According to the Economic Well-Being of U.S. Households report, 82% of adults in the U.S. had a credit card in 2022. Furthermore, between 2024 and 2029, the total number of credit cards in circulation is projected to increase by 25 million.

This high usage rate highlights the essential role credit cards play in everyday spending and personal finance management. As the number of users continues to grow, it’s important to choose cards that offer the best rewards and savings opportunities.

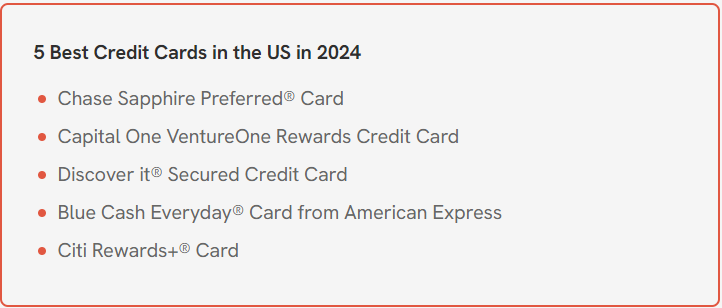

In this guide, we present the top 5 credit cards for 2024, detailing their features, main fees, and ideal use cases for each card.

Key Considerations When Selecting a Credit Card

Before diving into the list, it’s important to recognize that choosing a credit card requires careful consideration of several factors that can impact your financial well-being. Let’s explore some key points to keep in mind.

Your Credits Scores

Your credit score plays a crucial role in determining which credit cards you can qualify for. Generally, higher scores open the door to cards with lower interest rates and better rewards. In essence, your credit score helps refine your options.

While credit card issuers may not always disclose the exact score needed, they often provide ranges such as “good” or “excellent” credit, giving applicants a clearer idea of the requirements.

In the United States, credit scores typically range from 300 to 850 and are categorized as follows:

- Poor: Below 580

- Fair: 580 – 669

- Good: 670 – 739

- Very Good: 740 – 799

- Excellent: 800 and above

There may be slight variations in credit score ranges depending on the scoring model used, such as FICO or VantageScore, though FICO is the most commonly used.

In the U.S., you can request a free copy of your credit report from AnnualCreditReport.com, the only website authorized by the federal government to provide annual credit reports from the three major Credit Reporting Agencies (CRAs).

Alternatively, you can call 1-877-322-8228 (TTY: 1-800-821-7232) or complete the Annual Credit Report request form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

Type of Credit Cards

Once you know your credit score, the next step is to determine which type of credit card suits your needs.

There are two main categories to consider:

Secured Credit Cards: These require an upfront cash deposit as collateral, which sets your credit limit. Secured cards are ideal for individuals with poor credit or those new to credit, as they help establish or improve credit histories. The issuer typically reports your usage to the three major credit bureaus, aiding in credit building.

Unsecured Credit Cards: These cards do not require a security deposit. Instead, your credit limit is determined by your credit history and score. Unsecured cards are more common and usually require average to excellent credit scores.

For those with good credit who find it challenging to manage credit card debt, a specific type of unsecured card called a balance transfer credit card can be a practical solution. This card allows individuals to consolidate and reduce high-interest credit card debt by transferring existing balances to a card with lower interest rates.

Your Requirements

The best credit card for you is one that offers rewards aligned with your lifestyle while keeping costs manageable.

Think about whether you want to boost your credit score, earn rewards on daily spending, or obtain a low-interest rate for balance transfers.

For example, if you travel frequently, a co-branded airline or hotel card with benefits like generous miles and airport lounge access would be ideal. On the other hand, if you need to carry a balance from month to month, opting for a card with a low ongoing APR could help you save more in interest charges.

The Card’s Offers

When evaluating credit card offers, it’s important to consider not just the rewards and cashback rates, but also bonus categories, partner benefits, promotions, purchase protection, and how easy it is to earn and redeem rewards.

Look for sign-up bonuses, promotional interest rates, or temporary special rewards categories that can enhance your benefits.

