Quontic Bank

Quontic Bank is a digital-first bank that leverages innovative technology to provide a range of banking services. Known for its customer-centric approach, Quontic offers various deposit accounts, including checking, savings, and certificates of deposit (CDs), all with competitive interest rates. The bank prides itself on user-friendly online and mobile banking platforms, making it easy for customers to manage their finances on the go. Quontic Bank aims to combine the convenience of online banking with personalized service, offering unique features like adaptive lending and a crypto rewards checking account.

In a nutshell

Quontic Bank began as a community bank in New York City but has evolved into a digital bank with nationwide offerings. Recognized as a Community Development Financial Institution (CDFI) by the U.S. Treasury, Quontic primarily focuses on banking products, although it also provides home loans. One of its notable innovations is a ring that functions as a bank card.

Quontic Bank overview

Quontic Bank’s banking products

Checking

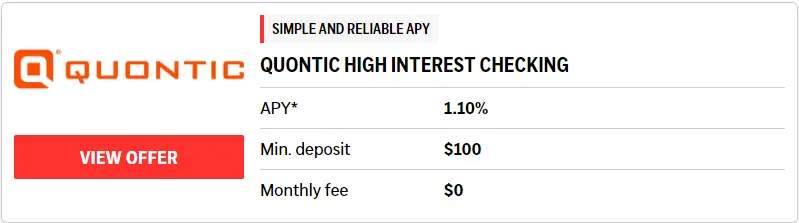

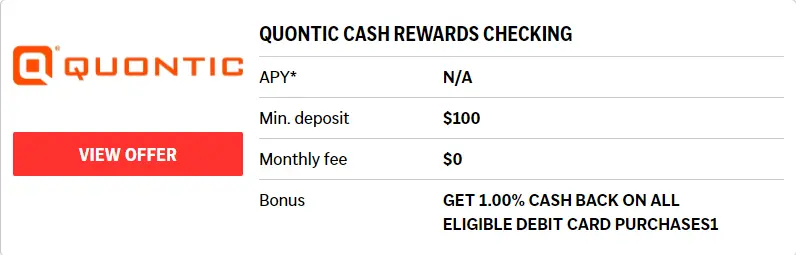

Quontic Bank offers two primary checking account options, each requiring a $100 opening deposit. These accounts provide access to a nationwide network of fee-free ATMs, though cash deposits are not allowed. Funding options include remote check deposit, direct deposit, and ACH transfers. Additionally, there is no overdraft protection available.

The High Interest Checking account offers a 1.10% APY, significantly higher than the average interest-bearing checking account rate of 0.07% APY reported by the FDIC in January 2024. However, to earn this high rate, you must make at least 10 qualifying debit card purchases each month; otherwise, the APY drops to 0.01%.

Quontic Bank’s alternative checking account is the Cash Rewards Checking account. This account provides 1% cash back on eligible debit card purchases but does not offer any interest yield.

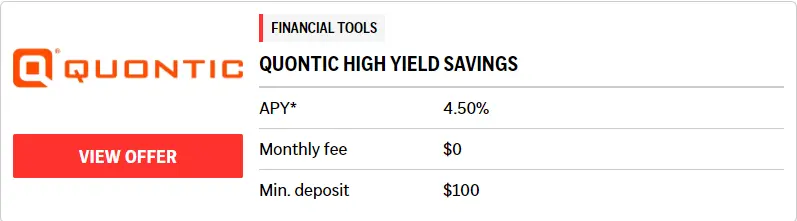

Savings

To open a High Yield Savings account with Quontic Bank, you need a $100 deposit. The account offers a 4.5% APY, significantly higher than the 0.46% average reported by the FDIC in January. Interest is compounded daily, including the previous day’s yield in the next calculation. Additionally, there are no monthly maintenance fees.

