Varo Bank

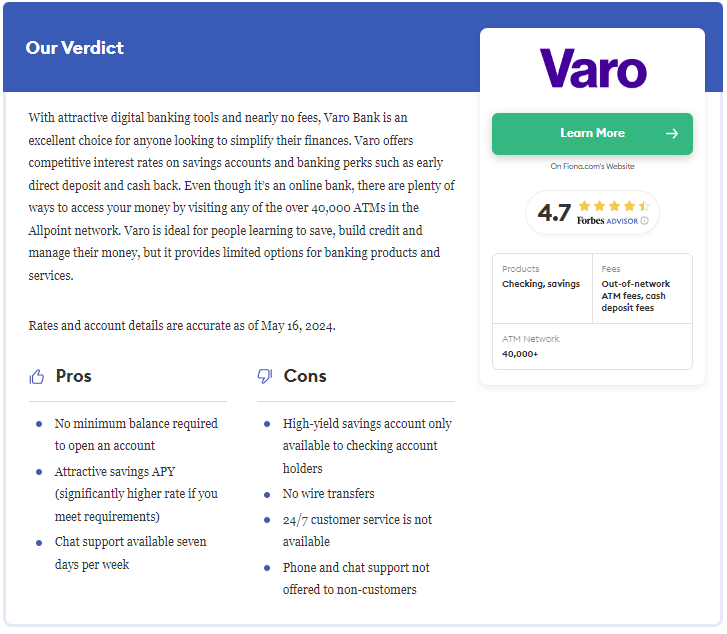

Varo Bank is a digital-first bank committed to providing a streamlined and efficient banking experience to its customers. Founded in 2015, Varo aims to revolutionize traditional banking by offering a range of financial services through its mobile app, making banking accessible and straightforward for users.

Varo Bank Basics

If you’ve never used an online-only bank, you might be worried about whether it’s truly as convenient as banking at the branch in your neighborhood. Varo offers plenty of capabilities for the on-the-go user that may convince you to take the online route.

Convenience and Security

Varo makes it easy to complete basic checking and saving transactions while going about your daily life, all through its user-friendly mobile app and extensive ATM network. Rest assured, your online banking information is protected by 256-bit AES encryption, ensuring your data’s safety.

Pioneering Online-Only Banking

In 2020, Varo became the first U.S. consumer fintech company to receive a national bank charter. This milestone allows Varo to offer FDIC insurance and expand its range of banking services, giving it a competitive edge in the online banking landscape.

Varo’s Account Offerings

Here’s what you should know about Varo’s account offerings:

- Varo Bank Account: No monthly fees or minimum balance requirements, with early direct deposit and overdraft protection options.

- Varo Savings Account: Competitive interest rates to help you maximize your savings.

- Varo Advance: Access small cash advances with no interest for qualifying customers.

- Cashback Rewards: Earn rewards on purchases made with the Varo Visa® Debit Card.

Varo Checking Account

Varo’s online checking account, known as the Varo Bank Account, offers a hassle-free experience with no monthly maintenance fees or minimum balance requirements. To sign up, you’ll need a government-issued ID and Social Security number, but there’s no minimum deposit needed to open your account. You must be 18 and have a device that can access Varo’s mobile app.

Varo promotes early access to direct deposit payments, often posting deposits on the same day they’re received, which can be up to two days earlier than the payer’s scheduled payment date. For most Friday paydays, this means funds may be available on Wednesday.

Getting cash is easy with access to more than 40,000 Allpoint ATMs surcharge-free, though there’s a $3.50 fee for out-of-network ATM withdrawals. You can also deposit cash at over 90,000 retail locations using Green Dot Reload.

Additionally, Varo offers free instant transfers to other Varo users, although wire transfers are not supported at this time.

Varo Savings Account

Once you open a Varo bank account, you have the option to open a Varo savings account without any minimum deposit or account balance requirements. As long as you have at least a penny in your savings account, you’re eligible to earn interest. The account currently offers a 3.00% APY without charging a monthly fee, with the potential to earn up to 5.00% APY by meeting specific monthly requirements. To qualify for the higher rate, you need to receive direct deposits of $1,000 or more within each qualifying period, maintain a daily savings balance of $5,000 or less for the entire calendar month, and keep balances above or equal to $0.01 in both savings and bank accounts for the entire month.

In addition to the savings account, Varo offers two automatic savings tools in conjunction with their bank accounts. The “Save Your Pay” feature allows you to set up a recurring transfer from checking to savings each time you receive a direct deposit payment, with the ability to choose the percentage of your payment to move to savings. The “Save Your Change” feature rounds up each checking transaction to the nearest dollar and moves the extra amount to your savings account.

Other Accounts and Services

Varo Advance is an optional borrowing program that offers a small financial cushion to help you avoid overdrawing your account. To qualify for Varo Advance, customers must have an active Varo Bank Account that is at least 30 days old and must have received at least $800 in direct deposits to either the Bank Account, Savings Account, or both combined within the past 31 days. Once qualified, Varo Advance provides instant access to up to $250, which must be paid back within 30 days without any interest. Depending on the advance amount, there is a fee ranging from $0 to $15. Customers can have only one outstanding Advance at a time.

