ally Bank Review 2024

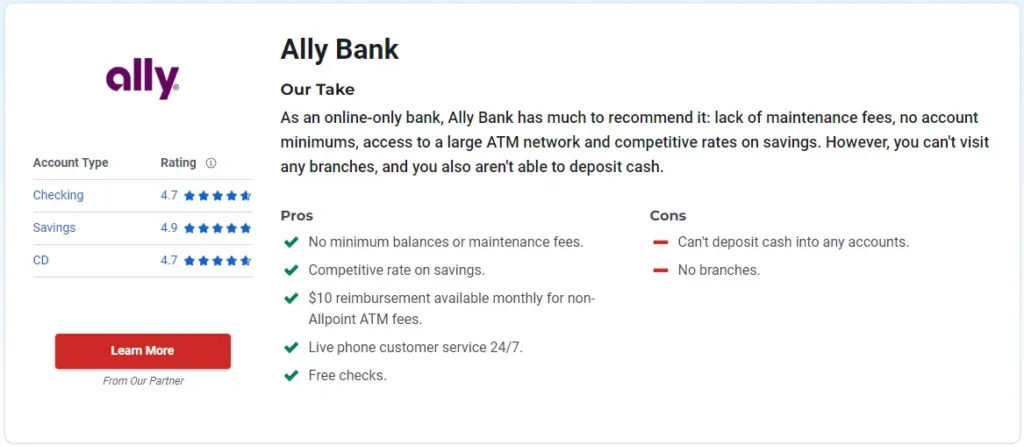

ally Bank

Ally Bank is a leading online bank known for its competitive rates, no-fee accounts, and customer-centric approach. Established as a digital-first financial institution, Ally Bank offers a wide range of banking products and services, including high-yield savings accounts, checking accounts, money market accounts, CDs, and auto loans. With no physical branches, Ally Bank focuses on providing a seamless online and mobile banking experience, making it convenient for customers to manage their finances anytime, anywhere. Its commitment to transparency, excellent customer service, and innovative digital tools has earned Ally Bank a strong reputation in the banking industry.

Overview

Ally Bank operates entirely online and offers a comprehensive range of financial products, including checking and savings accounts, money market accounts, certificates of deposit, credit cards, mortgages, auto loans, and investment products. As of December 31, 2023, Ally Bank had $186.1 billion in assets, ranking it No. 21 among American banks. The bank serves over 11 million customers with the help of 11,700 employees. Despite not having physical branches, Ally Bank provides access to accounts at approximately 43,000 ATMs through the Allpoint network, which offers surcharge-free ATM access.

More about Ally: Ally Financial Inc., based in Detroit, started as GMAC, an auto financing company, in 1919. The company launched GMAC Bank in 2000 and later formed Ally Bank in 2009.

Is Ally Bank Right for Me? Yes, if you:

- Prefer to do all your banking online.

- Prioritize earning high annual percentage yields on your savings.

- Want to avoid fees, even those that are typically easy to waive.

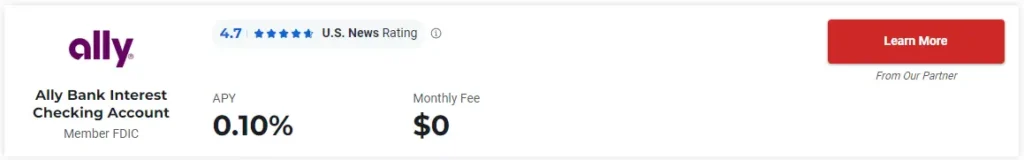

Checking

Ally Bank’s interest-bearing checking account includes the following features:

- No minimum balance requirement.

- No maintenance fees.

- No fees for domestic and international incoming wire transfers.

- Reimbursement for out-of-network ATM fees up to $10 per statement cycle.

- Remote check deposit.

- Early direct deposit, getting you paid up to two days sooner.

- No fees for overdraft transfer service, which moves funds from linked Ally savings or money market accounts to cover overdrafts.

- Interest-earning account.

Ally Bank Checking vs. Other Accounts

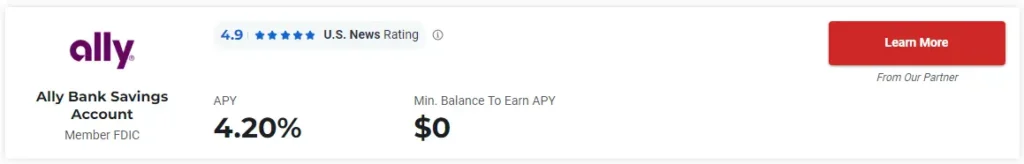

Savings

Ally offers a single savings account with the following features:

- No minimum balance requirement.

- No maintenance fees.

- Competitive interest rate.

- Daily compounded interest.

- No overdraft fees.

- Direct deposit.

- Transactions can be conducted online, by phone, or via mail.

- Remote check deposit.

