobile app, but Bank of America maintains a superior BBB rating of A- compared to Citibank’s rating of F.

Bank of America vs. Chase

While Chase maintains a larger physical footprint compared to Bank of America, Bank of America offers several advantages. Bank of America features lower overdraft fees, slightly more flexible conditions for waiving monthly fees, and provides IRA options, which Chase does not. However, Chase currently offers a more generous sign-on bonus, up to $300 for new checking account customers who make a direct deposit of at least $500 within the first 90 days, valid until July 24. In contrast, Bank of America’s offer goes up to $200 and requires a direct deposit of at least $2,000 by May 31.

Both banks offer modest interest rates on savings accounts, with Chase providing slightly higher rates on CDs compared to Bank of America. Bank of America’s mobile app receives better user reviews than Chase’s, although Chase holds a slightly higher Better Business Bureau (BBB) rating of A.

It’s important to note that many large banks offer similar fee structures, interest rates, and perks. Therefore, choosing between Bank of America and Chase may depend on which bank’s physical location is most convenient for you. If fee-free banking is a priority, consider exploring options with smaller regional banks or credit unions. Alternatively, for those less reliant on physical branches, exploring recommendations for top online banks may offer a preferable banking experience.

Bank of America Reputation and Customer Satisfaction

Bank of America maintains a strong reputation and high customer satisfaction ratings from accredited sources. The Better Business Bureau (BBB) awards Bank of America an A- rating, while Bauer Financial gives it 4 out of 5 stars, denoting an Excellent rating. Despite these accolades, the average customer rating on BBB stands at nearly 1.1 out of 5.0 stars, based on a relatively small sample of just over 1,000 reviews. In our consumer banking survey, 45% of Bank of America customers rated the customer service as excellent, with an additional 30% describing it as very good. Only a small fraction, less than 3%, rated the customer service as poor. We contacted Bank of America for comment on its BBB customer rating and our review scores for savings and CD accounts, but did not receive a response.

Our Methodology

Our team conducted extensive research on over 100 of the nation’s largest financial institutions, meticulously gathering data on account options, fees, interest rates, terms, and customer feedback. Each institution was evaluated based on key metrics to provide potential customers with comprehensive insights into their offerings. Here’s how we assessed each category:

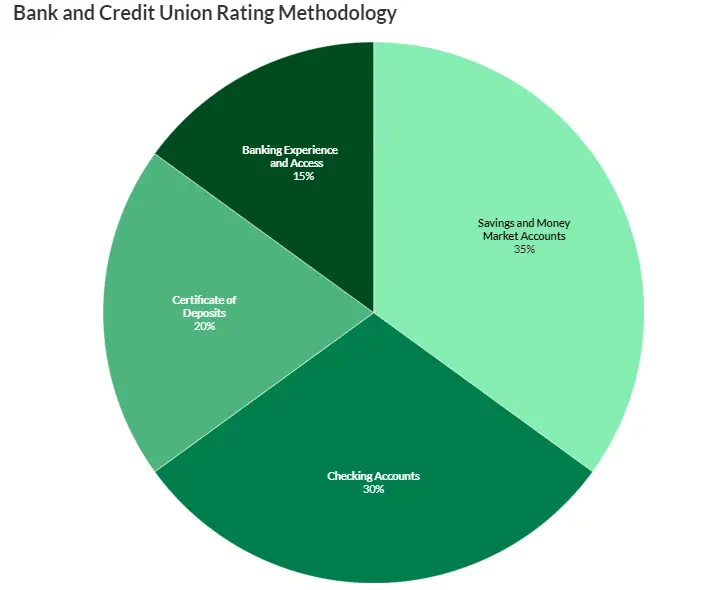

1. Savings and Money Market Accounts (35% of total score): We prioritized banks, credit unions, and fintech companies offering high interest rates coupled with minimal or no fees and low minimum opening deposits.2. Checking Accounts (30% of total score): High scores were awarded to institutions offering a range of checking account options with minimal fees, along with benefits such as reward programs and convenient features like mobile check deposit.3. Certificates of Deposit (20% of total score): We favored financial institutions that offer CDs with low or no minimum opening deposits, a variety of term options, and specialized CDs for enhanced flexibility.4. Banking Experience and Access (15% of total score): Institutions excelling in this category boast extensive branch and ATM networks, multiple checking and savings account options, and additional points were awarded for offering CDs and money market accounts.Our methodology ensures that customers can make informed decisions by comparing institutions across these critical factors, tailored to their financial needs and preferences.

FAQ: Bank of America Reviews

Bank of America receives positive ratings from reputable sources. It holds an A- rating and accreditation from the Better Business Bureau (BBB) and earns 4 out of 5 stars from Bauer Financial, indicating an Excellent rating.

In a recent consumer banking survey, 45% of Bank of America customers rated their customer service as excellent, and 30% described it as very good. Less than 3% indicated poor customer service experiences.

Bank of America’s mobile app receives generally positive reviews, though some users note occasional performance issues such as slowness. It scores 4.6 out of 5 stars on Google Play and 4.8 out of 5 stars on the Apple App Store.

Bank of America’s fee structures vary, with some fees waived for Preferred Rewards members and Advantage Relationship Banking account holders. Savings account and CD rates are competitive, though specific details may vary based on account type and location.