Some cards offer unlimited points, while others may have restrictions or caps on earnings. Additionally, check if the card allows you to redeem rewards for statement credits, gift cards, or charity donations.

Finally, be mindful of whether the credit card points expire.

The Card’s Eligibility

Eligibility criteria for credit cards typically include age, income, residency, and credit score. It’s important to ensure you meet these requirements before applying, as the application process can temporarily affect your credit score.

When you submit a credit card application, lenders conduct a hard inquiry on your credit report to assess your creditworthiness. This inquiry may result in a slight drop in your credit score, usually by a few points, and while the impact is temporary—lasting about a year—the inquiry will remain on your report for two years.

By understanding the eligibility criteria in advance, you can enhance your chances of approval while protecting your credit health.

Fees and Annual Percentage Rate (APR)

Common credit card fees include annual fees, late payment fees, balance transfer fees, and foreign transaction fees. These fees often reflect the card’s features, with higher fees associated with more benefits or larger spending limits. However, a high annual fee may not be justified if you don’t intend to take full advantage of its perks.

Understanding the Annual Percentage Rate (APR) is also crucial for avoiding credit card debt. The APR represents the annual cost of borrowing, including interest charges.

Credit card companies generally waive interest on purchases if the full balance is paid by the due date. However, if you carry a balance, interest will begin to accrue from the transaction date, increasing your monthly balance.

5 Best Credit Cards in the US

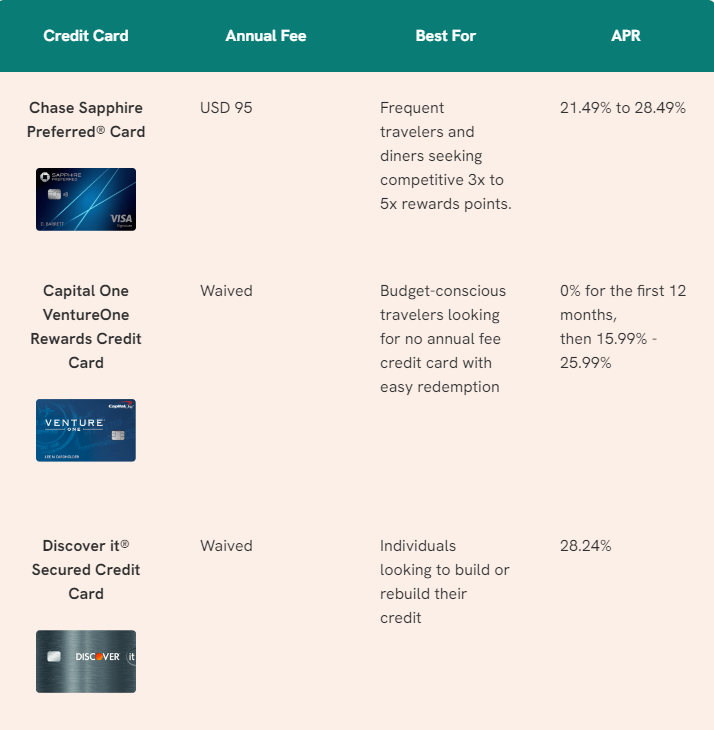

1. Chase Sapphire Preferred® Credit Card

The Chase Sapphire Preferred® Credit Card, offered by Chase, a division of JPMorgan Chase & Co., is well-regarded for its extensive range of credit card options and global presence.

Designed for travelers, this card combines travel rewards, dining perks, and various additional benefits, often featuring fluctuating welcome bonus points during promotional periods.

Operating on the Visa processing network, the Sapphire Preferred card is part of Chase’s premium travel and dining offerings, alongside the Chase Sapphire Reserve® Credit Card.

Key Benefits of the Chase Sapphire Preferred® Card

- 5x points on travel booked through Chase Travel (excluding hotel purchases eligible for the USD 50 Annual Chase Travel Hotel Credit).

- 3x points on dining, eligible delivery services, and takeout.

- 2x points on other travel expenses.

- 3x points on online grocery shopping (excluding Target, Walmart, and wholesale clubs).

- 3x points on eligible streaming services.

