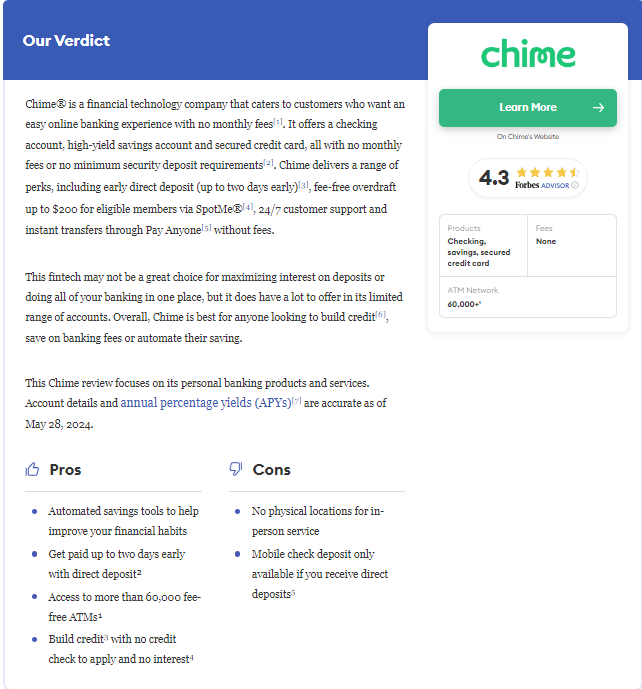

Chime Review

Chime, a prominent name in digital banking, offers a range of financial products through its highly-rated mobile app. Known for its user-friendly interface and fee-free banking options, Chime provides customers with innovative features such as early direct deposit, SpotMe® overdraft protection, and automated savings tools. This review explores Chime’s checking and savings accounts, as well as its secured credit card, highlighting key features, benefits, and considerations for those looking to manage their finances efficiently and conveniently online.

Who Is Chime Best For?

Chime offers several accounts with unique benefits that cater to a wide range of customers. It can be an excellent choice if you:

- Prefer banking entirely online without needing physical branches.

- Expect regular direct deposits.

- Aim to build credit without fees or a credit check.

- Seek an easy-to-use checking account with no monthly fees.

- Want to avoid overdraft fees, ATM withdrawal fees, or other service fees.

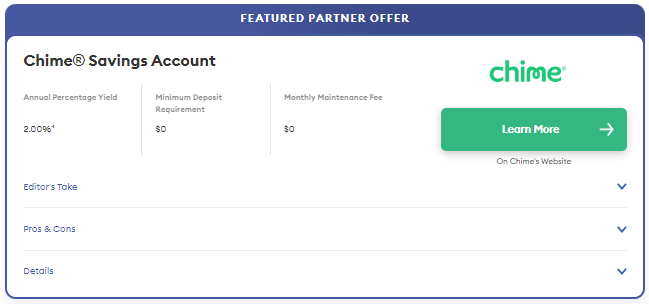

However, Chime may not be the best option for maximizing interest earnings. While the Chime® Savings Account offers a respectable 2.00%¹ APY, there are other savings accounts available that offer higher interest rates, such as some with rates up to 5%.

Our Review Methodology

Forbes Advisor evaluates banks based on a comprehensive set of criteria that encompass fees, interest rates, accessibility, account requirements, and more. Each product, such as checking accounts, savings accounts, money market accounts, and CDs, receives a unique rating, which is then aggregated to provide an overall score for the institution. Ratings are assigned on a scale from one to five stars, where one star represents the lowest rating and five stars indicate the highest.

Key factors considered in the ratings include:

- Fee structures

- Interest rates offered

- Customer experience and satisfaction

- Accessibility and functionality of mobile banking

- Minimum deposit requirements

What Is Chime?

Chime® is a financial technology company, not a bank, that partners with Bancorp Bank, N.A., and Stride Bank, N.A., both Members FDIC, to offer online banking services. Founded in 2013 and headquartered in San Francisco, Chime serves millions of customers with 24/7 online banking access and a vast network of over 60,000 ATMs nationwide.

Chime provides several key benefits, including the ability to receive direct deposits up to two days early, earn interest on savings, facilitate payments, and help customers build credit. Notably, Chime does not charge monthly fees and offers fee-free overdraft protection up to $200 for eligible customers.

How Does Chime Work?