The Varo Believe Secured Credit Card is designed to help Varo customers build their credit. The card has no minimum security deposit, no annual fee, and no APR, and applying for it does not affect your credit score. To qualify for the Believe secured card, you must be actively using a Varo Bank Account without any negative balances or an overdue Advance and have received at least $200 in qualifying deposits in the past 31 days. Your credit limit is equal to the available balance in your Varo Believe Secured Account, with limits of up to $2,500 per day for purchases and $1,000 per day for cash advances, totaling no more than $10,000 per billing cycle. Varo will report your payment history to the three major credit bureaus, and you can track your credit score’s progress in the Varo mobile app.

Access on the Go

Varo bank accounts come with a Visa debit card, which can be added to your Apple Pay or Google Pay mobile wallet. The debit card has a spending limit of $2,500 per calendar day for purchases or cash back. There is also a $1,000 daily cash withdrawal limit from ATMs. Varo customers have access to more than 40,000 Allpoint ATMs located in major retailers like Target, CVS, and Circle K for surcharge-free cash withdrawals. You can also get cash back at some store registers when making debit purchases. If you use an ATM outside the Allpoint network, Varo charges $3.50 per withdrawal, and the ATM operator may set additional fees.

For depositing cash, you can do so at over 90,000 Green Dot Reload@theRegister retail locations with a retail service fee of up to $4.95, which is not charged by Varo. Additionally, if you have direct deposit set up on your checking account, you can deposit checks via the Varo app, which is available for both iOS and Android. The highly-rated app allows you to manage your accounts, activate savings tools, and set up push notifications for deposits, withdrawals, and debit purchases.

If you misplace your card, you can lock it from the Varo app to prevent unauthorized use. Replacement cards sent by USPS are free of charge.

Varo Bank Fees

Fees can vary by bank and significantly impact your account balance. Fortunately, Varo’s fees are minimal. They include:

- Monthly maintenance: $0

- Foreign transactions: $0

- Cash deposits via third-party money transfer services: Up to $5.95

Varo Bank ATM Fees

Some banks charge a fee to withdraw cash or request a balance inquiry at an out-of-network ATM, with additional fees possibly applying to international ATMs. Varo’s ATM fees include:

- In-network (Allpoint) ATMs: $0

- Out-of-network (non-Allpoint) ATMs: $3.50 per transaction

Varo Bank Overdraft Fees

Some banks charge overdraft fees when you spend more money than you have in your account, which can make it challenging to break the cycle of overdrafts. Fortunately, Varo doesn’t charge overdraft fees. Here’s a comparison:

- Overdraft fee at Varo: $0

- Typical overdraft fees at other banks: $30-$35

How Varo Stacks Up

The Varo Savings Account is one of the best high-yield savings accounts for people with smaller balances and those interested in automatic savings tools. Similarly, the Varo Bank Account is competitive with the best checking accounts and is especially well-suited for individuals who may need early direct deposits.

Varo is a convenient option for someone with straightforward finances. If you use it as your primary checking and savings account, you’ll enjoy the greatest benefits. However, if you plan to use it as a secondary account without a steady stream of transactions and deposits, you may miss out on perks like a higher-yield savings rate and additional products and services such as CDs and money market accounts.

Varo vs. Chime®

Chime offers a comprehensive suite of financial products through a highly rated mobile app, including a checking account, savings account, and a secured credit card. Their checking account features early direct deposit and fee-free withdrawals at over 60,000 ATMs nationwide. Chime also provides SpotMe® overdraft protection, which allows up to $200 in overdraft coverage, surpassing the protection offered by Varo Advance. They’ve partnered with Walgreens for free in-store cash deposits at over 8,500 locations, and customers enrolled in direct deposit can conveniently deposit checks using the mobile check deposit feature.

In terms of savings, Chime’s savings account offers a competitive APY similar to Varo’s standard rate but lacks the opportunity to earn a higher rate through specific requirements. Chime encourages savings through features like Round Ups, which automatically saves the spare change from purchases by rounding up to the nearest dollar, and Save When I Get Paid, which sets aside a portion of each paycheck for savings. Chime provides 24/7 customer support and allows free instant transfers to any bank. Like Varo, Chime does not charge monthly maintenance fees, making it a convenient and cost-effective choice for managing finances through their mobile app.

Methodology

Forbes Advisor rates banks based on a range of factors including fees, interest rates, and ATM networks. They assign separate ratings to financial institutions and their individual products such as checking accounts, savings accounts, and CDs. Ratings are given on a scale from one to five stars, with one star indicating the poorest rating and five stars indicating the best. For more detailed information about Forbes Advisor’s rating and review methodology, you can refer to their guide on How Forbes Advisor Reviews Banks.

Frequently Asked Questions (FAQs)

Yes, Varo Bank, N.A. is a legitimate bank that operates entirely online.

Yes, Varo Bank, N.A. is FDIC insured. Deposits are insured up to the maximum allowable limit per depositor, per ownership category.

If your Varo debit card or card information is stolen, you can lock your card from the Varo app to prevent unauthorized transactions. Varo provides free replacement cards if needed.

No, Varo Bank operates solely online and does not have physical branches.