- 1 point for every dollar spent on all other purchases.

- Access to partner benefits worth over USD 150, including DoorDash, Instacart, Peloton, and Lyft.

- 1:1 point transfers to leading frequent travel programs like British Airways Executive Club, Emirates Skywards, and Marriott Bonvoy.

- Eligible cardholders can split purchases of USD 100 or more into interest-free monthly payments with My Chase Plan®, incurring a monthly fee of up to 1.72%.

- No foreign transaction fees for purchases made outside the U.S.

Who Should Consider the Chase Sapphire Preferred® Card

✅ Frequent travelers

✅ Consumers seeking a mix of travel and dining rewards

✅ Cardholders making frequent international purchases

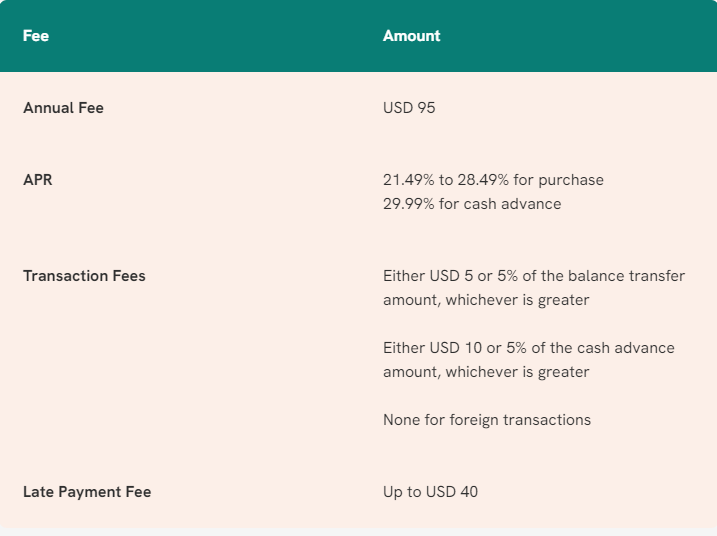

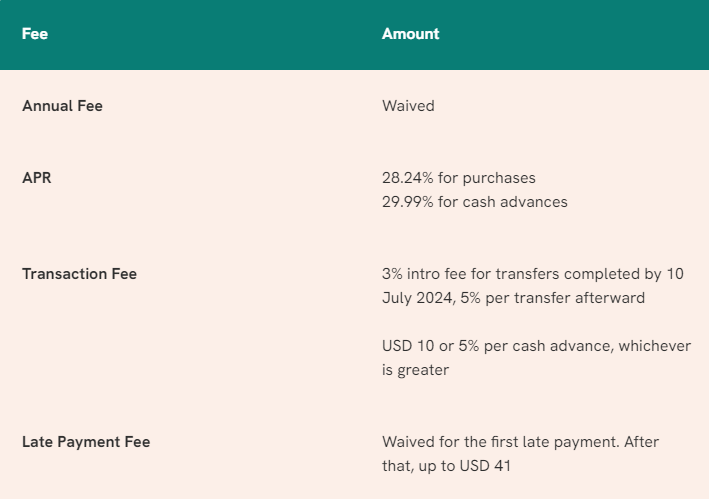

Chase Sapphire Preferred® Card Major Fees

Chase Sapphire Preferred® Card Eligibility

To apply for the Chase Sapphire Preferred® Credit Card, applicants must meet the following criteria:

- Be at least 18 years old (19 years old in Alabama and Nebraska; 21 years old in Puerto Rico).

- Have a valid permanent U.S. address (within the 50 states, the District of Columbia, Guam, Puerto Rico, or the U.S. Virgin Islands) or a U.S. military address.

- Existing Chase cardholders may not be eligible for a second card within the same Rewards Program.

- Cardholders currently enjoying promotional pricing or those who have only used cards for promotional offers may not qualify for a second card with similar pricing.

Please note that additional eligibility requirements may apply. For complete details, refer to the terms and conditions page for the Chase Sapphire Preferred® Credit Card.

2. Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card, offered by Capital One Financial Corporation, one of the largest banks in the U.S., is designed for travelers seeking versatile rewards and flexible redemption options without the burden of an annual fee. This card is particularly appealing to budget-conscious individuals, featuring a 0% introductory APR.

Part of Capital One’s Travel and Miles Rewards Credit Cards, the VentureOne card is joined by other options, including the Capital One Venture X Rewards, VentureOne Rewards for Good Credit, and Venture Rewards. Capital One partners with both the Visa and Mastercard® networks to issue its cards.

Key Benefits of the Capital One VentureOne Rewards Credit Card

- Earn unlimited 1.25 miles for every dollar spent on all purchases.

- Earn unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

- Use miles to book trips via Capital One Travel or receive reimbursement for previous travel purchases made elsewhere.

- Redeem miles as a statement credit for travel expenses within 90 days of the purchase.

- Rewards never expire as long as the account remains active.

- Transfer miles to over 15 travel loyalty programs, including Emirates Skywards, British Airways, and Accor Live Limitless.

- Redeem rewards with PayPal for eligible purchases at millions of online retailers or for Amazon.com transactions.

- No foreign transaction fees on purchases made outside the United States.

The Capital One VentureOne Rewards Credit Card Is Ideal For

✅ Budget-conscious travelers

✅ Individuals seeking travel rewards without an annual fee

✅ Those wanting a straightforward and flexible rewards program

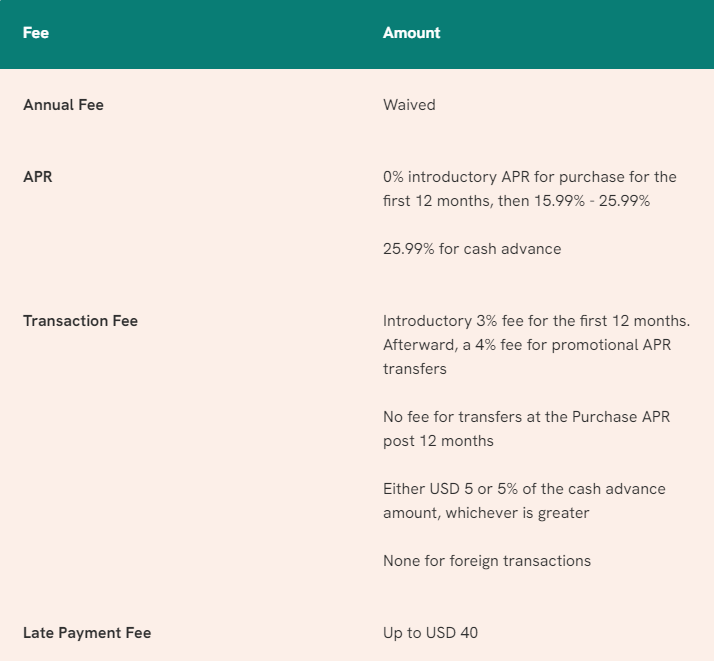

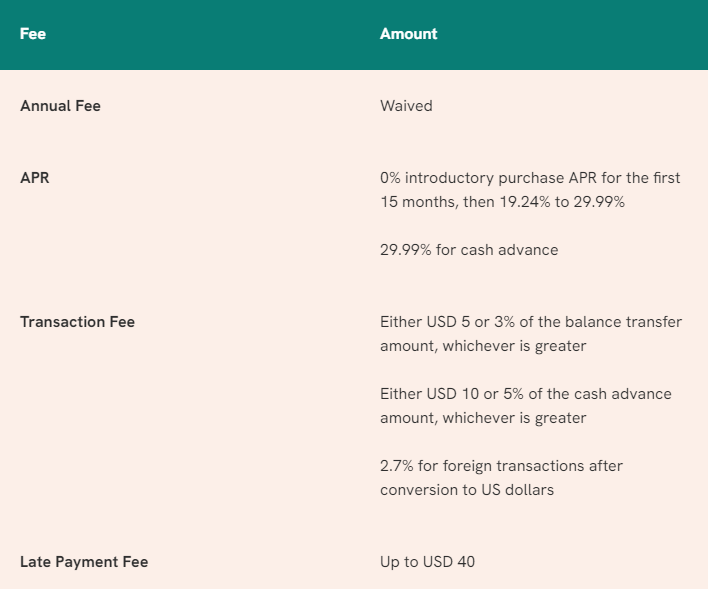

Capital One VentureOne Rewards Credit Card Major Fees

Capital One Venture Rewards Credit Card Eligibility

To apply for the Capital One VentureOne Rewards Credit Card, the following eligibility criteria must be met:

- The applicant must be at least 18 years old.

