Achieva Credit Union

Achieva Credit Union, established in 1937, is a member-owned, not-for-profit financial institution committed to providing exceptional banking services to its members. With a mission to empower individuals and communities by offering affordable financial solutions, Achieva has grown to serve tens of thousands of members across various locations. The credit union prides itself on its comprehensive range of products and services, including savings and checking accounts, loans, mortgages, and investment options. Achieva Credit Union’s dedication to member satisfaction and financial education ensures that its members have the tools and resources needed to achieve their financial goals. Through community involvement and a focus on personalized service, Achieva continues to build strong, lasting relationships with its members, helping them navigate their financial journeys with confidence and ease.

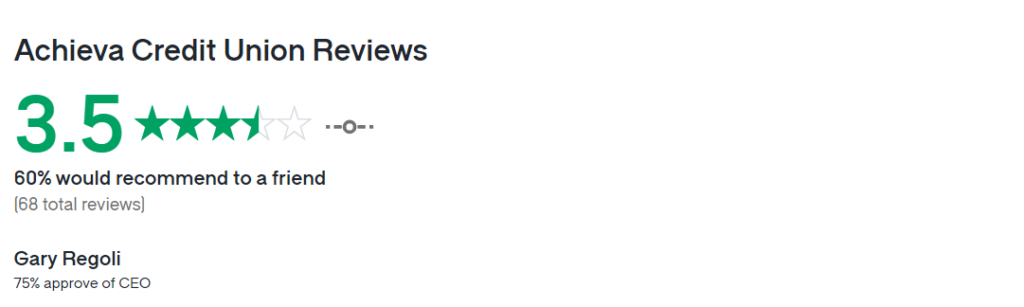

Achieva Credit Union Reviews

Achieva Credit Union has an employee rating of 3.5 out of 5 stars, based on 68 reviews on Glassdoor. This suggests that most employees have a positive working experience at the company. The rating is consistent with the average for employers in the Financial Services industry, which is 3.7 stars, falling within one standard deviation of the industry norm

Achieva Credit Union and Other Leading Banks

Achieva Credit Union and other leading banks provide diverse financial services, but their approaches differ significantly. As a member-owned, not-for-profit institution, Achieva focuses on personalized service, competitive rates, and community engagement, aiming to empower members with financial education and support. In contrast, top banks like Bank of America, Wells Fargo, and Chase, being for-profit entities, offer a broad range of products and services, extensive branch networks, and advanced digital banking solutions, prioritizing shareholder value alongside customer service. These distinctions highlight how both types of institutions cater to various consumer needs and preferences within the financial industry.

Achieva Credit Union Overview

Achieva Credit Union, established in 1937, is a member-owned, not-for-profit financial institution dedicated to serving its members with a wide range of financial products and services. With a focus on personalized service, Achieva offers savings and checking accounts, loans, mortgages, and investment options, aiming to empower its members through financial education and community involvement. The credit union prioritizes member satisfaction and strives to build strong, lasting relationships by providing affordable and accessible financial solutions tailored to individual needs.

Methodology

Achieva Credit Union’s methodology centers on providing personalized, member-focused financial services tailored to the unique needs of its community. This approach involves a deep commitment to financial education, ensuring members are well-informed about their options and can make sound financial decisions. Achieva emphasizes community engagement, regularly participating in local events and initiatives to foster strong, supportive relationships. The credit union also prioritizes innovation, continuously improving its product offerings and digital banking capabilities to enhance member experience. By maintaining a not-for-profit structure, Achieva is able to reinvest profits into better rates, lower fees, and enhanced services for its members.

Achieva Credit Union is a member-owned, not-for-profit financial institution that provides a wide range of banking services including savings and checking accounts, loans, mortgages, and investment options.

To become a member, you need to open an account with Achieva. Membership is open to anyone who lives, works, worships, or attends school in the areas we serve. You can apply online or visit one of our branch locations.

Achieva Credit Union offers a variety of accounts including savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs).

We offer a range of loan products including auto loans, personal loans, mortgages, home equity loans, and credit cards. Each loan product comes with competitive rates and flexible terms to suit your needs.

Yes, Achieva Credit Union provides both online and mobile banking services. Members can access their accounts, transfer funds, pay bills, and more through our secure online platform and mobile app.