Ally Bank Savings vs. Other Accounts

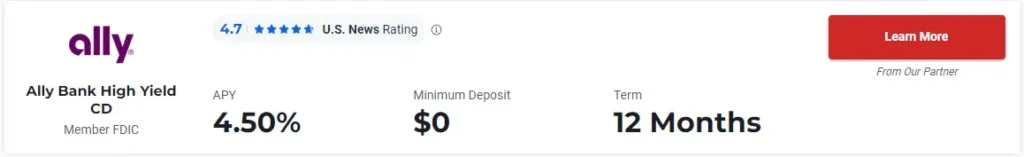

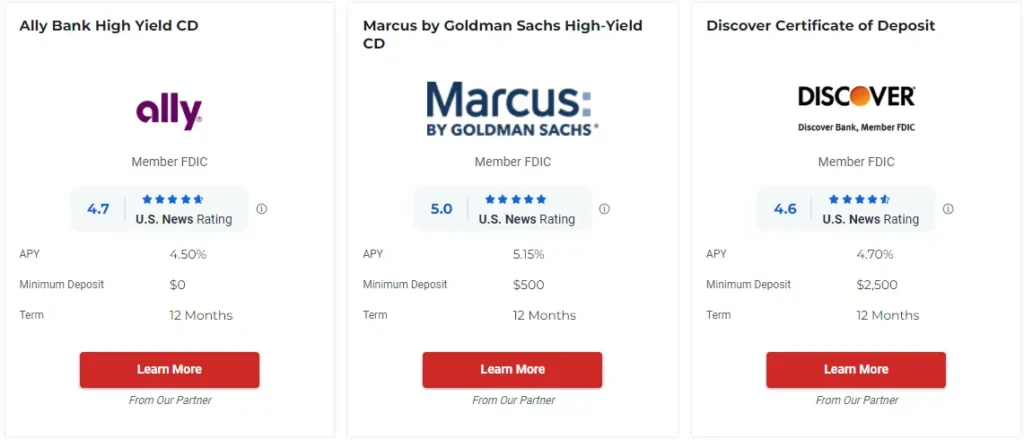

CDs

Ally offers three types of certificates of deposit: High Yield, Raise Your Rate, and No Penalty. Here are the features of each:

High Yield CD:

- No minimum deposit.

- Daily compounded interest.

- If interest rates rise within 10 days of opening, you get the higher APY.

- No monthly fee.

Raise Your Rate CD:

- Opportunity to increase your annual percentage yield once on a two-year CD and twice on a four-year CD.

- No monthly fee.

- No minimum deposit.

No Penalty CD:

- No minimum deposit.

- No monthly fee.

- Withdraw your full balance, including interest, without penalty anytime after the first six days of funding your account.

Ally Bank CDs vs. Other Accounts

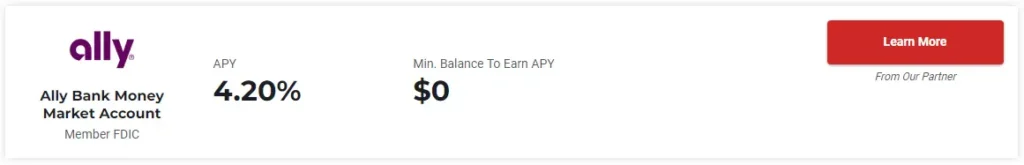

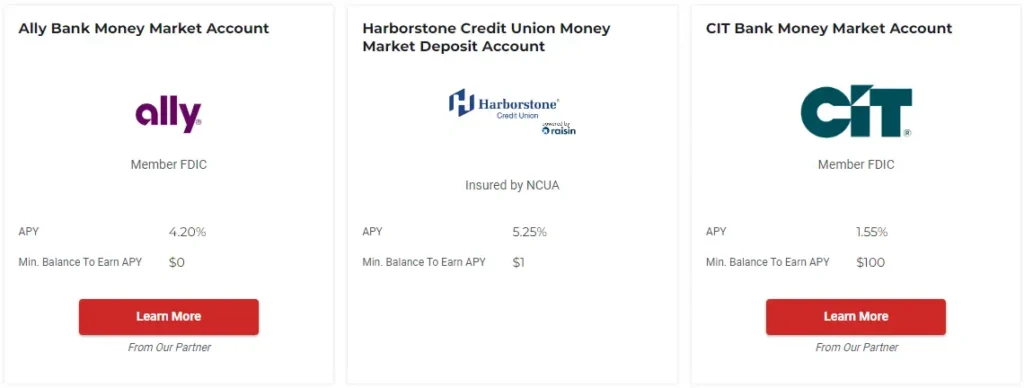

Money Market

Ally offers a money market account with the following features:

- No maintenance fees.

- No minimum balance requirement.

- Includes all features of an Ally savings account, plus a debit card and free checks.

Ally Bank Money Market vs. Other Accounts

How We Rate

We evaluate hundreds of deposit accounts to identify the Best CD Accounts, Best Savings Accounts, and Best Checking Accounts. Our ratings are based on key factors such as annual percentage yield, deposit requirements, and fees, providing clear and unbiased assessments to help you find the right account for your needs.

Ally Bank Reviews: FAQ

Customers often praise Ally Bank for its competitive interest rates, lack of fees, and convenient online and mobile banking services.

Ally Bank offers higher interest rates and lower fees compared to many traditional banks, but it lacks physical branches, which might be a drawback for those who prefer in-person banking.

Yes, Ally Bank is FDIC insured, providing the same level of security and protection for deposits as traditional banks.

Competitive interest rates, no minimum balance requirements, no maintenance fees, and a comprehensive suite of digital banking tools.

Pingback: Truist Bank Review 2024 Truist Bank Review 2024