- A valid Social Security Number or Individual Taxpayer Identification Number is required.

- The applicant must reside in one of the 50 United States, Washington, D.C., Puerto Rico, or a U.S. military location.

- Monthly income must exceed the applicant’s monthly mortgage payment by at least $425.

- The applicant’s Capital One credit card account should not be past due, over the credit limit, or charged off within the past year.

- The applicant must not have received a new card member bonus for this product in the past 48 months.

- There should be no unresolved bankruptcies.

Please note that additional eligibility requirements may apply. For comprehensive information, kindly refer to the terms and conditions page for the Capital One VentureOne Rewards Credit Card.

3. Discover it® Secured Credit Card

The Discover It® Secured Credit Card is provided by Discover, a leading American financial services company that oversees Discover Bank, the Discover and Pulse networks, and Diners Club International, making it one of the top five credit card brands in the U.S.

When you apply, you can make a refundable security deposit starting at $200, which sets your credit limit. After seven months, Discover conducts automatic monthly reviews to assess your eligibility for an unsecured card and refund your deposit. Responsible use of the card can help improve your credit score.

Discover It® Secured Credit Card Key Benefits

- Earn 2% Cashback Bonus® on purchases at gas stations and restaurants, up to $1,000 in combined spending each quarter.

- Enjoy unlimited 1% cash back on all other purchases.

- Receive an unlimited dollar-for-dollar match of all cash back earned at the end of your first year.

Discover It® Secured Credit Card Is Suitable For

✅ Individuals with poor or bad credit or those looking to rebuild their credit

✅ Those seeking rewards while building credit

✅ New credit users

✅ Anyone looking for a secured card that offers a pathway to an unsecured credit card

Discover it® Secured Credit Card Fees

Discover it® Secured Credit Card Eligibility

The applicant must be at least 18 years old.

The applicant must possess a Social Security number.

The applicant must have a U.S. address.

The applicant must maintain a U.S. bank account.

Please be aware that additional eligibility criteria may apply. For complete details, visit the important information page for the Discover it® Secured Credit Card.

4. Blue Cash Everyday® Card from American Express

The Blue Cash Everyday® Card from American Express is issued by American Express (Amex), a leading American bank holding company renowned for its expertise in payment cards. Amex serves as both a card issuer and a payment network.

This card is tailored for everyday essentials and is categorized as a cash back card, featuring a buy now pay later introductory offer, alongside two other Amex options: the Blue Cash Preferred® Card and the Cash Magnet® Card.

Blue Cash Everyday® Card Key Benefits

- Earn 3% cash back at eligible U.S. grocery stores, supermarkets, online retail, and gas stations, up to $6,000 annually (then earn 1%).

- Get 1% cash back on all other purchases.

- Cashback is provided in the form of Reward Dollars, redeemable as a statement credit.

- Enjoy shopping and entertainment perks through partners like Disney Bundle, Home Chef, ShopRunner, and Amex Experiences.

- Take advantage of the Buy Now Pay Later welcome offer (terms apply).

- Split purchases of $100 or more into monthly installments with a flat-rate fee.

- Browse and add eligible Amex Offers for additional savings.

