The checking account is ideal for daily transactions due to its easy accessibility for withdrawing funds via bank transfers, debit cards, or checks. Conversely, savings accounts are geared towards long-term savings goals by accruing interest on your idle balances.

In this article, we delve into the distinctions between checking and savings accounts while introducing five essential types of bank accounts. As you make financial decisions in 2023, we also spotlight Chime® as an attractive choice for managing your everyday transactions.

Checking vs Savings: Which Is Best for Everyday Transactions?

What Are the Main Differences Between Checking and Savings Accounts?

A checking account is primarily designed for managing day-to-day financial activities such as paying bills, receiving direct deposits, and making ATM withdrawals. It provides convenient and frequent access to your funds.

In contrast, a savings account serves as a tool for building an emergency fund or saving towards specific financial goals like purchasing a car or funding a vacation. Savings accounts typically offer higher interest rates compared to checking accounts, allowing your money to grow over time. While they do provide some access to your funds, there are usually limits on withdrawals (typically 6 per month) to encourage long-term saving.

Both types of accounts may come with associated fees. Checking accounts often have transaction-related fees such as overdraft or ATM fees. Savings accounts may have minimum balance requirements or fees for exceeding monthly withdrawal limits.

What Is a Checking Account?

Checking accounts are designed for day-to-day spending and easy access to your funds. They allow you to write checks, use a debit card, and make electronic transfers. Here’s how checking accounts generally operate:

Interest: While some checking accounts may offer interest, it is usually minimal compared to savings accounts. Checking accounts prioritize accessibility over earning interest. Common Fees: Fees associated with checking accounts often include a monthly maintenance fee, overdraft fee (charged when you spend more than your account balance), and fees for using out-of-network ATMs. Minimum Balance: Some checking accounts require a minimum balance to avoid monthly maintenance fees. It’s important to maintain this balance to avoid unnecessary fees. Transfer Limits: Checking accounts typically have no limits on transfers, but specific bank policies may apply, so it’s wise to check for any restrictions.

Advantages of Checking Accounts:

Convenience: Checking accounts provide convenient access to your funds, making them ideal for handling daily expenses and transactions.

Payment Options: They offer diverse payment methods such as checks, debit cards, and electronic transfers, facilitating easy bill payments and purchases.

Safety: Funds held in checking accounts are insured up to a specified limit by the FDIC (Federal Deposit Insurance Corporation) for banks or the NCUA (National Credit Union Administration) for credit unions, ensuring protection against losses.

What Is a Savings Account?

Savings accounts are designed for accumulating and growing your savings over time, rather than for frequent spending. Here’s a breakdown of how savings accounts generally operate:

Interest: Savings accounts offer higher interest rates compared to checking accounts. Banks reward you with a percentage of your account balance monthly or annually as interest, encouraging you to save more and earn more over time.

Common Fees: Fees associated with savings accounts may include a monthly maintenance fee, a charge for falling below the minimum balance requirement, and fees for exceeding the monthly withdrawal limit.

Minimum Balance: Many savings accounts require a minimum balance to avoid fees. These requirements are typically higher than those for checking accounts, aiming to encourage consistent saving habits.

Limits on Transfers: Federal regulations restrict certain types of withdrawals or transfers from savings accounts to six per statement cycle. This limit is in place to promote saving rather than frequent spending from these accounts.

Advantages of Savings Accounts:

Interest Earnings: Savings accounts offer higher interest rates compared to checking accounts, providing an opportunity for your savings to grow steadily over time through earned interest.

Safety: Like checking accounts, funds held in savings accounts are insured by either the FDIC (for banks) or NCUA (for credit unions). This insurance ensures that your deposits are protected up to a certain limit, even if your financial institution encounters financial difficulties.

Long-Term Savings: Savings accounts are ideal for accumulating funds for future needs or emergencies. They provide a secure and accessible place to store money while earning interest, making them a reliable choice for managing savings over the long term.

5 Types of Bank Accounts You Should Know

As previously mentioned, checking accounts and savings accounts are the primary types of accounts you’ll encounter when banking. Checking accounts are ideal for daily transactions like card payments, local transfers, and cash withdrawals. On the other hand, savings accounts are designed for storing surplus cash over longer periods, typically earning interest.

Beyond these basics, various other types of bank accounts serve distinct financial purposes. Below, we explore five common bank account types to help you navigate your banking options effectively:

Checking Account:

Checking accounts are designed to handle daily transactions such as ACH transfers, debit card purchases, check payments, and bill pay. Banks may impose fees for common services like overdrafts, wire transfers, and ATM withdrawals. International money transfers are typically costly, prompting a recommendation for online specialists as more cost-effective options.

Monthly maintenance fees at banks can often be waived by meeting specific conditions, such as maintaining a minimum balance or holding a mortgage with the same bank.

Savings Account:

Savings accounts provide higher interest rates compared to checking accounts, enabling you to grow your savings over time. When selecting a savings account, prioritize banks offering the highest Annual Percentage Yield (APY) to maximize your earnings on idle balances. Additionally, consider the frequency of interest compounding—daily, weekly, monthly, or annually—as more frequent compounding can enhance your overall returns.

While some banks may impose monthly fees on savings accounts, these fees are typically avoidable by maintaining a minimum balance or fulfilling specific criteria set by the bank.

Certificate of Deposit (CD):

Certificates of Deposit (CDs) come with fixed terms ranging from a few months to several years. During this period, you cannot withdraw funds without penalty, but CDs generally offer higher interest rates compared to savings accounts.