CDs

Quontic’s CD product is straightforward, requiring a minimum deposit of $500 to open. You can choose terms of six months, or two, three, or five years. Currently, the six-month CD offers the highest rate with a 5.05% APY. The five-year CD provides a 4.3% APY, which is still high compared to the national average of 1.39% APY reported by the FDIC in January 2024. Early withdrawals are subject to penalties.

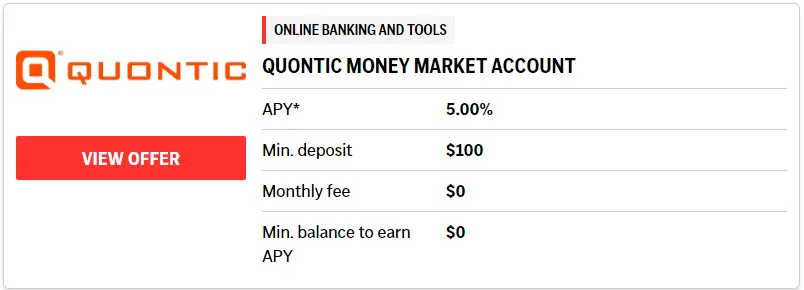

Money Market Account (MMA)

Quontic Bank’s Money Market Account offers one of the highest rates available at 5.00% APY, earned on the daily account balance. To open this account, a minimum deposit of $100 is required. While it provides a competitive rate, the account functions more like a savings account with a limit of six transfers and withdrawals per statement cycle.

Other banking products

In addition to its checking and savings products, Quontic Bank focuses primarily on mortgage offerings. While it provides traditional mortgage options, Quontic also caters to nontraditional borrowers such as self-employed individuals and foreign nationals. As a Community Development Financial Institution (CDFI), Quontic Bank takes a unique approach to its mortgage products.

Quontic Bank’s customer experience

Despite holding a high BBB rating and receiving few complaints, Quontic Bank faced recent regulatory actions. In October 2023, the Office of the Comptroller of the Currency took enforcement action, citing unresolved regulatory concerns dating back to 2018. Additionally, in July 2023, Quontic Bank agreed with the Philadelphia Fed to refrain from making capital distributions or paying dividends without prior regulatory consent.

How does Quontic Bank compare?

Comparing Quontic with CIT: While CIT offers competitive yields, accessing high rates typically requires maintaining a higher balance. Quontic Bank, on the other hand, offers competitive rates without the same high balance requirements.

Comparing Quontic with Ally: Both Ally and Quontic provide competitive yields on savings and CDs, but Quontic’s checking APY stands out as notably higher. However, Ally offers a broader range of financial products and services compared to Quontic.

Comparing Quontic with Axos: Axos Bank stands out with its high-yield Rewards Checking, which surpasses many other yield-bearing checking accounts. However, Axos employs a tiered system, whereas Quontic does not. Additionally, Axos offers a wider array of loan and investment options, whereas Quontic focuses primarily on savings and mortgages.

Methodology

Using our comprehensive review methodology, we strive to empower consumers like you in making informed decisions when selecting a consumer bank that fits your financial goals and preferences. Our evaluations consider crucial factors including interest rates, fees, minimum balance requirements, access to funds, and more, providing valuable insights to guide your choices. It’s important to note that our reviews rely on publicly available information, and we advise verifying the latest details directly from the financial institutions themselves.

Frequently asked questions (FAQs)

Yes, Quontic Bank is FDIC insured. Your deposits at this bank are insured for up to $250,000.

Whether Quontic Bank is considered good or bad can vary based on individual experiences and financial needs. Customer reviews on BBB indicate some consumers have had negative experiences. Additionally, recent enforcement actions against Quontic may raise concerns for some customers. However, if you’re seeking straightforward banking products with the potential for high yields, it may align with your needs.

Quontic Bank may appeal to beginners looking to manage checking and savings accounts as it does not have an overdraft program, thus eliminating overdraft fees. However, beginners seeking personal loans or investment services will need to explore other options.