Blue Cash Everyday® Card Is Suitable For

✅ Individuals seeking rewards on everyday household spending

✅ Those prioritizing cash-back rewards over travel perks

✅ Those who typically spend a few hundred dollars or less on their card each month

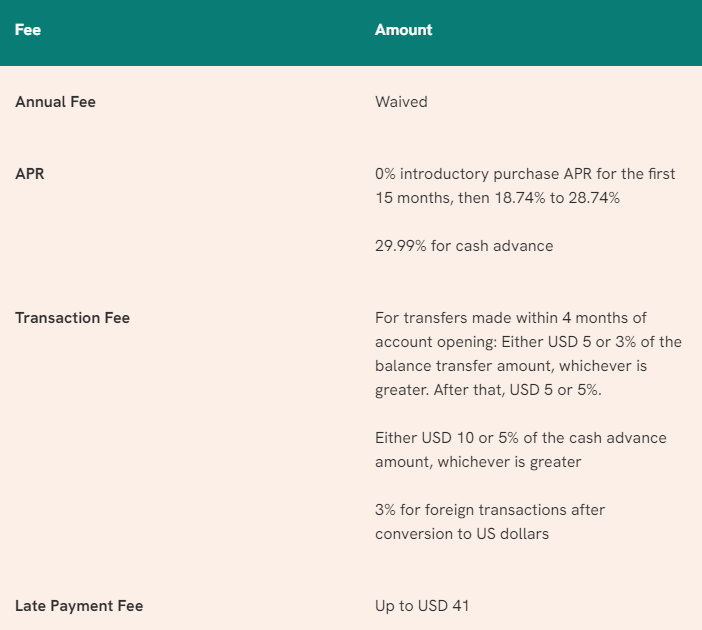

Blue Cash Everyday® Card Fees

Blue Cash Everyday® Card Eligibility

To apply for the Blue Cash Everyday® Card, the applicant must be at least 18 years old and a U.S. resident.

Please be aware that additional eligibility criteria may apply. For more information, please visit the terms and conditions page for the Blue Cash Everyday® Card.

5. Citi Rewards+® Card

The Citi Rewards+® Credit Card is offered by Citibank, a prominent U.S. banking subsidiary of Citigroup. This card is designed for everyday use and features unique benefits like points rounding and a points rebate.

Operating on the Mastercard® network, the Citi Rewards+® Card provides several key benefits:

Citi Rewards+® Card Key Benefits

- Earn 5 ThankYou® Points per dollar spent on hotels, car rentals, and attractions booked through CitiTravel.com until December 31, 2025.

- Earn 2 ThankYou® Points per dollar at supermarkets and gas stations, up to $6,000 per year.

- Earn 1 ThankYou® Point for all other purchases.

- Points round up to the nearest 10 on each transaction.

- Receive 10% Points Back on redemptions, up to the first 100,000 points annually.

- ThankYou® Points never expire, and there’s no limit on how many you can earn.

- Redeem points for gift cards, online shopping at sites like Amazon.com and BestBuy.com, or for travel expenses.

- Use points to offset recent purchases with a statement credit.

Citi Rewards+® Card Is Suitable For ✅ Those looking to maximize rewards on everyday spending through points accumulation.

✅ Individuals seeking rewards for domestic spending with occasional travel benefits.

Citi Rewards+® Card Fees

Citi Rewards+® Card Eligibility

- Offer valid for new accounts only.

- Applicants must be at least 18 years old or 21 years old in Puerto Rico.

- Applicants must reside in the United States and its territories.

Please note that additional eligibility criteria may apply. For further details, please refer to the terms and conditions page for the Citi Rewards+® Credit Card.

FAQs

The best credit card in the US often depends on individual needs and spending habits. However, the Chase Sapphire Preferred® Card is frequently highlighted for its robust travel rewards, sign-up bonus, and flexible redemption options, making it a top choice for travelers.

The Capital One Quicksilver Cash Rewards Credit Card offers unlimited 1.5% cash back on every purchase with no annual fee, making it a great option for those looking for straightforward rewards without added costs.

The Discover it® Secured Credit Card is highly accessible for those with no credit or poor credit, as it allows applicants to start with a refundable security deposit. It also reports to credit bureaus, helping users build or rebuild their credit history.

The Citi Double Cash Card is ideal for general use, as it offers 2% cash back on all purchases (1% when you buy and 1% when you pay), making it versatile for various spending habits without any annual fee.