Chime, as a financial technology company rather than a bank itself, operates its banking services through Bancorp Bank, N.A., or Stride Bank, N.A. Despite this distinction, opening and managing an account with Chime via its app is similar to using other mobile banking platforms. You can handle your accounts online or through the app, contact customer support via phone or live chat, and benefit from FDIC insurance covering your deposits up to standard limits through Chime’s bank partners.

There are no fees to open any Chime account. Upon opening a Checking Account, you’ll receive a Chime Visa® Debit Card for immediate use. To apply for a Chime Savings Account, you must first have a Chime® Checking Account. Additionally, eligibility for the Secured Chime Credit Builder Visa® Credit Card requires a qualifying direct deposit of $200 or more.

Chime Basics

Chime offers two primary bank account options designed to simplify money management, but you can only open a savings account if you first have a checking account. Here’s a breakdown of each account’s features, benefits, and costs:

Chime® Checking Account The Chime® Checking Account has no monthly maintenance fees and no minimum balance requirements.

Key features of the Chime Checking Account include:

- Early direct deposit, allowing you to receive your paycheck up to two days earlier.

- SpotMe® feature for fee-free overdraft up to $200 (requires $200 or more in direct deposits each month).

- Automated savings tools.

- Fee-free money transfers to friends and family (up to a $5,000 monthly limit).

- Access to over 60,000 fee-free ATMs nationwide.

- Ability to disable transactions if your card is lost or stolen.

- Free replacement for lost or stolen debit cards.

- Compatibility with Google Pay and Apple Pay.

The Chime® Checking Account is designed to minimize fees. For instance, by enrolling in Chime’s SpotMe® service, you can avoid overdraft fees up to $200. You only need a single monthly deposit of $200 in qualifying direct deposits to qualify for this benefit. Chime may increase your SpotMe® allowance based on factors like your account history, deposit frequency, spending patterns, and more. It’s important to note that SpotMe® does not cover non-debit card transactions such as ACH transfers, Pay Anyone transfers, or check transactions.

Opening an account and receiving a Chime Visa® Debit Card does not require a credit check. Your debit card is accepted anywhere Visa® debit cards are used.

Chime’s Savings Account offers a competitive 2.00%[7] annual percentage yield (APY), making it an attractive option among high-yield savings accounts offered by top online banks.

Key features of the Chime® Savings Account include:

- No monthly fees

- No minimum balance requirements

- No limit on the amount of interest you can earn

- No minimum deposit required to open an account

To open a Chime Savings Account, you first need to have a Chime Checking Account. Once both accounts are set up, you can utilize Chime’s automated savings tools:

- Round Ups[10]: Automatically saves by rounding up your Chime Visa® Debit Card purchases to the nearest dollar and transferring the difference from your checking to your savings account. For example, if you spend $25.50, Chime will transfer 50 cents to your savings.

- Save When I Get Paid[11]: Automatically transfers 10% of your direct deposit paycheck of $500 or more from your checking account to your savings each time you get paid.

Chime offers the Secured Chime Credit Builder Visa® Credit Card as part of its additional accounts and services, tailored especially for those looking to build or improve their credit score without requiring a credit check to apply. To qualify for this secured card, you need to have a Chime Checking Account and receive monthly direct deposits totaling at least $200.

Here’s how the Secured Chime Credit Builder Visa® Credit Card works:

- Transfer money from your Chime Checking Account to your Credit Builder secured account.

- Use the amount transferred as your credit limit to make purchases with the Credit Builder card.

- Pay off your purchases on time to establish a positive credit history.

Chime reports your payment activity to all three major credit bureaus—TransUnion®, Experian®, and Equifax®—which can help improve your credit score over time. According to Chime, many cardholders have seen their scores increase after consistently making on-time payments. The Secured Chime Credit Builder Visa® Credit Card has no interest charges, no annual fee, and does not require a minimum security deposit.

To apply for the Secured Chime Credit Builder Visa® Credit Card, you must maintain a Chime checking account and meet the monthly direct deposit requirement of $200 or more.

Access on the Go

Chime is designed primarily for use through its mobile app, available on both Android and iOS devices, offering a host of features to enhance mobile banking convenience.

The Chime app provides daily account balance notifications and transaction alerts for purchases made. You can manage your card security by disabling transactions directly from the app, eliminating the need for a customer service call if your card is misplaced. Additionally, you have the option to disable international transactions through the app.

Your Chime Visa debit card is accepted wherever Visa debit cards are used, and it can be added to your Apple Pay or Google Pay mobile wallet for added convenience. Access to over 60,000 MoneyPass, Allpoint, and Visa Plus Alliance ATMs is available, and you can use the Chime app to locate fee-free ATMs or avoid out-of-network ATM fees.

