What are business bank accounts?

If you request your banker to open a separate bank account for your side hustle, startup, or small business, the checking or savings account they set up for you will likely resemble those used for personal banking.

While the minimum balance requirements and transaction costs may be slightly higher, you’ll need to provide the following during sign-up:

- An Employer Identification Number (EIN) or Social Security number (SSN)

- Any necessary business licenses

- Depending on your business entity, documents like bylaws, operating agreements, or articles of incorporation.

Initially, entry-level business checking and savings accounts offered by consumer banks are similar to regular accounts. However, as your business grows and evolves, your banking needs may change as well.

You may require additional services such as purchase protection, lines of credit, or business credit cards. To access these services, you might need to pay higher transaction fees, maintain a higher minimum balance, or consider upgrading to a more specialized business account.

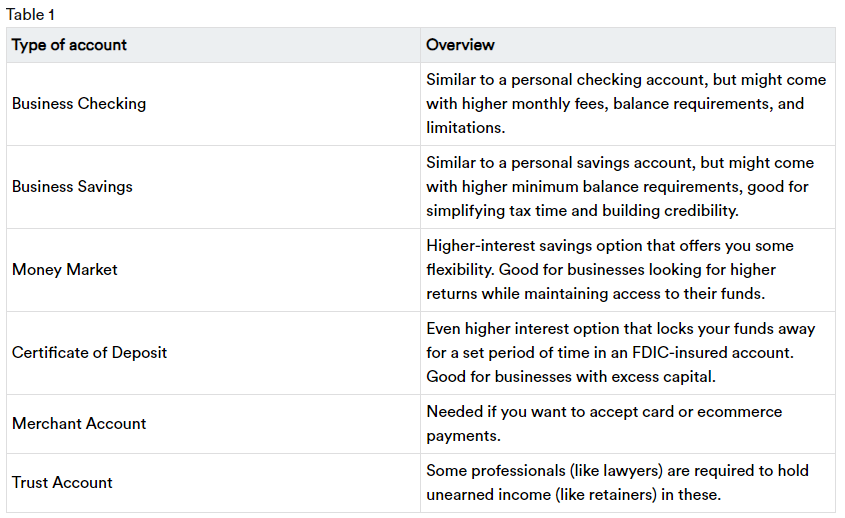

Business bank accounts at a glance

Banks provide a wide range of accounts and services tailored for businesses, and with the growth of online financial institutions and ecommerce, these options have expanded further. To simplify, this guide categorizes business bank accounts into three main types:

- Standard business savings and checking accounts

- Higher interest accounts such as certificates of deposit and money market accounts

- Industry-specific accounts like merchant and trust accounts

Before diving in, let’s take a moment to clarify what each of these terms means.

Business checking account

While personal checking accounts are typically free or have low fees, business checking accounts often come with higher costs, higher balance requirements, and additional restrictions.

However, the process of choosing a business checking account is similar to selecting a personal one. Consider the following factors:

- ATM network coverage offered by the bank.

- Current promotions or incentives available for new small business customers.

- Availability of services such as overdraft protection.

- Monthly maintenance fees and transaction limits (similar to personal accounts, most small business accounts have a set number of free transactions per month).

- Mobile banking and online banking capabilities—ensure the bank provides a robust app if you conduct mobile banking.

- Initial deposit and minimum balance requirements—check for any minimum opening deposit or ongoing balance requirements.

Pros

Financial Separation: If you’ve explored the Bench blog, you likely understand the importance of channeling all your business earnings and expenses through a dedicated business checking account. This practice significantly enhances organization during tax season.

Legal Separation: Separating your finances becomes even more crucial if your business is incorporated and benefits from limited liability. Mixing personal and business assets can jeopardize this protection, while maintaining separation safeguards your assets and reduces the risk of creditors or legal actions targeting personal belongings in case of business complications.

Building Relationships and Credibility: Beyond organizational benefits, having a separate business checking account under your business’s official name enhances credibility with stakeholders. It demonstrates your commitment to the business’s longevity and facilitates the establishment of a distinct business credit score. This score can prove invaluable when seeking loans or attracting investors.

Access to Credit: Certain business checking accounts offer lines of credit that businesses can utilize during cash flow shortages. Learn more about lines of credit here.

Business Credit Cards: Many banks also provide business credit cards to account holders. These cards not only help in building a business credit profile but also offer rewards tailored to business expenses.

Cons

You Might Not Need One Yet: If your business is still in its early stages, such as a side project with minimal revenue, consider delaying the opening of a business bank account. Establishing and managing a business account requires time and effort that might be better invested in planning for your business’s future growth.

