Commerce Bank

Commerce Bank, now known as Commerce Bancshares, Inc., is a major regional bank in the United States. Here are some key points about Commerce Bank in the U.S.:

- History: Founded in 1865 in Kansas City, Missouri, Commerce Bank has grown to serve a significant part of the Midwest and beyond.

- Services: Commerce Bank offers a range of financial services, including personal banking, business banking, wealth management, and investment services. Their offerings include checking and savings accounts, credit cards, loans, mortgages, and more.

- Branches and ATMs: Commerce Bank operates hundreds of branches and ATMs across several states, primarily in the Midwest.

- Online and Mobile Banking: The bank provides robust online and mobile banking services, allowing customers to manage their accounts, transfer funds, pay bills, and more from their computers or mobile devices.

- Customer Service: Commerce Bank is known for its strong focus on customer service, offering various support channels including phone, email, and in-person assistance at branches.

- Corporate Banking: In addition to personal banking, Commerce Bank offers comprehensive banking services for businesses, including treasury management, commercial lending, and international banking services.

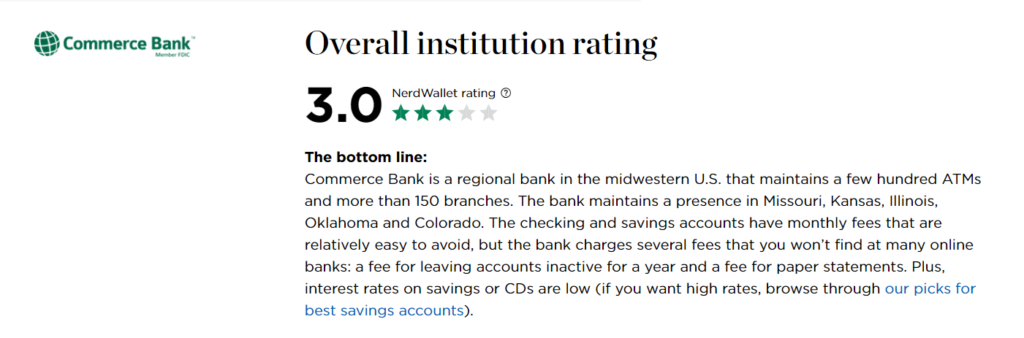

Overall institution rating

Best If:

If you live in an area where Commerce Bank operates and you’re looking for a bank with robust savings-goal features, Commerce Bank is a solid choice.

Pros

- No monthly fees on checking accounts

- No minimum opening deposit on savings accounts

- Highly rated mobile apps

Cons

- Expensive overdraft fees

- Low interest rates

- Monthly fees on savings accounts (though they can be avoided)

- Limited branch access

- Small ATM network

Methodology

NerdWallet’s overall ratings for banks and credit unions are calculated as weighted averages across several categories: checking, savings, certificates of deposit (CDs) or credit union share certificates, banking experience, and overdraft fees. Depending on the category, factors considered include rates and fees, ATM and branch access, account features and limits, user-facing technology, customer service, and innovation. Ratings range from poor (one star) to excellent (five stars) and are rounded to the nearest half-star.