Nova Credit Bank

By leveraging cross-border credit data, Nova Credit enables individuals to use their international credit history to access U.S. financial products, such as credit cards, loans, and phone plans. This unique approach helps immigrants establish and build credit in the U.S. more efficiently. Nova Credit Bank is dedicated to offering a seamless banking experience, combining advanced technology with personalized service to meet the unique needs of its diverse customer base. Through a commitment to financial inclusion and support, Nova Credit Bank empowers its clients to achieve their financial goals and build a stable future in their new home.

Your Guide to Bank Accounts in the United States

Curious about your banking options as a new immigrant in the United States? This article covers everything you need to know.

Nova Credit is a cross-border credit bureau that enables newcomers to use their foreign credit history to apply for U.S. credit cards, phone plans, and loans.

We and our authors aim to deliver high-quality content. However, the views expressed in the articles on this website are solely those of the authors, unless otherwise cited, and do not constitute professional financial or legal advice. We cannot guarantee the accuracy or completeness of the information in the articles or the sources referenced. Please use this information at your own discretion.

Whether you’ve relocated to the US for work, education, family, or other reasons, one of the first steps to establishing your financial stability is opening new financial accounts. A bank account is central to personal finances, as it manages the inflow and outflow of money weekly and allows for savings in separate accounts.

Understanding the different options and how they function is crucial. You’ll need to know which type of bank account suits everyday transactions and what the various types of bank accounts are. Common options include:

- Checking accounts

- Savings accounts

- Money market accounts

- Certificates of deposit

- Brokerage accounts

- Individual retirement accounts

Sahil Vakil, founder of Myra Wealth, notes that newcomers to the US are sometimes confused by the terminology of accounts. “What you call a certificate of deposit (CD) here is called a fixed deposit in India,” he says. “By looking at the structure, you may recognize it as similar to an account type at home.”

Fortunately, there are only a few basic types of bank accounts to familiarize yourself with.

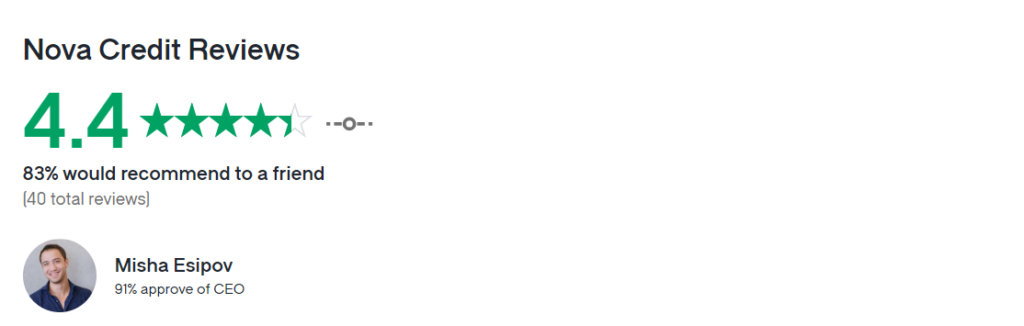

Nova Credit Reviews

Nova Credit boasts an impressive employee rating of 4.4 out of 5 stars on Glassdoor, based on 40 company reviews. This high rating indicates that most employees have an excellent working experience at the company. The employee rating for Nova Credit is consistent with the average for employers in the Information Technology industry, which stands at 3.9 stars, falling within one standard deviation of the industry norm.

What Are The Different Accounts in a Bank?

Checking accounts

A checking account is where many people deposit their paychecks and keep money for daily expenses. Typically, a checking account comes with checks (hence the name) and a debit card, allowing you to spend the money in your account.

Some checking accounts may have a monthly maintenance fee if you don’t meet certain requirements, such as maintaining a minimum balance or setting up a direct deposit each month. Generally, checking accounts don’t offer high interest rates on the money you keep in the account, although there are exceptions, such as online-only and high-yield checking accounts.

For deposit accounts, the interest you earn is displayed as an annual percentage yield (APY), which includes compounding interest (the interest earned on interest). You can use the APY to calculate how much you could earn in interest each year and compare different accounts.

Checking accounts are often the easiest accounts to withdraw money from, making them ideal for paying regular bills and daily expenses.

Savings accounts

Keeping your savings in a separate account from your day-to-day spending money can help you avoid the temptation to spend it. Savings accounts generally offer a higher interest rate than checking accounts, and spending the money is more challenging since you won’t have checks or a debit card directly linked to the savings account.

However, be aware that if you try to make more than six withdrawals or transfers from your savings account in a month, you may have to pay a fee. There are exceptions for certain types of transactions.

Our bank offers a variety of accounts, including checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), brokerage accounts, and individual retirement accounts (IRAs).

You can open a bank account online through our website or by visiting one of our branch locations. You will need to provide identification and some personal information to complete the application process.

Some checking accounts may have monthly maintenance fees, which can often be waived if you meet certain requirements, such as maintaining a minimum balance or setting up direct deposit. Other fees may include ATM fees, overdraft fees, and fees for additional services.

You can access your account online by logging in through our website or mobile app. If you haven’t registered for online banking, you can sign up using your account information.

The interest rate on savings accounts varies depending on the type of account and current market conditions. You can check the current rates on our website or by contacting customer service.

Pingback: Varo Bank Review of 2024

Pingback: The different types of bank accounts