Depositing funds into your Chime Checking Account is easy with mobile check deposit through the Chime app. Cash deposits are also accepted at over 85,000 partner locations, including Walgreens, Walmart, and 7-Eleven, although fees may apply. Once accepted, cash deposits are transferred to your selected Chime Account—barcode and debit card cash deposits go directly into your Checking Account, while Credit Builder card cash deposits are first directed to your Card Account and then to your Secured Account if applicable.

If your Chime debit card is lost or stolen, you can disable transactions instantly via the Chime app. Replacement debit cards are available at no charge and can be requested directly through the app.

Chime Fees

Chime prides itself on a fee structure that contrasts with traditional brick-and-mortar banks. Notably, Chime does not burden its customers with various fees commonly found elsewhere, such as:

- Minimum balance fees

- Monthly fees

- Maintenance fees

- Direct deposit fees

- Overdraft fees[4]

However, there is one fee to be mindful of: Chime charges a $2.50 fee for ATM withdrawals made at machines outside its network. Additionally, the ATM operator may impose an additional third-party fee.[9]

Alternatives To Chime

If you’re seeking comprehensive banking services, Chime might not be the ideal choice. However, if you’re starting out on your financial journey and prefer a straightforward set of financial tools accessible through a versatile app, Chime offers a solid option. Its automated savings features are especially appealing for customers aiming to build up emergency funds or save toward specific goals.

Chime vs. Ally

Ally Bank provides a wide range of banking products and services that include:

- Interest checking accounts

- Online savings accounts

- Credit cards

- Money market accounts

- High-yield certificates of deposit (CDs)

- Raise Your Rate CDs

- No-penalty CDs

Unlike Chime, Ally Bank is a full-service online bank that is FDIC-insured. In addition to deposit accounts, Ally offers loans, mortgages, a cash-back credit card, and investment accounts. Both Ally and Chime are recognized for their absence of monthly maintenance fees or minimum balance requirements.

When comparing interest rates, Ally Bank’s offerings include:

- The Ally Bank Interest Checking Account, which earns 0.10% APY for balances below $15,000 and 0.25% APY for balances of $15,000 or more.

- The Ally Bank Savings Account offers an APY of up to 4.20%, with the rate varying based on your account balance.

- Ally Bank reimburses up to $10 in foreign ATM fees per statement cycle, providing added convenience for international transactions.

Chime vs. Varo

Varo provides a straightforward banking experience with its Varo Bank Account and Varo Savings Account, both of which feature no monthly fees or overdraft fees. These accounts can be managed conveniently through Varo’s online platform or its mobile banking app. Varo customers have access to a network of over 55,000 fee-free Allpoint ATMs nationwide.

For added financial flexibility, Varo offers two notable features:

- Varo Advance: This feature allows customers to receive advances of up to $500 against their paychecks, helping to manage unexpected expenses.

- Varo Believe: Designed to help customers build credit without requiring a security deposit, Varo Believe charges no fees and does not accrue interest, making it accessible for those looking to establish or improve their credit history.

What Is Required To Open a Chime Account?

To open a Chime account, you must meet several requirements:

- You must be at least 18 years old.

- You must be a legal citizen or permanent resident of the U.S.

- You must have a valid Social Security number.

You are limited to having one of each type of account with Chime. When applying, you’ll need to provide your personal information, including a mailing address, phone number, and email address. Chime may also request a photo of a government-issued ID to verify your identity during the application process.

Frequently Asked Questions (FAQs)

Chime is a legitimate financial technology company offering online banking services through its banking partners, Bancorp Bank and Stride Bank, both Members FDIC. Founded in 2013 and headquartered in San Francisco, Chime serves millions of customers with 24/7 online banking access.

Yes, funds in Chime deposit accounts are FDIC insured through its banking partners, Bancorp Bank and Stride Bank, up to the standard limits established by the FDIC.

If your Chime debit card is lost or stolen, you can immediately disable transactions through the Chime mobile app. Chime offers zero liability protection, meaning you won’t be held responsible for unauthorized transactions made with your card.

To open a Chime account, you need to be at least 18 years old, a legal citizen or permanent resident of the U.S., and have a valid Social Security number. You’ll also need to provide personal information such as a mailing address, phone number, and email. Verification of identity may require submitting a photo of a government-issued ID.