They’re More Expensive Than Personal Accounts: Using a free personal checking account, alongside meticulous bookkeeping for your business finances, could be more cost-effective during the initial phases. It avoids the expenses associated with a dedicated business checking account.

Bottom Line: Once your business begins generating revenue or incurring expenses, transitioning to a business checking account becomes advisable. Until then, sticking with your personal bank account may be sufficient.

Business savings account

Just as individuals open personal savings accounts to set aside extra cash, businesses also utilize savings accounts to store surplus capital and earn interest.

Pros: Higher Interest Rates: Business savings accounts generally offer higher interest rates compared to checking accounts. This makes them a viable option for businesses with excess funds looking to earn a competitive return.

Quarterly Payments: A business savings account can serve as a secure place to set aside cash for quarterly estimated tax payments to the IRS. The higher interest rates can help maximize the return on these funds until they are needed.

Financial Cushion: Regular contributions to a savings account can build a financial cushion for your business, alleviating stress and preparing for unforeseen expenses or opportunities.

Depositor Insurance: Most business savings accounts are insured by the FDIC or NCUA, providing protection for your deposits in case of bank or credit union failure.

Cons: More Restrictions: Business savings accounts often come with higher minimum balance requirements and stricter withdrawal limitations compared to checking accounts.

Bottom Line: Opening a business savings account can be beneficial if your business anticipates maintaining excess capital for tax purposes, cash reserves, or future investments. However, if interest rates are low or you don’t expect to hold significant spare cash, a standard business checking account may suffice.

Business money market account

Money market accounts, distinct from money market funds, offer businesses higher interest rates in exchange for certain limitations, leveraging the short-term borrowing and lending market.

If you find traditional business savings accounts don’t yield enough return on your excess capital, consider opening a business money market account.

Pros:

- Higher Interest Rates: Money market accounts typically offer higher interest rates than standard savings accounts and often provide features like debit cards and check-writing capabilities.

Cons:

- Restrictions: These accounts come with limitations that can make them less flexible compared to regular business savings or high-interest checking accounts.

Bottom Line: If your bank offers attractive interest rates, a money market account could be a better financial choice than a traditional savings account. Just ensure the restrictions align with your business’s liquidity needs.

Business Certificate of Deposit (CD) Account:

Certificates of Deposit (CDs) offer businesses even higher interest rates than money market accounts by locking in funds for a predetermined period.

Pros:

- Higher Interest Rates: CDs typically yield higher interest rates than savings or money market accounts, making them ideal for businesses with surplus funds that won’t be needed immediately.

Cons:

- Early Withdrawal Penalties: Unlike savings or money market accounts, CDs impose penalties if funds are withdrawn before the maturity date.

Bottom Line: For businesses able to commit funds for a fixed term, a CD account can maximize interest earnings. However, if flexibility is crucial, consider alternatives like savings or money market accounts.

Merchant account

Merchant accounts facilitate businesses in accepting payments from various sources such as debit and credit cards. Unlike traditional bank accounts where funds are held, merchant accounts act as a conduit in the payment processing chain.

For ecommerce ventures or businesses using physical card readers, having a merchant or merchant services account alongside a standard business banking account is essential.

Pros:

- Flexibility: In today’s fintech-driven world, customers expect diverse payment options. A merchant account bridges these payment methods with traditional banking, enabling businesses to cater to a wider audience and increase revenue opportunities.

- Purchase Protection: Banks typically offer purchase protection under merchant account agreements, ensuring secure handling of customer information.

Cons:

- Additional Transaction Fees: Using a merchant account incurs fees for card and electronic transactions. Fee structures vary; providers may charge a percentage of the transaction, a flat fee, or a combination. These fees cover costs to customer banks, your bank, and payment networks like Visa and Mastercard.

Bottom Line: Merchant accounts are indispensable for businesses that accept card payments and need to integrate multiple payment methods. When selecting a provider, carefully review terms to understand transaction fees and ensure they align with your business’s financial strategy.

Trust accounts

Certain professionals are mandated to handle unearned income through a trust account, managed independently by a third party. In the United States, for instance, lawyers are prohibited from earning interest on unearned retainer fees. Instead, these funds must be held in a trust account known as an “IOLTA” (Interest on Lawyers’ Trust Accounts).

Trust accounts are highly regulated, with strict guidelines dictating permissible actions. Violating these rules can result in significant penalties. If your business requires a trust account, it’s advisable to seek legal counsel to understand the specific regulations governing its use.