CD interest rates are fixed, providing predictability for your earnings regardless of market fluctuations. However, early withdrawals before the CD matures typically incur penalties, which may include forfeiting some or all of the accrued interest.

Money Market Account (MMA):

Money market accounts offer higher interest rates compared to standard savings or checking accounts. Unlike Certificates of Deposit (CDs), money market accounts provide some liquidity by allowing limited access to funds when needed. For instance, they often include a limited number of checks that can be written each month.

However, to avoid monthly fees, you typically need to maintain a higher minimum balance compared to checking or savings accounts.

Individual Retirement Accounts (IRAs):

IRAs, short for Individual Retirement Accounts, are investment accounts that offer tax advantages, provided the funds are generally not withdrawn until retirement age. In the United States, there are two primary types of IRAs: Traditional IRA and Roth IRA.

The main distinction between Roth and Traditional IRAs lies in their tax treatment. Contributions to a Traditional IRA may be tax-deductible, but withdrawals are typically taxed as income when taken out during retirement. In contrast, Roth IRAs are funded with after-tax dollars, meaning contributions are not tax-deductible, but qualified withdrawals, including earnings, are tax-free.

Another difference is that Traditional IRAs require minimum distributions starting at age 72 (as of 2022), whereas Roth IRAs do not mandate withdrawals during the account holder’s lifetime. Additionally, early withdrawals from a Traditional IRA before age 59½ may incur a 10% penalty on top of regular income tax, unless certain exceptions apply. Roth IRAs allow penalty-free withdrawals of contributions at any time, with earnings subject to penalties if withdrawn early under certain conditions.

Do Checking and Savings Accounts Pay Interest?

Yes, both checking and savings accounts can potentially earn interest, but savings accounts generally offer higher interest rates compared to checking accounts.

The interest you earn on a savings account is known as the Annual Percentage Yield (APY), which represents the percentage of your account balance that the bank pays you annually. Higher balances and higher APYs result in more interest earned over time. In contrast, checking accounts may offer lower interest rates or none at all, since their main function is to handle daily transactions and provide easy access to funds.

Are My Balances in My Checking and Savings Accounts Safe?

Yes, funds held in both checking and savings accounts are secure when deposited at institutions insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA).

The FDIC and NCUA are federal agencies that ensure deposits up to $250,000 per account holder, per institution. This means that if your bank or credit union encounters financial difficulties, your deposits are protected up to the insurance limit.

These insurance programs operate on a membership basis, where banks and credit unions contribute to a fund that collectively insures customer deposits. The FDIC and NCUA are independent entities from the financial institutions they insure, and they manage these funds separately to safeguard customer money.

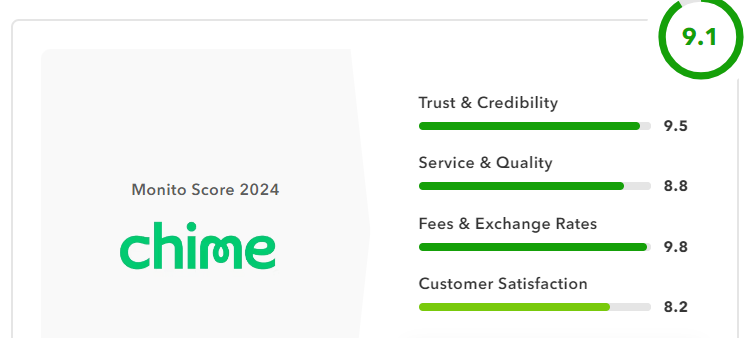

Why Chime is Our Top Choice for Everyday Transactions in 2024

Chime’s checking account stands out as an excellent option for everyday transactions in the US. This account boasts several advantages: no monthly maintenance fees, no minimum opening deposits, and no requirements for minimum balances. Additionally, its debit card doesn’t charge foreign transaction fees, which makes it particularly advantageous for international travel.

It’s important to note that Chime operates as a financial technology company rather than a traditional bank. However, banking services for Chime accounts are provided by The Bancorp Bank or Stride Bank, N.A., both members of the FDIC. This affiliation ensures that your deposits are FDIC-insured, providing peace of mind regarding the safety of your balances.

Seamless Account Integrations

Chime allows you to easily link multiple bank accounts to its app, facilitating seamless money transfers between them. Moreover, you can instantly transfer funds to Chime’s high-yield savings and credit builder accounts. Starting with just a penny, you can earn a competitive 2% APY on your savings, making it a convenient and rewarding option for managing your money.

Instant Money Transfers

Chime offers free and instant money transfers to other Chime account holders, and you can conveniently pay bills using your unique account and routing numbers or your Chime debit card. Managing recurring payments is simplified through the Chime app, and you can even request the app to send physical checks to designated addresses, saving you valuable time.

Although Chime doesn’t have a direct integration with Zelle, you can link your Chime debit card to your Zelle account to facilitate swift bank transfers to friends and family members.

Widespread ATM Access

Chime’s Visa debit card grants access to a large network of over 60,000 ATMs across the country, including major locations such as Walgreens and CVS. This extensive network reduces the inconvenience of out-of-network ATM withdrawals, though there is a $2.50 fee associated with such transactions.

No Overdraft Fees and Get Paid Early

Chime eliminates overdraft fees entirely and offers up to $200 in overdraft coverage without additional charges. Additionally, when you set up direct deposit with your employer, you can access your paycheck up to two days earlier with Chime.

Known for its user-friendly design, transparent fee structure, and innovative features, Chime streamlines your daily financial transactions, making it our top choice for a convenient and hassle-free checking account.